Trump Admin Resumes Student Loan Forgiveness Programs 22 Oct 11:36 AM (21 hours ago)

Key Points

- The American Federation of Teachers (AFT) and the U.S. Department of Education reached an agreement to pause parts of their ongoing lawsuit over income-driven repayment (IDR) programs.

- The Education Department will continue processing loan discharges and halt denials for borrowers lacking “partial financial hardship.”

- Six more public status reports will provide transparency on loan forgiveness and application processing.

The American Federation of Teachers and the U.S. Department of Education have temporarily resolved key disputes in a major federal lawsuit challenging the handling of income-driven repayment and forgiveness programs.

In a joint status report filed Friday (PDF File) in the U.S. District Court for the District of Columbia, both sides asked Judge Reggie B. Walton to deny, for now, the union’s motions for a preliminary injunction and class certification. Those motions sought immediate relief for borrowers who said they were wrongly denied or delayed in receiving debt cancellation.

The agreement allows the Education Department to continue processing student loan forgiveness under the Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) programs while the lawsuit remains pending.

The AFT had filed suit earlier this year, alleging that the Department was failing to provide legally required repayment plans and loan forgiveness. The lawsuit has a potential impact on millions of borrowers navigating overlapping repayment rules and deadlines.

Would you like to save this?

We'll email this article to you, so you can come back to it later!

@thecollegeinvestor New updates in Department of Ed lawsuits: IBR, ICR, and PAYE loan forgiveness processing continues, the effective date of loan forgiveness is clarified, and status reports will continue. #studentloans #studentloandebt #personalfinance ♬ original sound The College Investor

Key Terms Of The Agreement

The new joint filing outlines a detailed temporary framework meant to protect borrowers as litigation continues:

- No More Denials for “Partial Financial Hardship.” The Department agreed not to reject any borrower applying for the IBR plan solely because they lack a “partial financial hardship,” a standard rooted in a decades-old definition from the Higher Education Act. Borrowers denied on this basis since July 4, 2025, will be invited to reapply once the Department’s systems are updated.

- Continued Loan Discharges. Borrowers already eligible for cancellation under IBR, ICR, or PAYE will continue to see their loans discharged, and the Department confirmed that those whose payments exceed their final qualifying amount will receive reimbursements.

- Clarified Tax Treatment. The Education Department affirmed that it will not issue IRS Form 1099-C for borrowers whose loans are discharged in 2025, provided conditions in IRS Notice 2022-1 apply. However, the agency noted that final tax determinations remain under the authority of the IRS and the Treasury Department.

- Public Transparency. Over the next several months, the Department must file six public status reports detailing application volumes, pending cases, decisions, and discharges across the income-driven repayment and Public Service Loan Forgiveness (PSLF) Buyback program. The first report will be due within 30 days after the current government shutdown ends.

The first report must also explain how the Department identifies borrowers eligible for discharge and disclose how many IBR applications were denied after July 4 on financial-hardship grounds.

What This Means For Student Loan Borrowers

For millions of Americans still repaying student loans, the agreement signals both relief and continued uncertainty. By halting hardship-based denials, the Education Department effectively ensures that borrowers leaving the Saving on a Valuable Education (SAVE) plan or other repayment programs won’t lose eligibility due to outdated definitions.

Borrowers who became eligible for cancellation in 2025 under income-driven plans will be treated as having their loans discharged as of their eligibility date, not the later date when paperwork is processed. This clarification could prevent tax complications.

The inclusion of PSLF “Buyback” data also reflects ongoing efforts to monitor the program, which allows borrowers to receive credit for earlier periods of qualifying payments, but is experiencing significant delays.

What Comes Next

The court must still approve the agreement. If accepted, the case will remain open but paused while the Department issues its reports and implements system updates.

For now, the most immediate benefit will be clarity for borrowers who applied for IBR after July 4, 2025, but were rejected on financial-hardship grounds. Those individuals will have an opportunity to reapply once processing systems are fixed - expected in Winter 2025.

Borrowers, meanwhile, will at least get more transparency in what's happening with the student loan system amidst the changes.

Don't Miss These Other Stories:

Editor: Colin Graves

The post Trump Admin Resumes Student Loan Forgiveness Programs appeared first on The College Investor.

Best 12-Month CD Rates for October 22, 2025: Up to 4.20% 22 Oct 10:00 AM (23 hours ago)

Certificates of deposit (CDs) remain one of the most reliable short-term savings tools, especially for those seeking guaranteed returns as rates begin to level off. As of October 22, 2025, the best 12-month CD rates reach up to 4.20% APY (annual percentage yield), with many banks and credit unions still offering yields far above the national average of 1.68%, according to the FDIC.

CDs lock in your rate for a fixed period, offering peace of mind even as the Federal Reserve prepares further rate adjustments. If you’re looking to earn a predictable return over the next year, these are the best CD rates available today.

💰 Today's Best 12-Month CD Rates At a Glance

Here are the best bank and credit union savings accounts rates today:

Bank or Credit Union | Top APY | Minimum Deposit |

|---|---|---|

4.20% | $100,000 | |

4.10% | $1,000 | |

4.00% | $1,000 | |

4.00% | $1,000 | |

3.80% | $0 |

1. Credit One Bank - Credit One Bank is offering a jumbo CD at 4.20% APY, but it does require a $100,000 minimum deposit to open.

2. Alliant Credit Union - Alliant Credit Union offers short term and long term CDs with competitive APYs. Right now you can get 4.10% APY on a 12-month CD option! Read our full Alliant Credit Union Review.

3. Community Savings - This bank based in Ohio is currently offering 4.00% APY on a 12-month CD with just a $1,000 minimum.

4. Seattle Bank - Seattle Bank is currently offering a 12-month CD at 4.00% APY with just a $1,000 minimum deposit.

5. Barclays Bank - Barclays Bank offers short term and long term CDs with competitive APYs. Right now you can get 3.80% APY on a 12-month CD option! Read our full Barclays Bank review here.

How 12-Month CDs Work

A 12-month certificate of deposit pays a fixed interest rate for one year in exchange for keeping your money on deposit until maturity. If you withdraw early, the bank charges a penalty - typically 90 days of interest.

CDs appeal to savers who prefer guaranteed, short-term returns. While high-yield savings accounts offer flexibility, CDs can secure a higher fixed return for a set period, which can be helpful if rates are expected to decline.

For example, a $25,000 CD at 4.00% APY would earn roughly $1,000 in one year, compared with about $420 based on today's national average 12-month CD rate.

What To Know Before Opening A CD

Certificates of deposit operate differently than savings accounts. Make sure you understand what you're getting:

- Short-Term Goals: Ideal for saving toward tuition, a wedding, or a home down payment within a year.

- Rate Protection: A CD locks your APY, so you’re insulated from rate cuts.

- Ladder Strategy: Pair a 12-month CD with longer terms (24- or 36-month) to capture higher rates while maintaining liquidity.

- Safety: FDIC or NCUA insurance protects up to $250,000 per depositor, per institution.

Before opening an account, make sure you understand all the terms:

- Minimum Deposit: Some banks require $1,000 or more to open.

- Withdrawal Terms: Review penalties before committing funds.

- Renewal Policy: Many CDs automatically renew at maturity unless you opt out.

- Rate Guarantees: Confirm whether your rate is locked at the time of application or funding.

- Online Access: Ensure the bank allows easy transfers and e-statements.

How We Track And Verify Rates

At The College Investor, our editorial team reviews CD rates daily from more than 30 banks and credit unions nationwide. We confirm every APY directly from official rate disclosures and regulatory filings.

Only FDIC- or NCUA-insured institutions available to U.S. consumers are included.

Our rankings are editorially independent - compensation does not influence placement. While we may earn a referral fee when you open an account through some links, our reviews and recommendations are based solely on yield, accessibility, and overall customer experience.

FAQs

Are 12-month CDs safe?

Yes. CDs are federally insured up to $250,000 per depositor, per institution.

Can I withdraw my money early?

Yes, but you’ll forfeit some interest, typically three months’ worth.

Are CD earnings taxable?

Yes. Interest earned is subject to federal income tax, and in some states, state tax.

What happens when a CD matures?

You’ll usually have a 7- to 10-day grace period to withdraw or renew your funds.

Is now a good time to open a CD?

Rates remain near their cycle highs, so locking in a short-term CD can make sense before potential cuts.

Editor: Colin Graves Reviewed by: Richelle Hawley

The post Best 12-Month CD Rates for October 22, 2025: Up to 4.20% appeared first on The College Investor.

37% of Google AI Finance Answers Are Inaccurate in 2025 21 Oct 11:20 PM (yesterday, 11:20 pm)

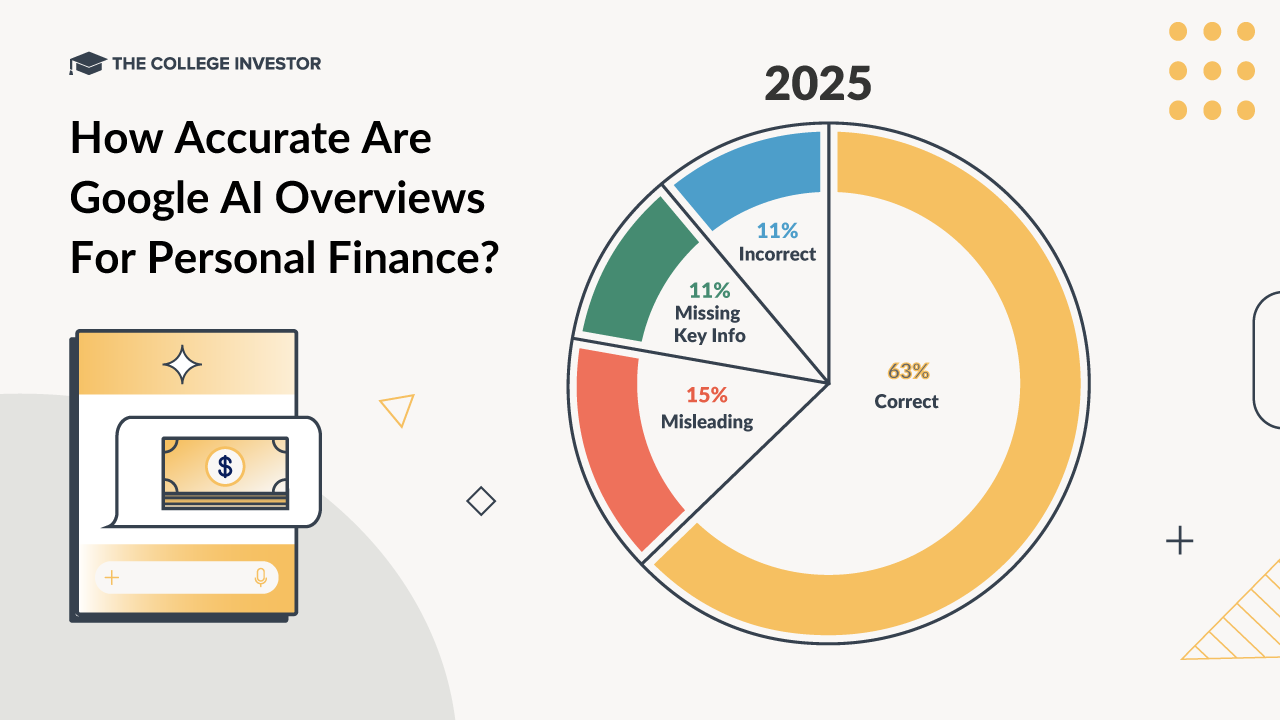

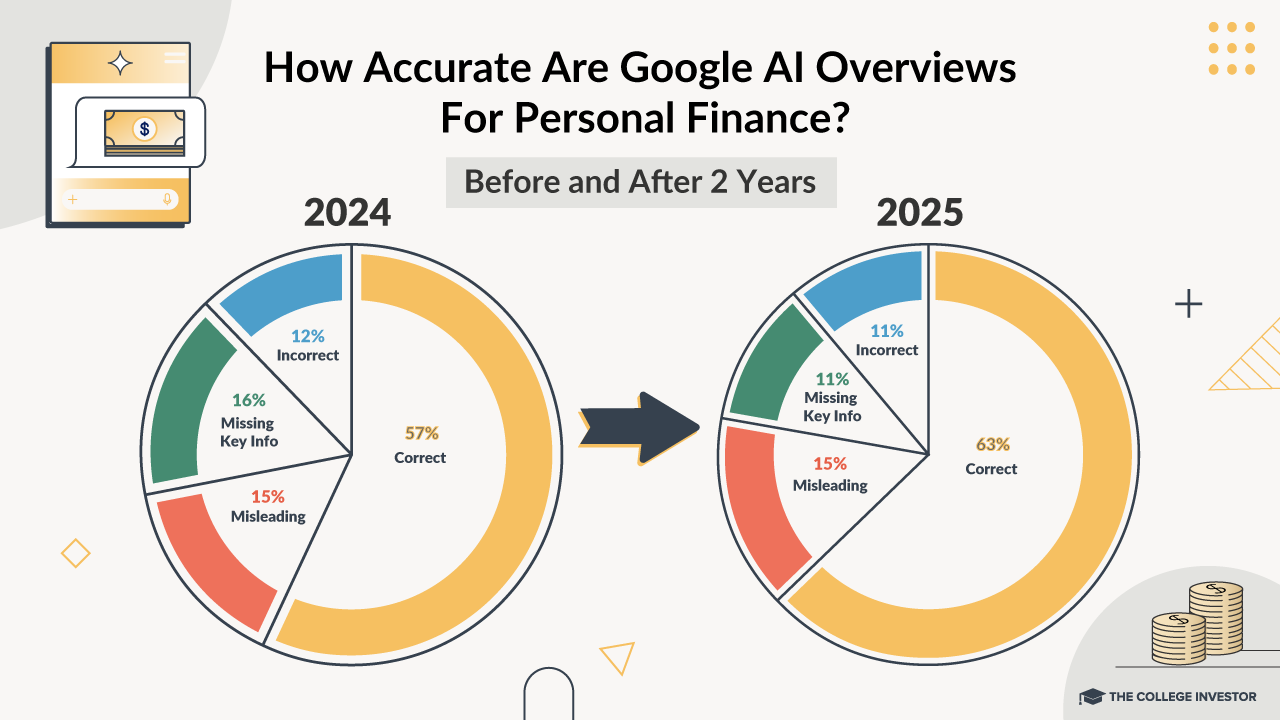

Google AI overviews are misleading or inaccurate in 37% of finance-related searches, according to The College Investor's latest analysis. This is an improvement from last year, where 43% of AI Overviews were inaccurate - but a one-third error rate is troubling when it comes to personal finance.

This is causing consumer confusion, and potentially harming Americans' finances. The overviews were especially bad when it comes to tax, insurance, and financial aid related queries.

What's Happening: Over the last several years, Google has been rolling out AI-driven answers in search results. At the top of the search results they show AI Overviews, and they're now expanding the use of AI Mode. The problem is they are plagued with inaccurate answers. And experts say it's a serious issue.

It's important for searchers to realize that Google is simply analyzing the existing web results and trying to provide an answer based on what it knows and what it finds. It links to some of the resources it finds on the right side.

However, at the end of the day this information is not vetted by a professional or anyone with knowledge of personal finance. It may not be accurate. Even Google alludes to it with their disclaimer (which is different than last year's):

Google search screenshot. [Screenshot by The College Investor]

Would you like to save this?

We'll email this article to you, so you can come back to it later!

Key Issues With Google AI-Overviews And Personal Finance

We re-tested 101 personal finance-related queries across multiple areas of personal finance, including banking, credit, investing, insurance, student loans, and financial aid. You can jump to every query we tested below. This was a follow-up to the same study we did in 2024.

Out of 100 searches, we found that Google AI Overviews were correct in 63 instances, and provided misleading or inaccurate information in 37 instances. Notably, one of the queries no longer has an AI Overview appear for it - and this query had difficulty providing an accurate result last year.

We labeled the incorrect answers three ways:

- 🔶 Misleading: The AI answer provided could be interpreted in a way that causes financial harm.

- 🔶 Missing Key Information: The AI answer was semi-correct, but also missed key information that could cause financial harm (such a key exceptions or state-based rules).

- ❌ Incorrect: The AI answer was simply incorrect, typically using outdated or incorrect values or information, which could lead to financial harm.

We found the the AI-Overviews were completely incorrect in 11 instances. This was only a marginal improvement over the 12 incorrect instances last year. This included issues such as providing outdated information on products and services (or simply making up product names) and outdated information on student loan repayment plans.

The remaining 26 errors were either misleading results or the results were missing key information.

Compared to The College Investor's 2024 AI Overview Study, it improved it's answers in 18 AI Overviews, but got worse in 14 AI Overviews. This shows that both the search results and related AI Overviews continue to change - but the underlying AI technology can't seem to get it right.

When Google Gets It Right

Generally, the AI Overviews were correct for basic 101-level questions, such as "what is" or "how to". They had the most correct answers when covering basic personal finance topics, including banking and getting out of debt.

Compared to last year, they significantly increased the "robustness" of answers. Many of the improvements we saw were queries that were previously Missing Key Information, and now the AI Overview covers the nuances.

When Google Gets It Wrong

AI Overviews struggled the most with recency and nuance - which is most of personal finance. Most of the incorrect answers involved navigating changes to student loans and financial aid, One Big Beautiful Bill tax topics, investing topics, and insurance.

The biggest area of decline was when it came to actual product or service decisions. Last year it appeared to create its own listicle of answers. This year, it was making up products or service names in two of our queries, and continued to get interest rates wrong. For major financial institutions, this is a big compliance issue.

What Surprised Us The Most

Last year, the results were pretty strong on trending news. This year, we noticed that many answers were "hedging their bets", and while providing a lot of information, they didn't really answer the questions.

It was surprising that there were no improvements (and actually declines) in comparing banking products. Checking interest rates on savings accounts seems like a pretty easy task. We do it everyday. But Google seems to fail at it.

The amount of spam in the AI overviews appeared to have increased from last - from images linking to weird foreign spam domains, or parasite content hosted on .edu domains.

We also saw a lot of YouTube videos were being pulled in to the results, which was different than last year.

What Google Is Saying

A Google Spokesperson told The College Investor, "The vast majority of AI Overviews are factual and we’ve continued to make improvements to both the helpfulness and quality of responses, including for financial queries where we have an even higher bar for accuracy. We also inform people when it’s important to seek out expert advice or to verify the information presented."

When sharing some of the examples from this study, the spokesperson said "When issues arise - like if our features misinterpret web content or miss some context - we use those examples to improve our systems, and we take action as appropriate under our policies."

Why Does This Matter For You

When you search for financial information online, you're often looking for help with decisions that directly affect your money - how to pay off your student loans, ways to lower insurance costs, or how to choose the right savings account. If those answers are wrong, the consequences can be serious.

An AI-generated answer that misstates tax rules could lead you to file incorrectly and owe extra taxes and penalties. A bad suggestion about refinancing student loans could cost you loan forgiveness. Even something as simple as outdated credit card details could push you toward a product that no longer exists or carries different fees.

Unlike information from a certified financial planner, a government website, or trusted outlets such as The College Investor, Google’s AI answers aren’t reviewed by experts. They’re stitched together from web content that may be outdated, incomplete, misleading, or flat-out wrong.

That matters because more Americans now rely on their digital devices as their first stop for financial advice. When the search engine that most people use starts presenting unverified information as fact, it doesn’t just waste your time — it can cost you real money.

The government has also been focused misleading and deceptive AI. The FTC announced it was going after a variety of AI scams, California just passed a host of new restrictions on AI, and there has been an increase in UDAAP enforcement in deceptive banking and finance advertising.

When it comes to your money, real human expertise still matters — because getting it wrong can cost you more than just a click.

AI Overviews

All AI overviews were categorized as follows:

- ✅ Correct - The AI answer provided would be correct and helpful, and would not cause financial harm.

- 🔶 Misleading - The AI answer provided could be interpreted in a way that causes financial harm.

- 🔶 Missing Key Information - The AI answer was correct, but also missed key information that could cause financial harm (such a key exceptions).

- ❌ Incorrect - The AI answer was simply incorrect, typically using outdated or incorrect values or information, which could lead to financial harm.

General Personal Finance

These are topics related to general personal finance, such as banking, budgeting, and credit. It was interesting to see timely topics generate AI overviews, such as the Chase Glitch.

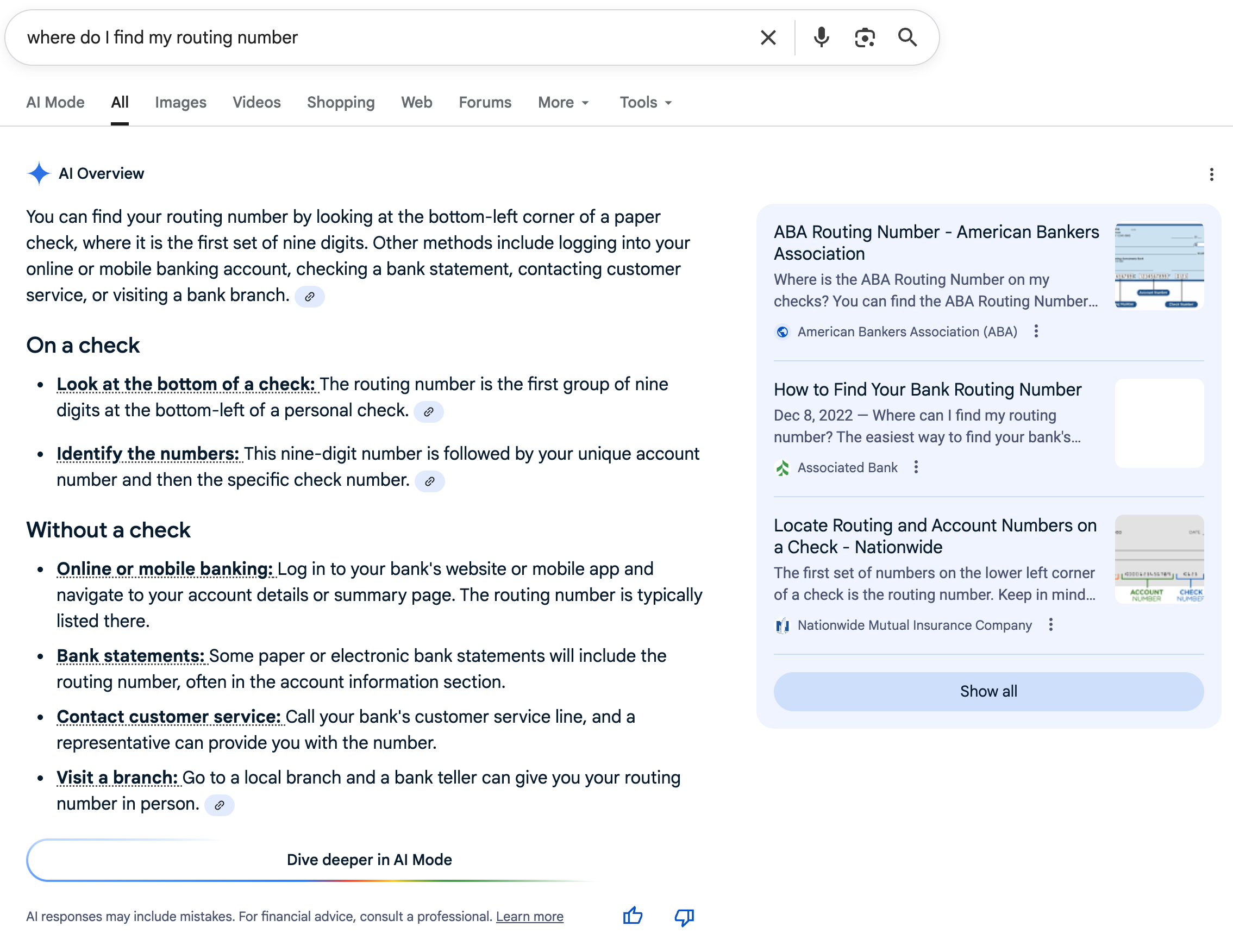

✅ Where Do I Find My Routing Number?

Verdict: Correct

Google search screenshot of query "Where do I find my routing number"? [Screenshot by The College Investor]

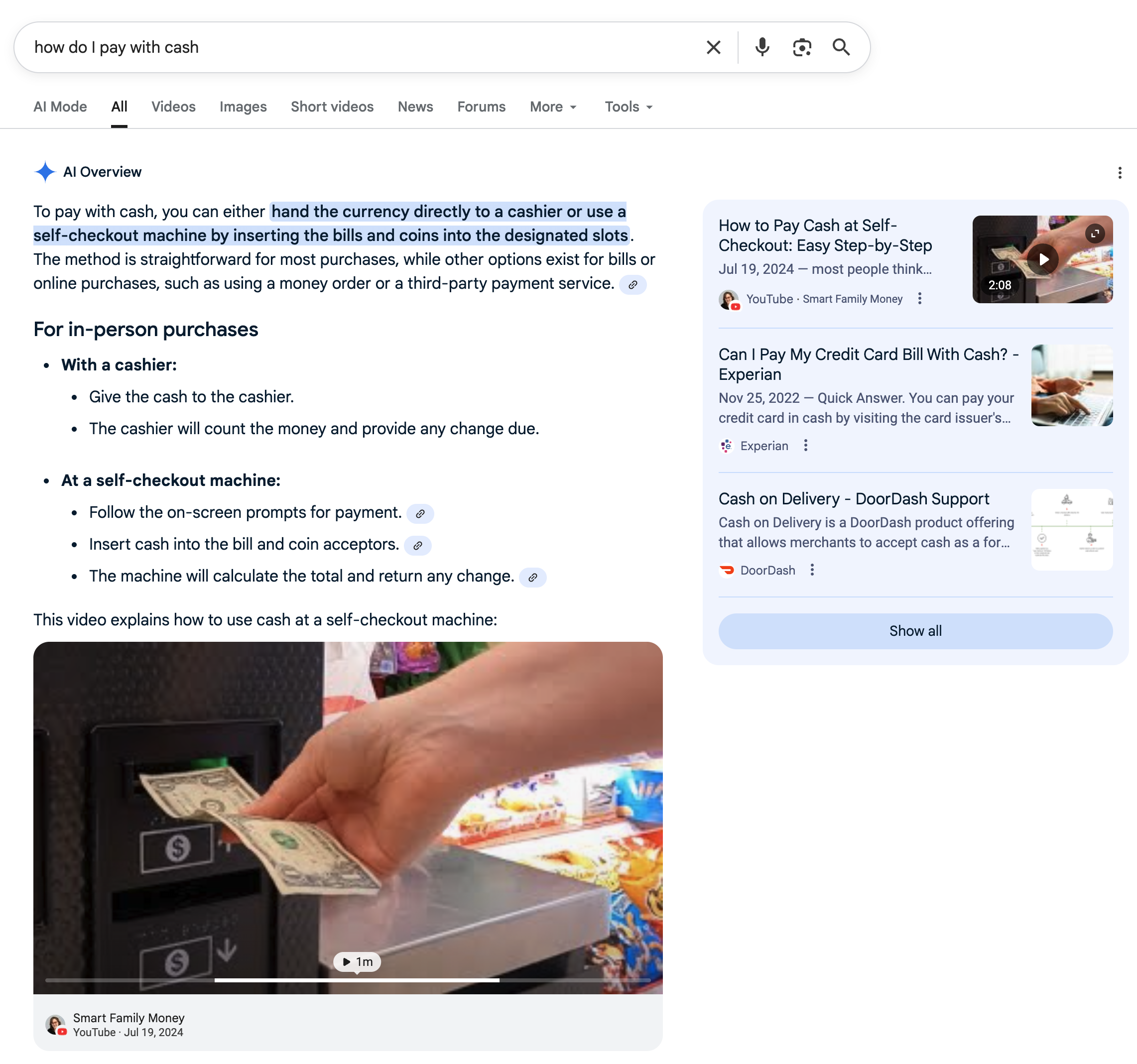

✅ How Do I Pay With Cash?

Verdict: Correct

Google search screenshot of query "How Do I Pay With Cash?" [Screenshot by The College Investor]

✅ What If I Don't Pay My Bills?

Verdict: Correct

Notable that the AI pulls in some blog spam from the University of Wisconsin - Madison in the sidebar.

Google search screenshot of query "What If I Don't Pay My Bills?" [Screenshot by The College Investor]

✅ What Is A Wire Transfer?

Verdict: Correct

As a side note, notice the image that was used from a website called Merchant Cost Consulting without credit or links to their website in the AI overview.

Last year, this same query linked to The Balance without credit or attribution. Odd that this one query wants to pull an image when many others don't.

Google search screenshot of query "What is a wire transfer?" [Screenshot by The College Investor]

✅ What Is The Debt Snowball Method?

Verdict: Correct

Google search screenshot of query "What is the debt snowball method?" [Screenshot by The College Investor]

✅ How Does A Credit Card Work?

Verdict: Correct

Google search screenshot of query "How Does A Credit Card Work?" [Screenshot by The College Investor]

✅ How Does A Check Work?

Verdict: Correct

Another image taken from the Remitly website without any credit. Lot's of money transfer spam sites on the links.

Google search screenshot of query "How Does A Check Work?" [Screenshot by The College Investor]

✅ What Was The Chase Glitch?

Verdict: Correct

Google search screenshot of query "What Was The Chase Glitch" [Screenshot by The College Investor]

✅ Why Is It Bad To Just Make The Minimum Payment On A Credit Card?

Verdict: Correct

Google search screenshot of query "Why Is It Bad To Just Make The Minimum Payment On A Credit Card?" [Screenshot by The College Investor]

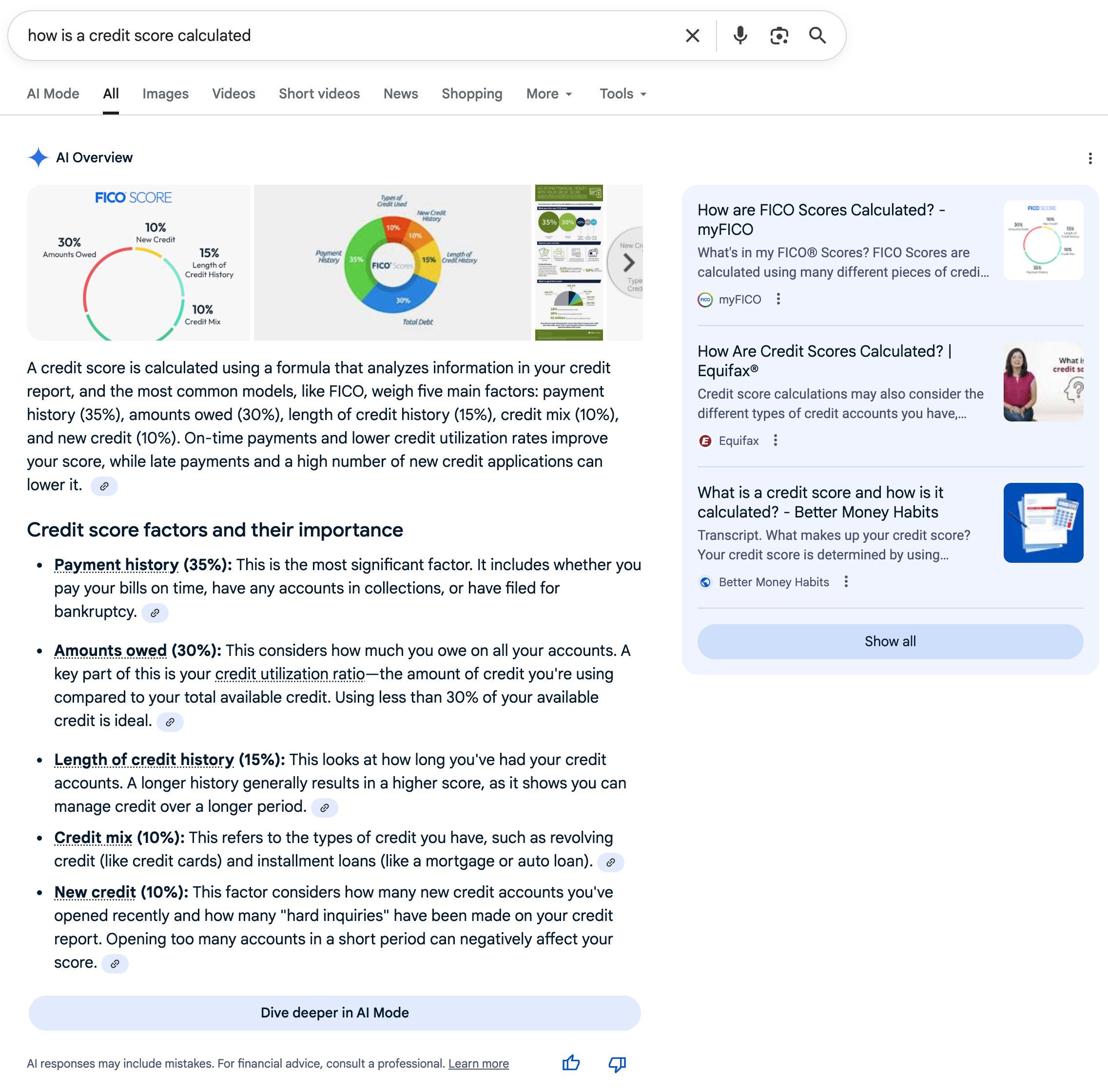

✅ How Is A Credit Score Calculated?

Verdict: Correct

While it pulls in FICO and Vanguard scores, the images are all from spammy domains, some ending in .in.

Google search screenshot of query "How Is A Credit Score Calculated?" [Screenshot by The College Investor]

✅ What Is Considered Bad Credit?

Verdict: Correct

Google search screenshot of query "What Is Considered Bad Credit?" [Screenshot by The College Investor]

❌ Where To Open A Checking Account?

Verdict: Incorrect

This was kind of an improvement, but still a miss compared to last year. If you remember last year, this query Google tried to provide a list that ranked Wells Fargo #1, and followed it up with a list of the largest banks.

This year, it drops it's own ranking in exchange for the four ad spots before the AI Overview (and of course, before the content), and now the AI overview doesn't actually answer the query but just so you can open an checking account at banks and credit unions.

There are lots of free checking account options and lists that can be provided here. This is a miss.

Google search screenshot of query "Where To Open A Checking Account?" [Screenshot by The College Investor]

❌ Where To Open A Savings Account?

Verdict: Incorrect

We were going to leave this one as misleading, but then we read the list... the last bank doesn't exist - I'm really curious how the AI transformed Sallie Mae bank into Sally May (and it links to a YouTube listicle - but the Youtuber has an accent so I'm wondering if it was using voice).

Overall, this doesn't help readers find the best place to open a savings account, though you could argue that it's correct in that these banks do allow people to walk into a branch or open an account.

Except Discover Bank is stopping online deposits soon due to it's merger with Capital One. And then it notes UK options.

All in all, a bad response.

Google search screenshot of query "Where To Open A Savings Account?" [Screenshot by The College Investor]

❌ Where To Open A 12-Month CD?

Verdict: Incorrect

Last year, this tried to provide it's own list of 12-month CD rates (that was outdated).

This year, it makes up a new bank called Hustle Digital Credit Union. There is credit union called HUSTL, which is a division of Vantage West Credit Union. But there's another problem - they don't offer a 4.5% APY 12-month CD. They currently offer a 4.10% APY 12-month CD.

Google search screenshot of query "Where To Open A 12-Month CD?" [Screenshot by The College Investor]

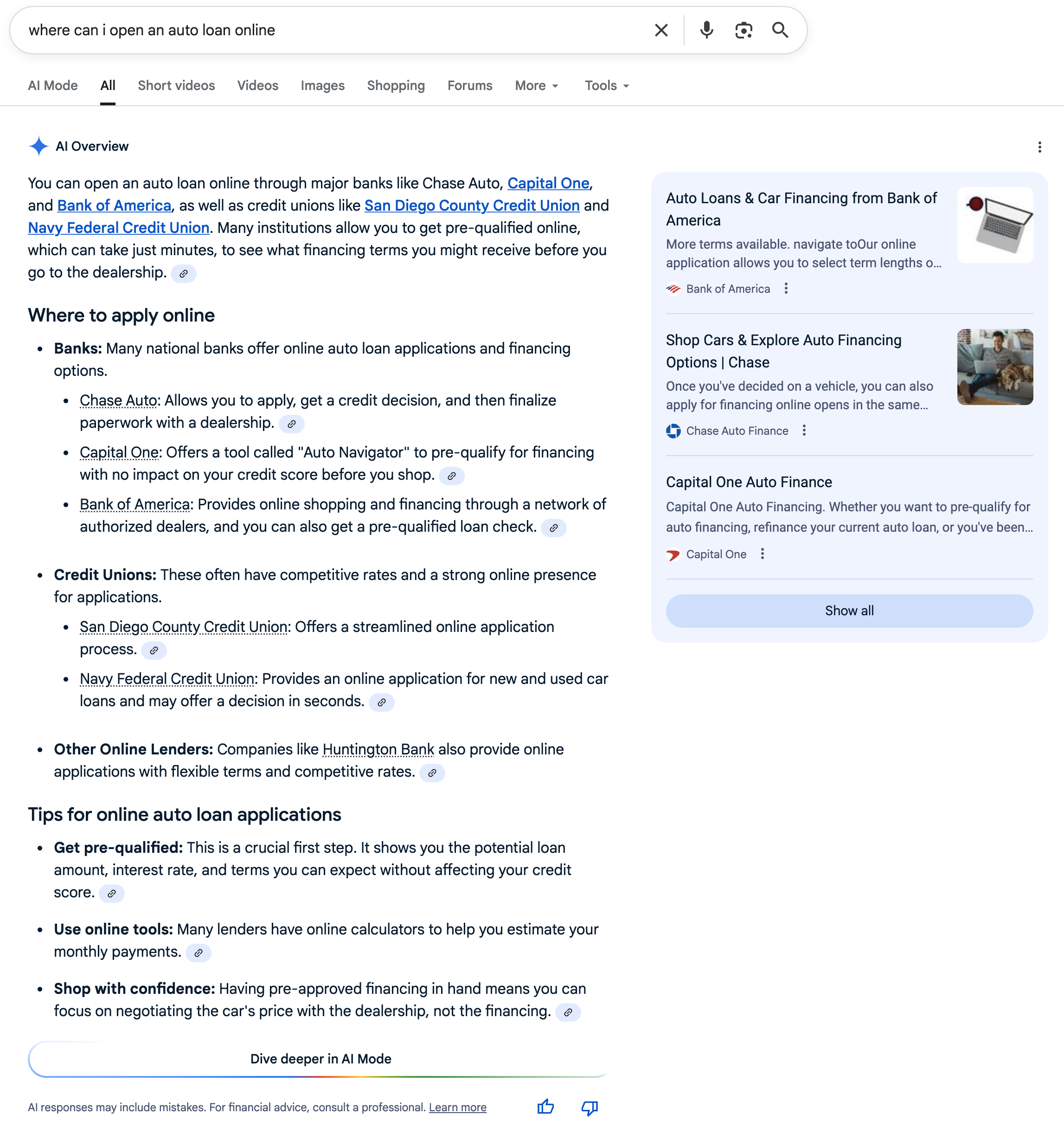

❌ Where Can I Open An Auto Loan Online?

Verdict: Incorrect

We rate this incorrect because the first blue link, Capital One, doesn't allow you to open an auto loan online. The so-called "Auto Navigator" they mention connects you with dealers where you can get pre-qualified through then.

It appears to not understand the query, or is continuing to favor certain big brands.

Google search screenshot of query "Where Can I Open An Auto Loan Online?" [Screenshot by The College Investor]

Taxes

These are topics related to taxes. These topics are concerning to us the most because they have large financial implications for incorrect or misleading answers.

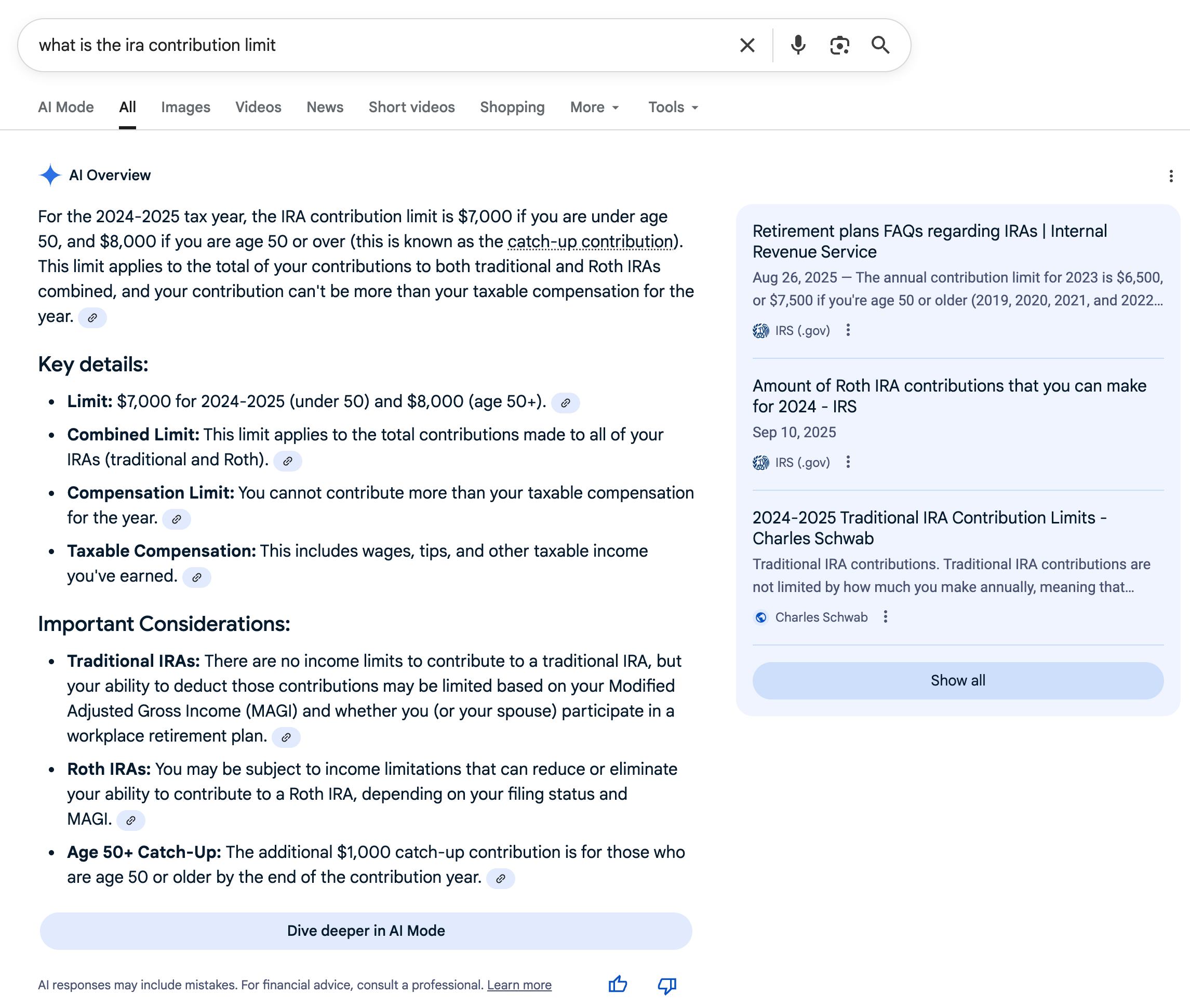

🔶 What Is The IRA Contribution Limit?

Verdict: Misleading

We marked this misleading because there is no 2024-2025 tax year. There is a 2024 tax year, and a 2025 tax year.

Granted, the IRA contribution limits remained the same in both 2024 and 2025 - but we had to do a double-take. And this is way to basic to mess up.

Google search screenshot of query "What Is The IRA Contribution Limit?" [Screenshot by The College Investor]

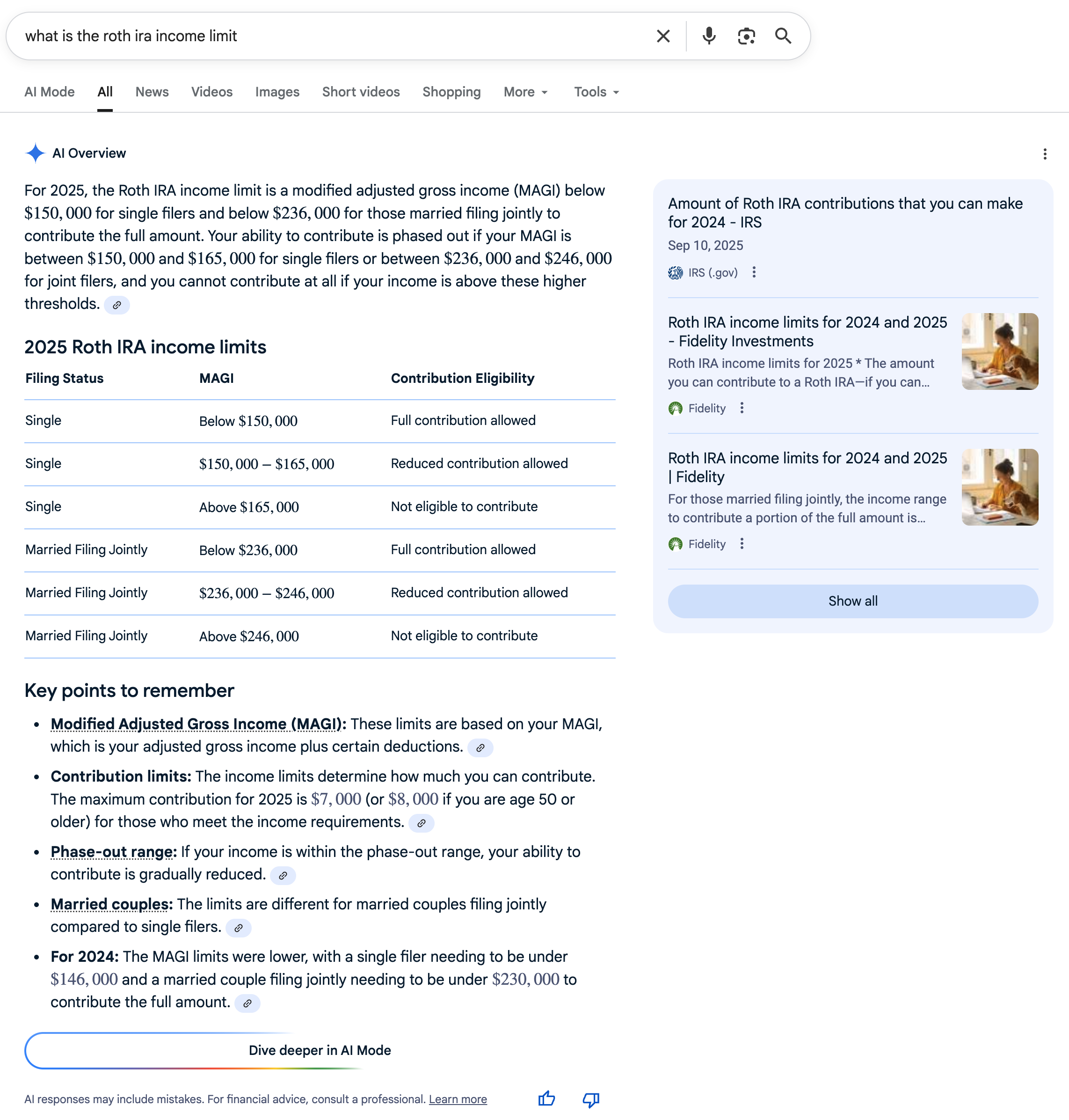

✅ What Is The Roth IRA Income Limit?

Verdict: Correct

Last year this overview incorrectly stated the lower limit. This year, the AI pulls in a nice little chart.

Google search screenshot of query "What Are The Roth IRA Income Limits?" [Screenshot by The College Investor]

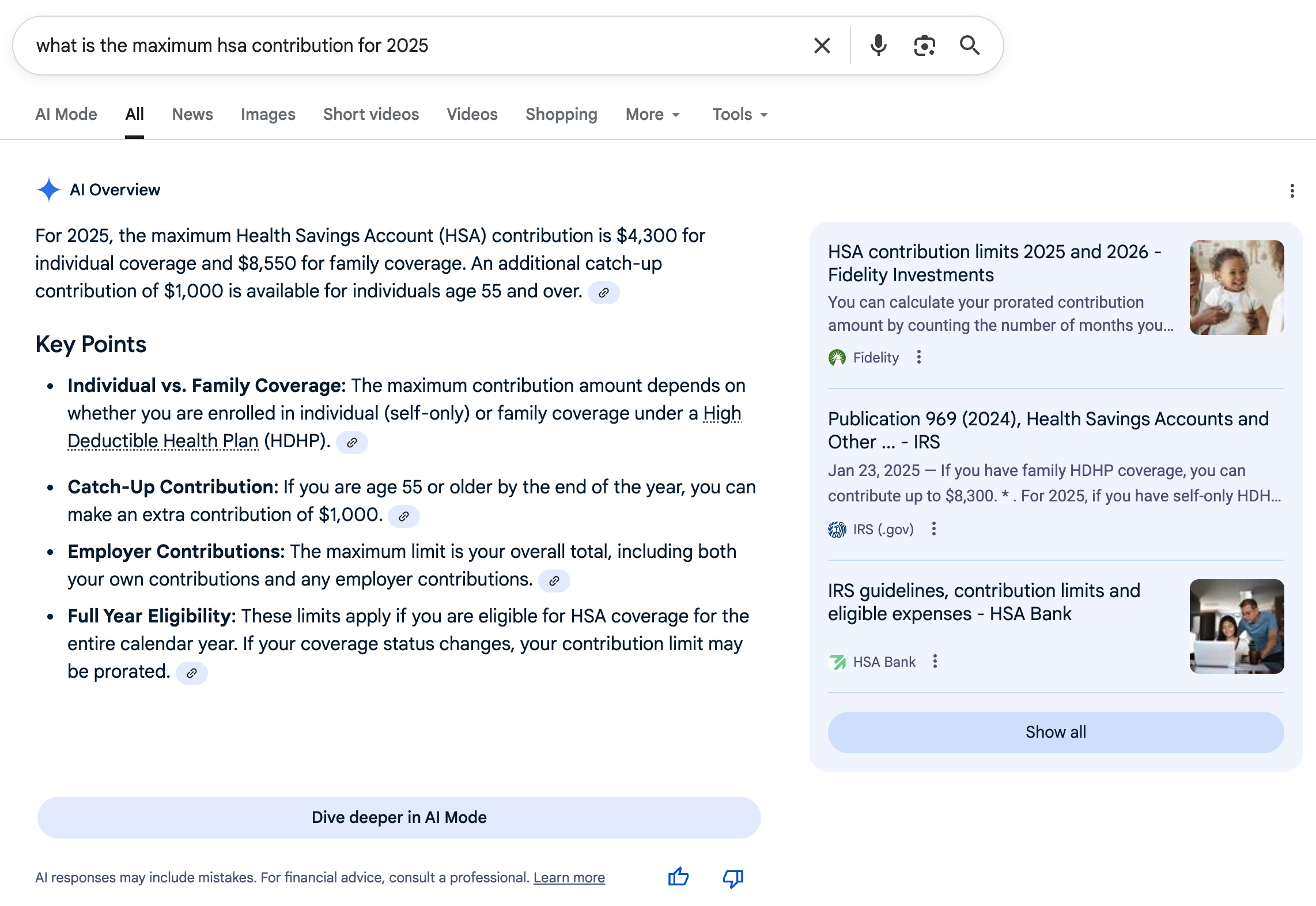

✅ What Is The HSA Contribution Limit?

Verdict: Correct

As a side note for this query, it won't show an AI overview unless you specify a year.

Google search screenshot of query "What Is The HSA Contribution Limit?" [Screenshot by The College Investor]

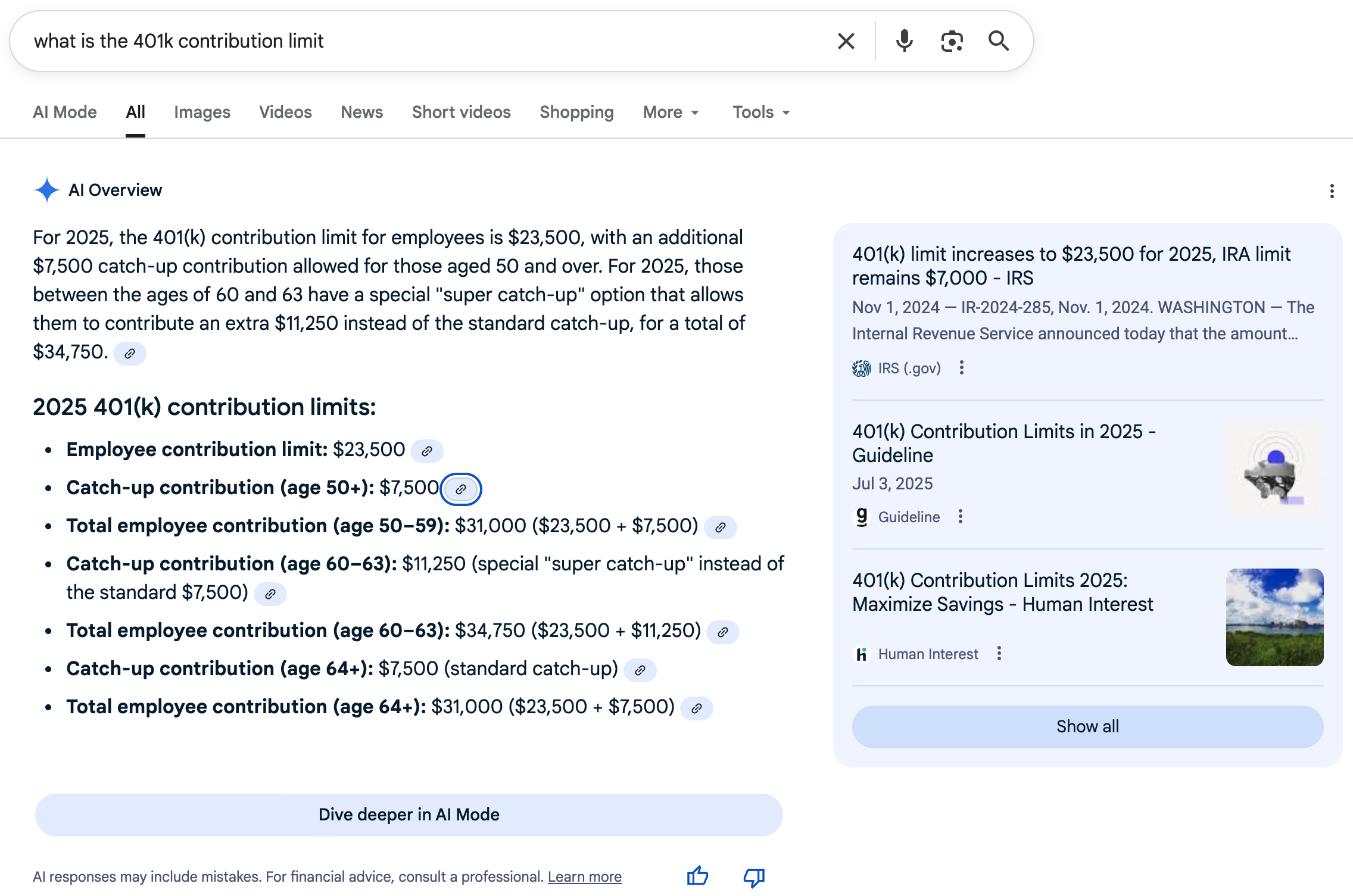

✅ What Is The 401k Contribution Limit?

Verdict: Correct

Google search screenshot of query "What Is The 401k Contribution Limit?" [Screenshot by The College Investor]

✅ What Is The 529 Plan Contribution Limit?

Verdict: Correct

Google search screenshot of query "What Is The 529 Plan Contribution Limit?" [Screenshot by The College Investor]

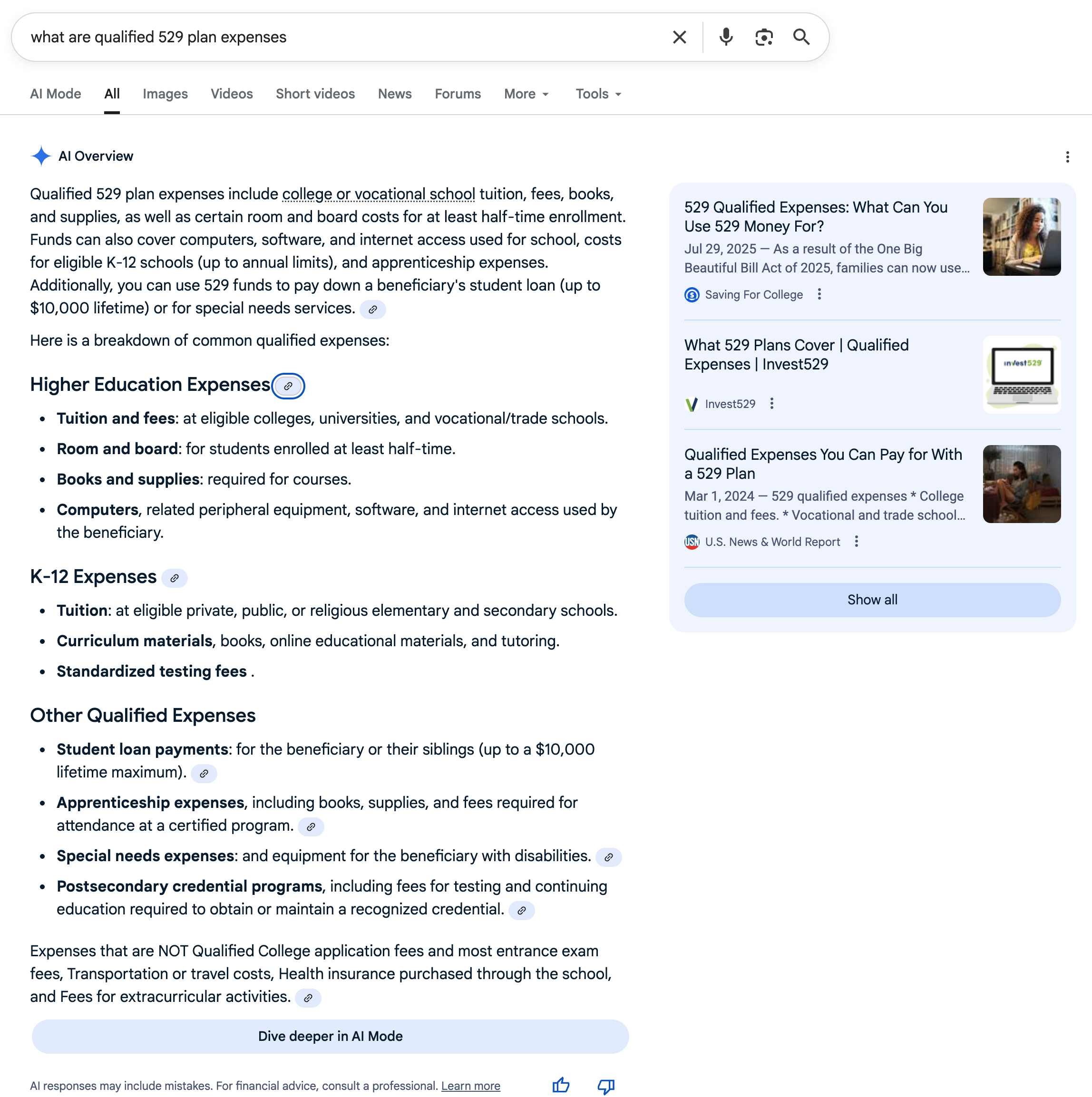

🔶 What Are Qualified 529 Plan Expenses?

Verdict: Misleading

This AI overview of qualifying 529 plan expenses was a little better than last years, it at least hedged with eligible K-12 education 529 plan expenses with (up to annual limits - this is changing in the recent OBBBA).

But it continues to ignore that all states don't conform with federal rules, and is mixed messaging on standardized test fees, which also just changed.

Google search screenshot of query "What Are Qualified 529 Plan Expenses?" [Screenshot by The College Investor]

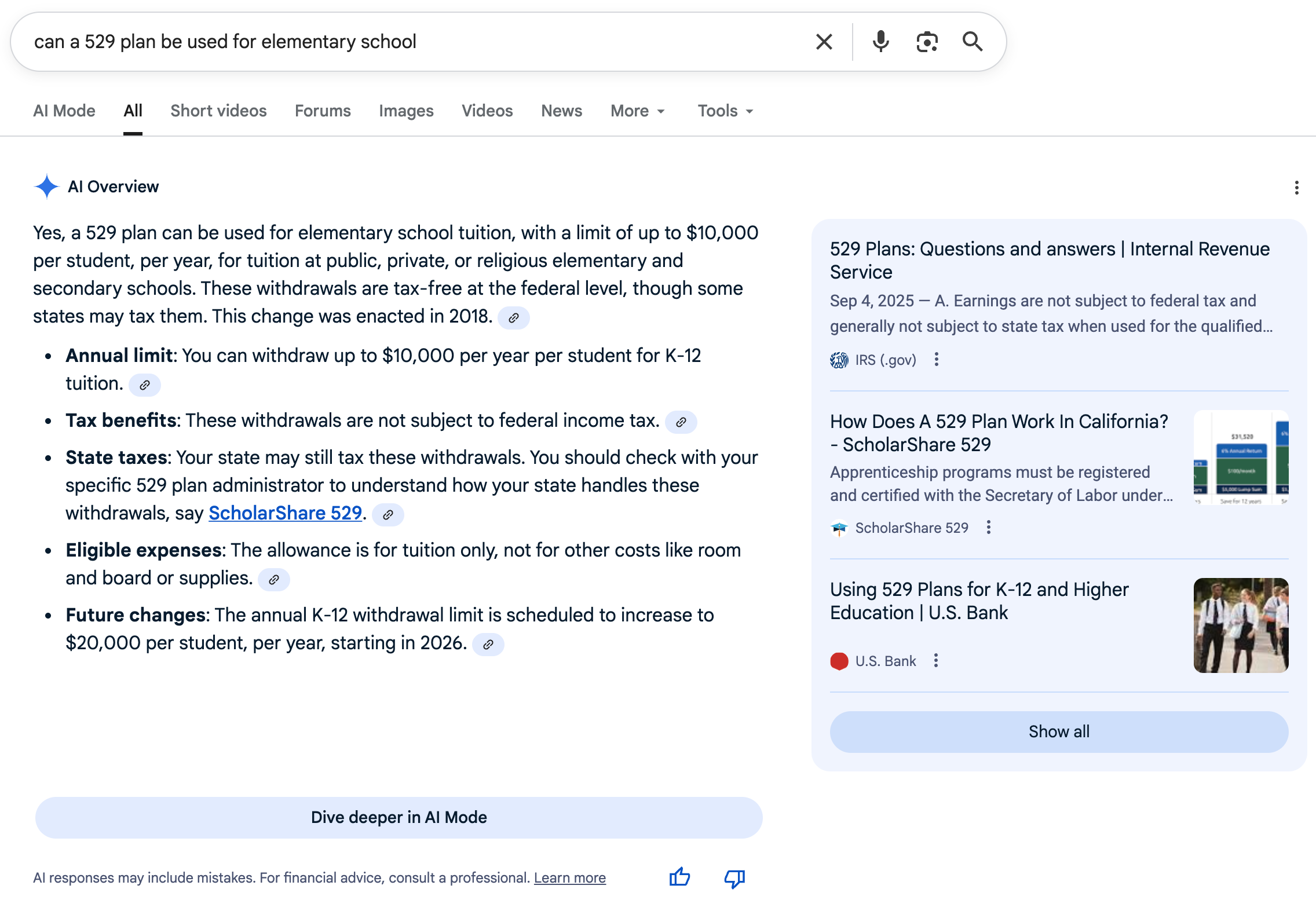

🔶 Can A 529 Plan Be Used For Elementary School?

Verdict: Misleading

The answer to whether you can use a 529 plan for elementary school is "maybe", depending on your state. The AI Overview leads with "Yes", which is misleading, however, it does mention that some states may tax this.

In the future changes, it also doesn't mention that it can be used for more than tuition as well.

Google search screenshot of query "Can You use a 529 plan for elementary school?" [Screenshot by The College Investor]

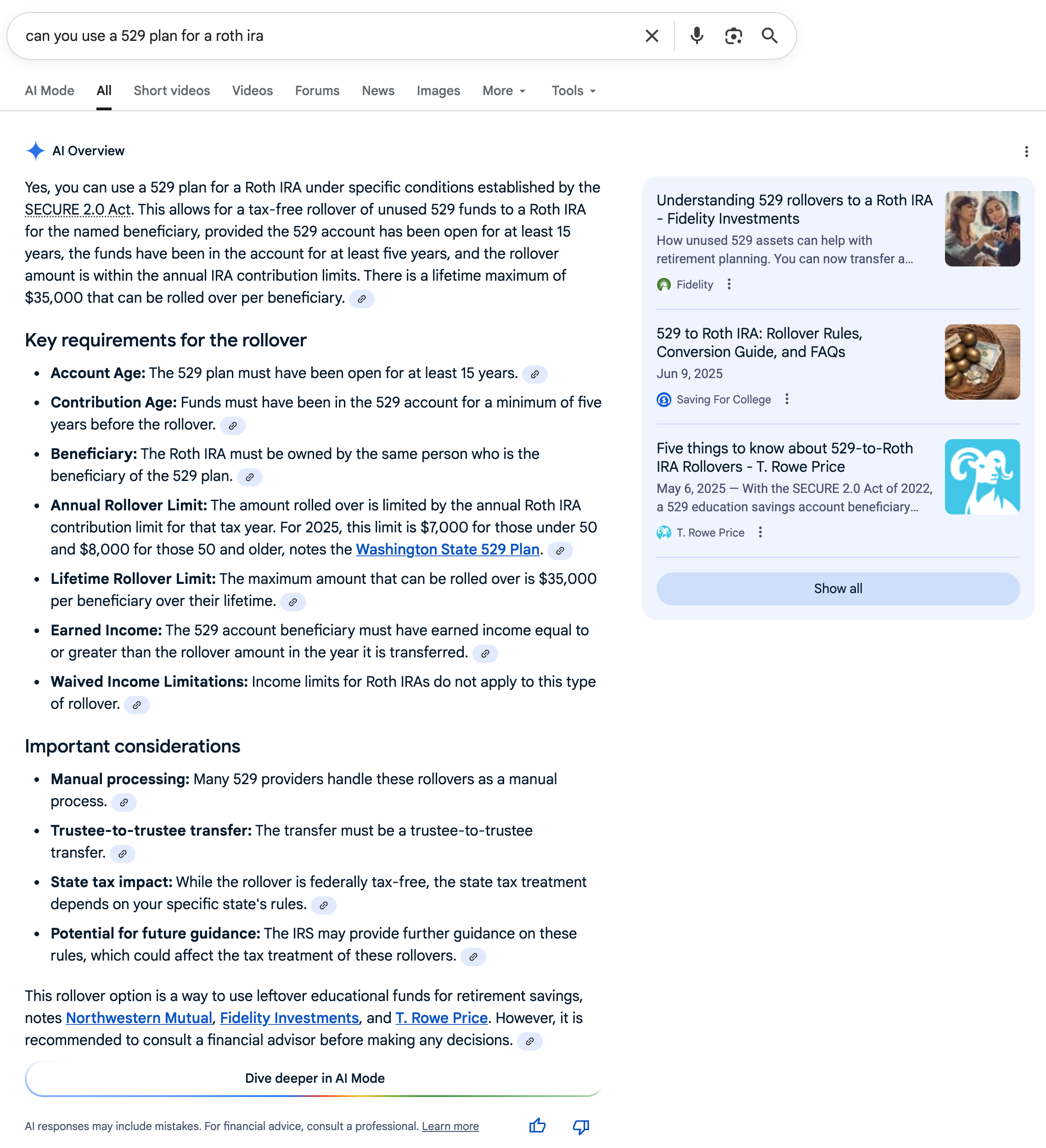

❌ Can You Use A 529 Plan For A Roth IRA?

Verdict: Incorrect

This answer completely ignores that one-third of states (including states like California and Colorado) do not allow this. Unlike the elementary school query, this answer does not include the exceptions in the bullet points. The bottom line is there are very specific 529 plan to Roth IRA rollover rules.

If California residents were to do this, they would faces taxes and penalties.

Google search screenshot of query "Can You Use A 529 Plan For A Roth IRA?" [Screenshot by The College Investor]

✅ Does California Have A 529 Plan Penalty?

Verdict: Correct

Google search screenshot of query "Does California Have A 529 Plan Penalty?" [Screenshot by The College Investor]

✅ How Much Do I Need To Take For An RMD?

Verdict: Correct

Google search screenshot of query "How much do I need to take for an RMD?" [Screenshot by The College Investor]

✅ Is It Legal To Pay My Child?

Verdict: Correct

Google search screenshot of query "Is It Legal To Pay My Child?" [Screenshot by The College Investor]

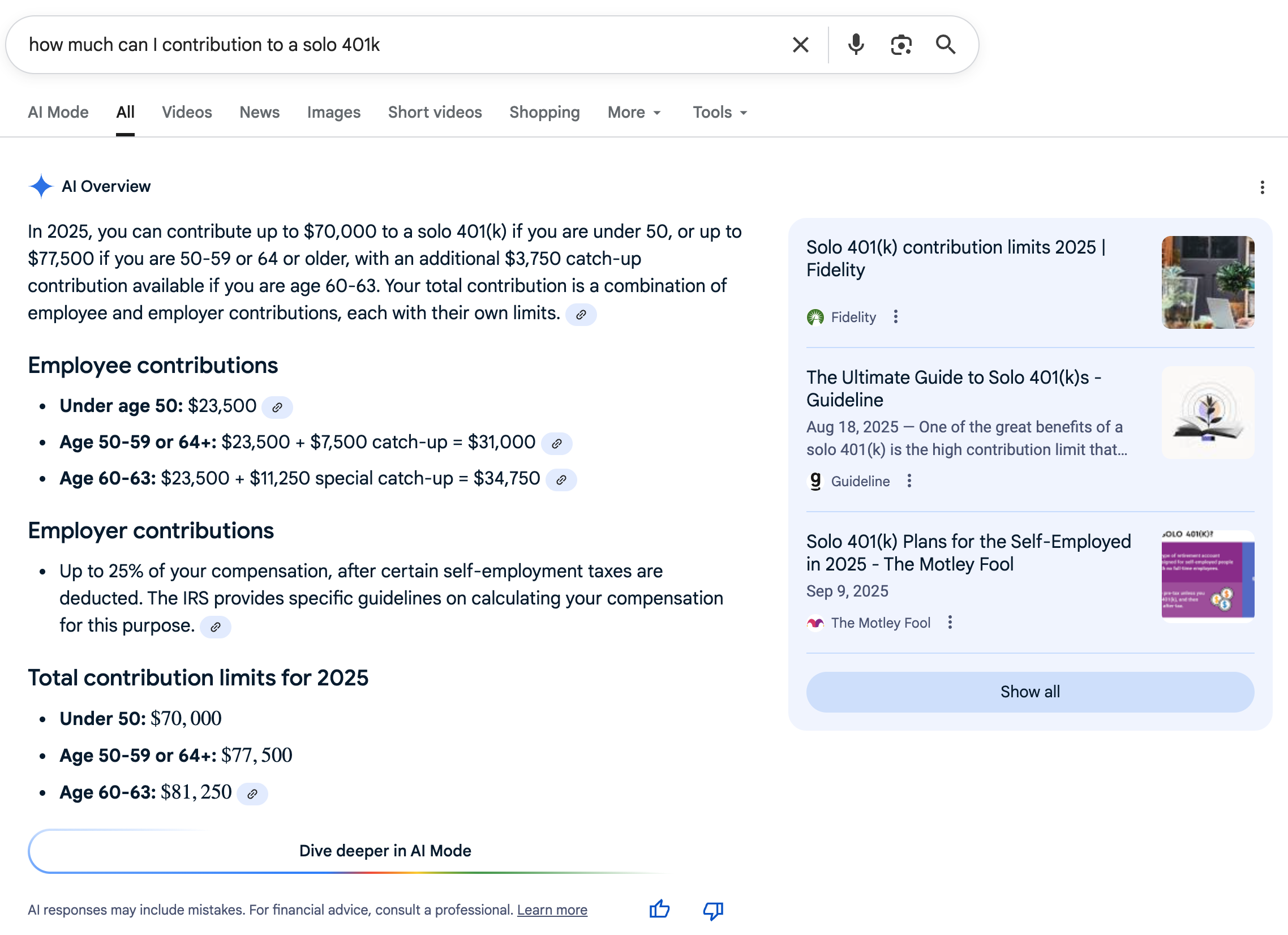

🔶 How Much Can I Contribute To A Solo 401k?

Verdict: Missing Key Information

The maximum amount you can contribute to a solo 401k is $70,000 technically, the the real amount is very nuanced.

The table is a helpful improvement, but the employer contributions don't explain the actual variables based on business structure and income.

Google search screenshot of query "How Much Can I Contribute To A Solo 401k?" [Screenshot by The College Investor]

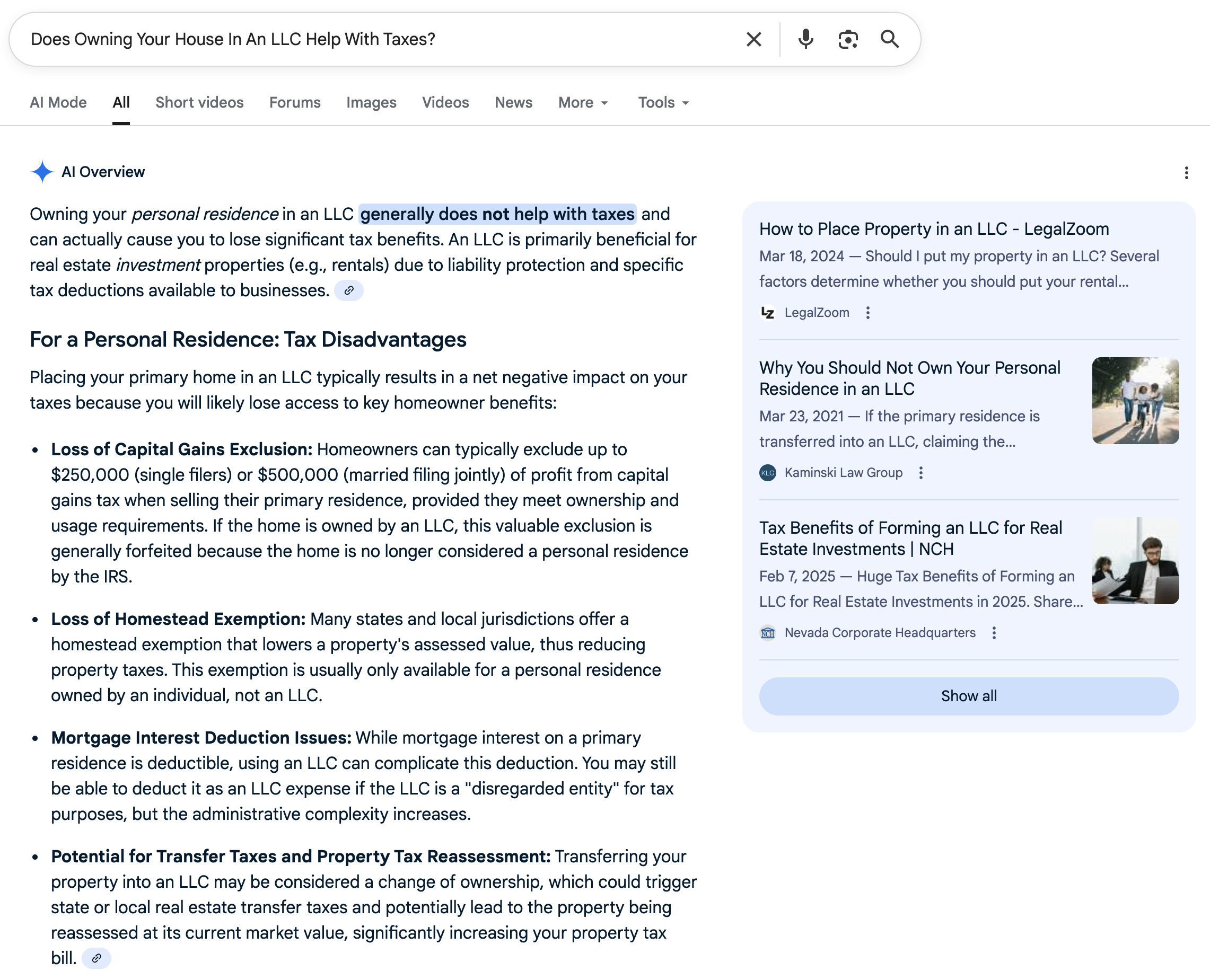

✅ Does Owning Your House In An LLC Help With Taxes?

Verdict: Correct

This one is a huge improvement over last year. Last year it said "Yes". This year, it actually said no and shared reasons why.

Google search screenshot of query "Does Owning Your House In An LLC Help With Taxes?" [Screenshot by The College Investor]

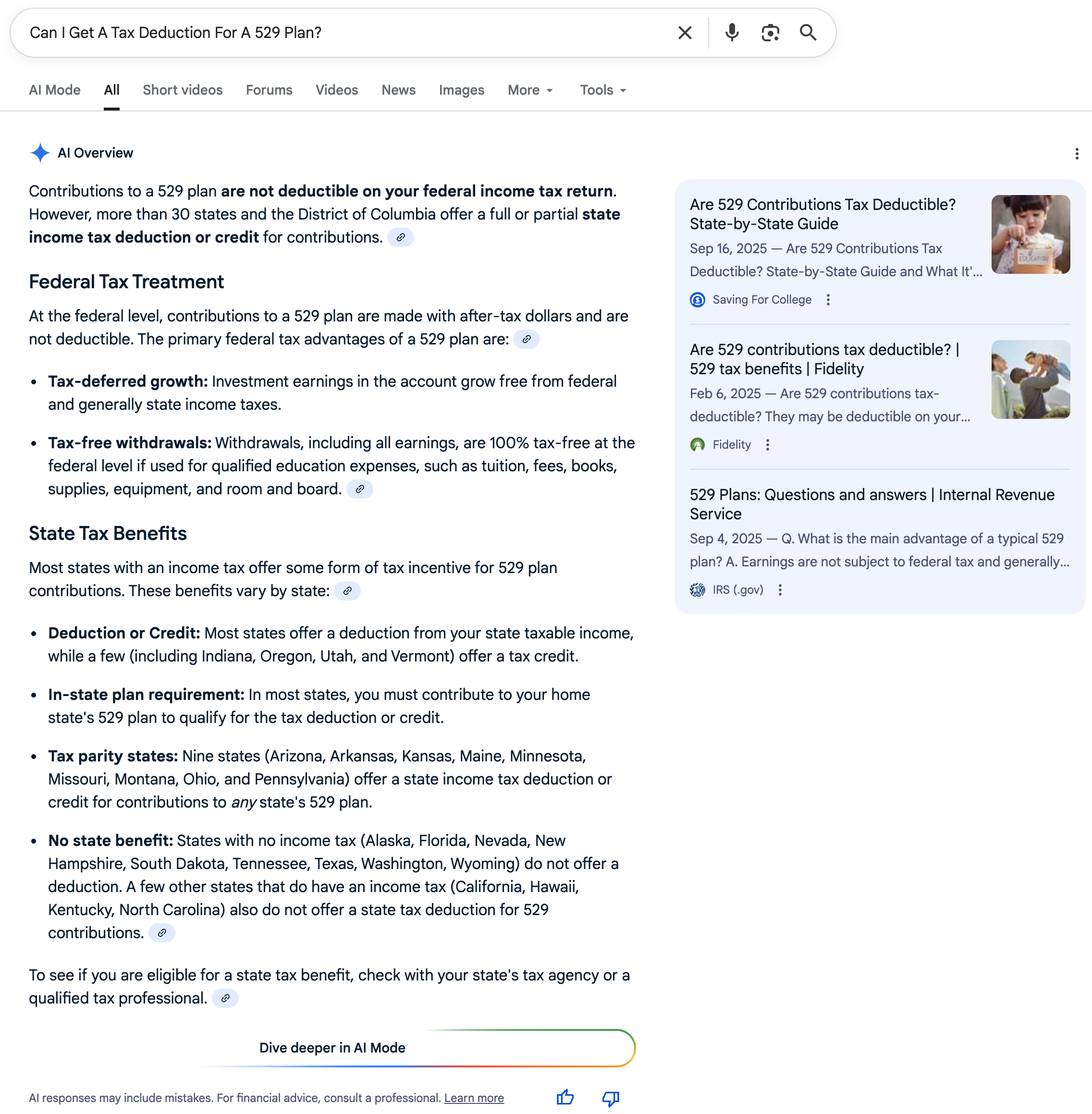

❌ Can I Get A Tax Deduction For A 529 Plan?

Verdict: Incorrect

While the sentence is correct that you don't get a Federal tax deduction, 34 states currently offer a tax deduction or tax credit to a 529 plan. This is mentioned in bullet point three, but since the actual sentence is "No", we view this as incorrect.

Google search screenshot of query "Can I Get A Tax Deduction For A 529 Plan?" [Screenshot by The College Investor]

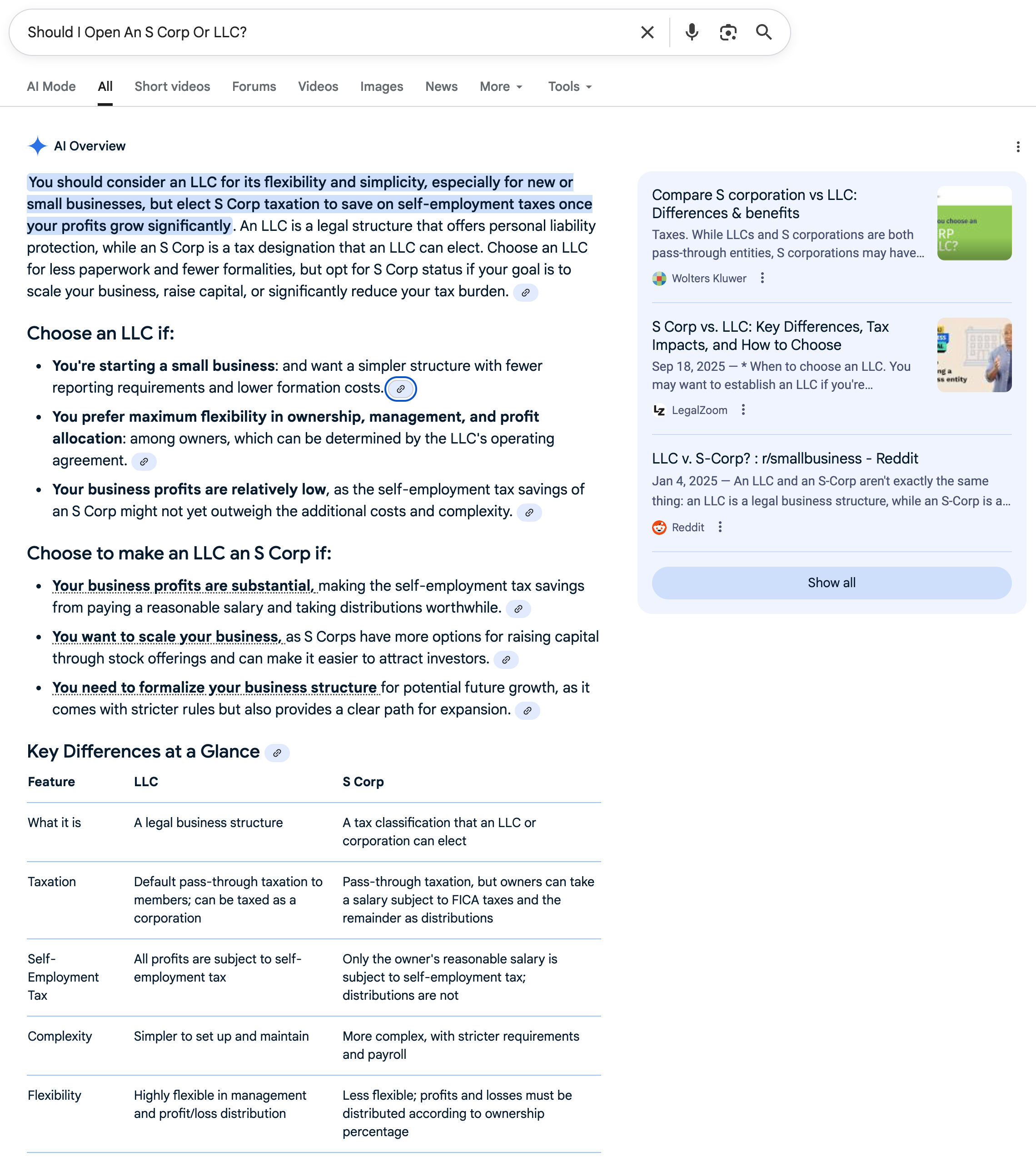

🔶 Should I Open An S Corp Or LLC?

Verdict: Misleading

It did better this year compared to last year, but we also view this answer as very confusing - especially for someone who doesn't understand the difference or maybe saw this on social media.

Google search screenshot of query "Should I Open An S Corp Or LLC?" [Screenshot by The College Investor]

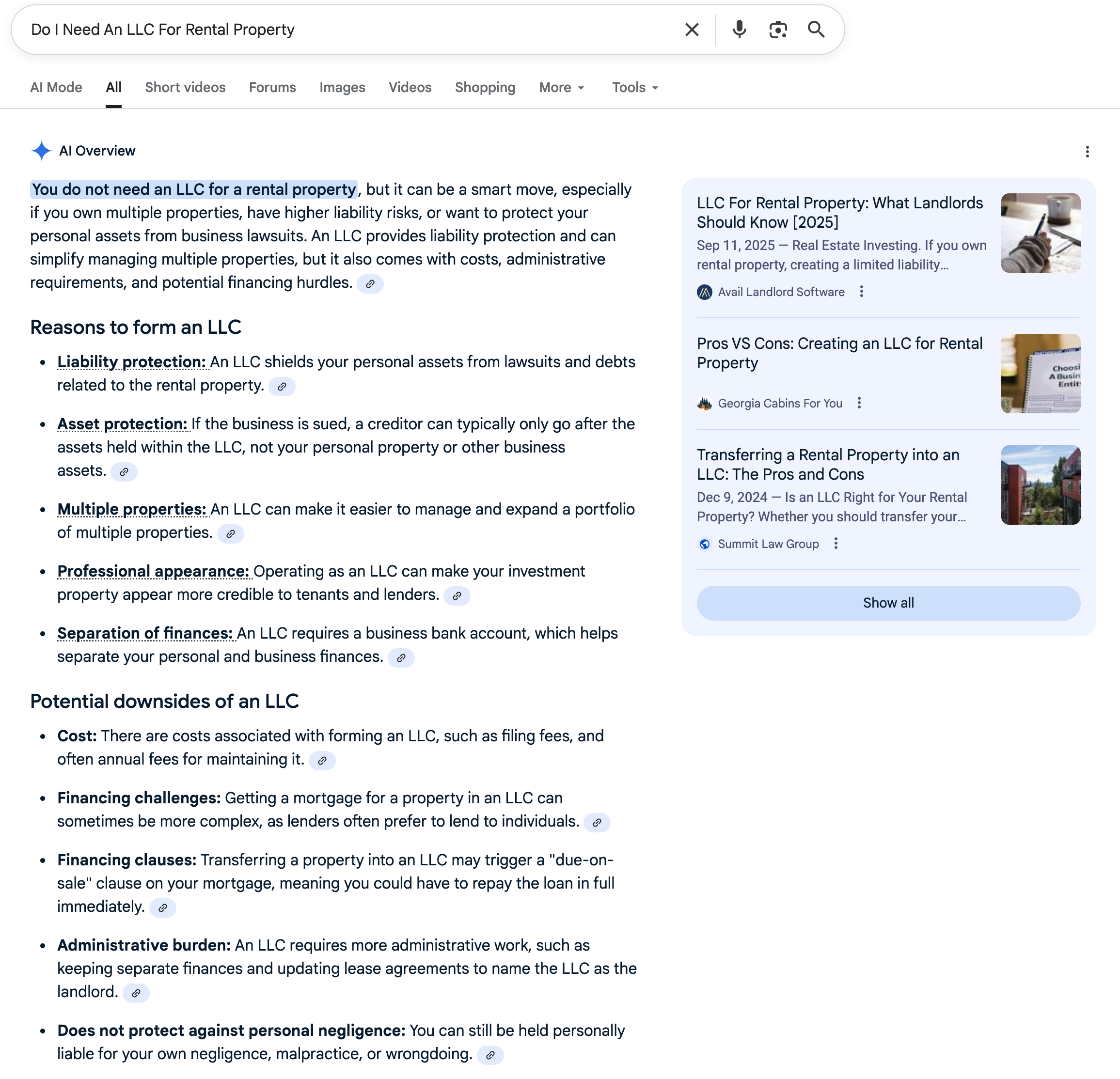

✅ Do I Need An LLC For Rental Property

Verdict: Correct

This was a significant improvement over the answer from last year, which got it wrong.

Google search screenshot of query "Do I Need An LLC For Rental Property?" [Screenshot by The College Investor]

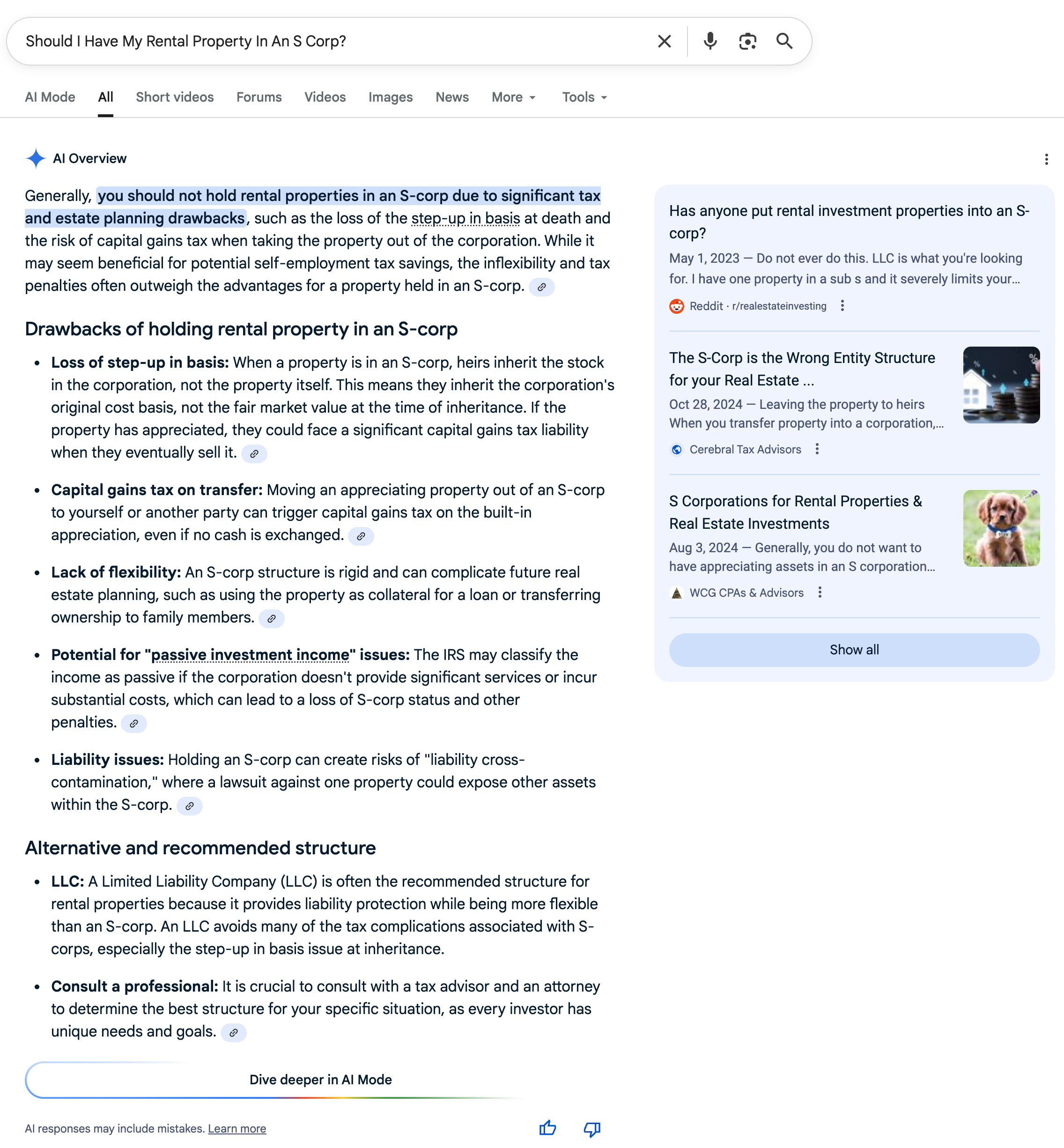

✅ Should I Have My Rental Property In An S Corp?

Verdict: Correct

This was another big improvement from last year, when it said "Yes" - but the correct answer is nearly always "No".

Google search screenshot of query "Should I Have My Rental Property In An S Corp?" [Screenshot by The College Investor]

Investing

These are topics related to investing and investment vehicles.

🔶 What Is The Backdoor Roth IRA?

Verdict: Missing Key Information

The process for a backdoor Roth IRA, while correct, misses many parts of the process and doesn't highlight any pitfalls that get a lot of investors in trouble. Messing up the backdoor Roth IRA can lead to taxes and penalties.

Also, note the infographic from The White Coat Investor, which is not linked in the AI Overview, and is now outdated.

Google search screenshot of query "What Is The Backdoor Roth IRA?" [Screenshot by The College Investor]

🔶 What Is The Mega Backdoor Roth IRA?

Verdict: Missing Key Information

This information about the Mega Backdoor Roth IRA is also semi-correct, but misses a lot of key information and pitfalls. It also focuses on employer-sponsored plans, when most people taking advantage of this will be Solo 401k plans.

Finally, notice the image from Investopedia without any credits or mentions. This article also had several spam links in AI overview.

Google search screenshot of query "What Is The Mega Backdoor Roth IRA?" [Screenshot by The College Investor]

✅ What Is The Wash Sale Rule?

Verdict: Correct

This information on the wash sale rule is correct and a nice improvement versus last year's AI overview.

Google search screenshot of query "What Is The Wash Sale Rule?" [Screenshot by The College Investor]

🔶 How Do I Open A Roth IRA?

Verdict: Misleading

Last year it said you had to have earned income. This year it leaves eligibility vague. Either way, it's a simple question that doesn't need this much nuance.

Google search screenshot of query "How Do I Open A Roth IRA?" [Screenshot by The College Investor]

🔶 How Do I Open An HSA?

Verdict: Misleading

The first sentence says you must first be enrolled in a High Deductible Health Plan (HDHP). While that's true to contribute, that's not true to open one. And there are scenarios where you want to open one and may not have a HDHP. For example, if you left your job and want to rollover your old HSA to a new HSA provider.

And the number of HSA providers is relatively limited.

Google search screenshot of query "How Do I Open An HSA?" [Screenshot by The College Investor]

✅ Can I Use A Roth IRA To Pay For College?

Verdict: Correct

Google search screenshot of query "Can I Use A Roth IRA To Pay For College?" [Screenshot by The College Investor]

✅ Can I Invest If I'm Under 18?

Verdict: Correct

Google search screenshot of query "Can I Invest If I'm Under 18?" [Screenshot by The College Investor]

✅ How Much Money Do I Need To Start Investing?

Verdict: Correct

Google search screenshot of query "How Much Money Do I Need To Start Investing?" [Screenshot by The College Investor]

✅ What's The Difference Between Saving And Investing?

Verdict: Correct

Google search screenshot of query "What's The Difference Between Saving And Investing?" [Screenshot by The College Investor]

✅ Are Municipal Bonds Taxable?

Verdict: Correct

Google search screenshot of query "Are Municipal Bonds Taxable?" [Screenshot by The College Investor]

✅ Can You Trade Options In Your IRA?

Verdict: Correct

Google search screenshot of query "Can You Trade Options In Your IRA?" [Screenshot by The College Investor]

🔶 Can I Withdraw From My Roth IRA Early?

Verdict: Missing Key Information

There are a lot of nuances here that are just missing from this AI overview, and the taxes implications can be harsh.

Google search screenshot of query "Can I Withdraw From My Roth IRA Early?" [Screenshot by The College Investor]

✅ How Do Expense Ratios Work?

Verdict: Correct

Google search screenshot of query "How Do Expense Ratios Work?" [Screenshot by The College Investor]

✅ How Do I Invest In Stocks?

Verdict: Correct

Side note, we think it's pretty bold of Google to try an explain this concept in an AI Overview.

Google search screenshot of query "How Do I Invest In Stocks?" [Screenshot by The College Investor]

🔶 Where To Open An IRA?

Verdict: Misleading

This is a better AI Overview than last year, but still leaves people wondering why? Combine that with the top result on the right sidebar which is blogspam (Deskera is an HR blog) and a lot of outdated content pieces (such as best places in 2024), it leaves you wondering...

Google search screenshot of query "Where To Open An IRA?" [Screenshot by The College Investor]

✅ Where To Open A Brokerage Account?

Verdict: Correct

Not a bad list, it's almost like they took real publisher's lists of the best brokerage firms.

Google search screenshot of query "Where To Open A Brokerage Account?" [Screenshot by The College Investor]

🔶 Where To Open An Options Trading Account?

Verdict: Missing Key Information

This is not a bad list, but it doesn't tell you why you should open an account at any of these places. It's also missing (but really not mentioning) ThinkorSwim, which is widely regarded as the best tool - albeit it's a part of Charles Schwab.

Google search screenshot of query "Where To Open An Options Trading Account" [Screenshot by The College Investor]

Student Loans

These are topics related to student loans. It was interesting to see a mix of both outdated information, and some decent answers for current queries.

Last year, it appeared they were blocking certain queries:

AI Overview Not Available For This Search. [Screenshot by The College Investor].

This year, it appears they have removed that specific block, and the answer is pretty good:

Can The President Forgive Student Loans Query. [Screenshot by The College Investor].

✅ How To Get Student Loans?

Verdict: Correct

A much improved answer this year.

Google search screenshot of query "How To Get Student Loans?" [Screenshot by The College Investor]

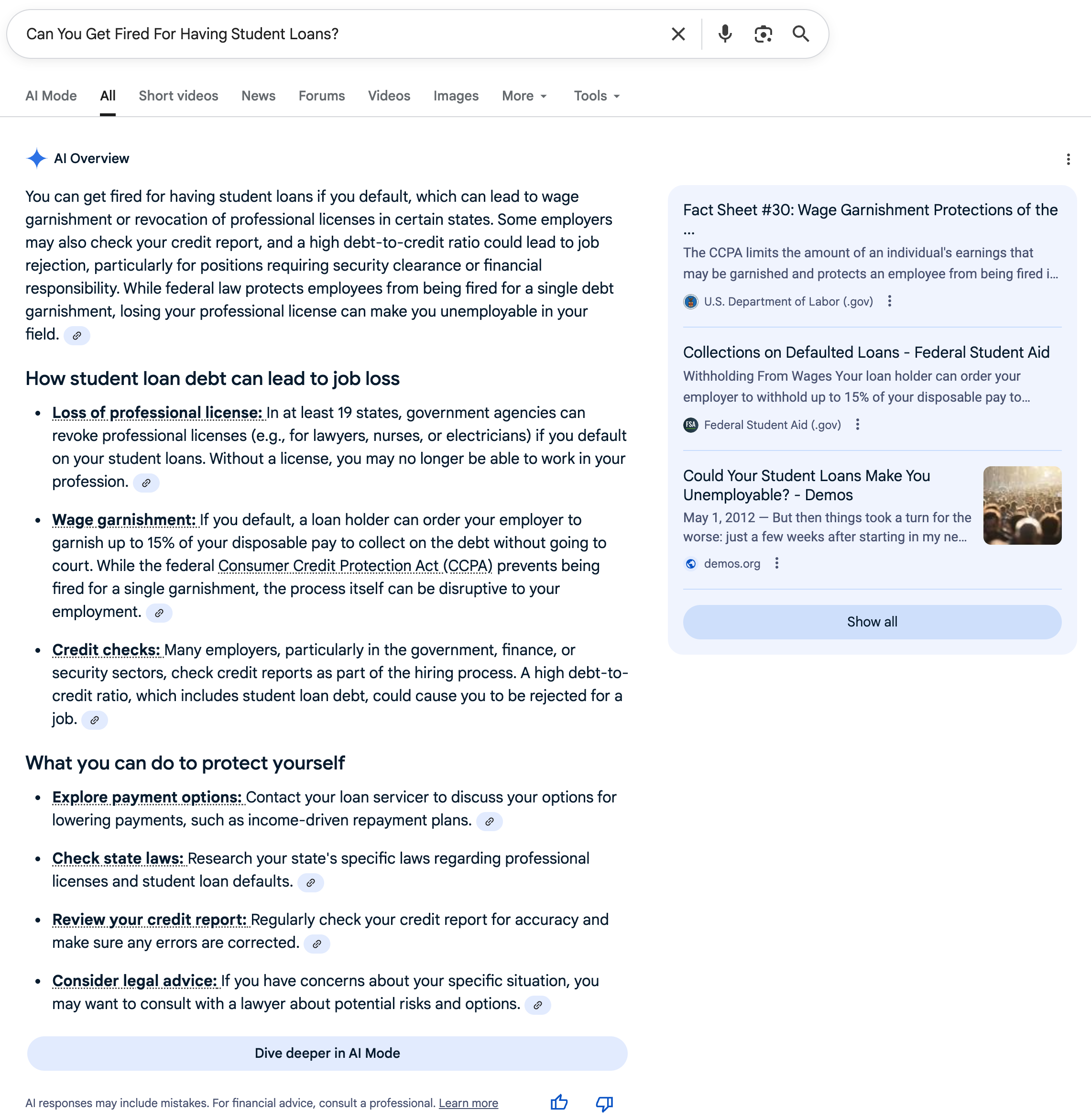

✅ Can You Get Fired For Having Student Loans?

Verdict: Correct

Yes, you can be fired for student loans under numerous situations, and this AI Overview got it right this year.

However, there is a lot of blogspam in the results and outdated content over 10 years old.

Google search screenshot of query "Can You Get Fired For Student Loans?" [Screenshot by The College Investor]

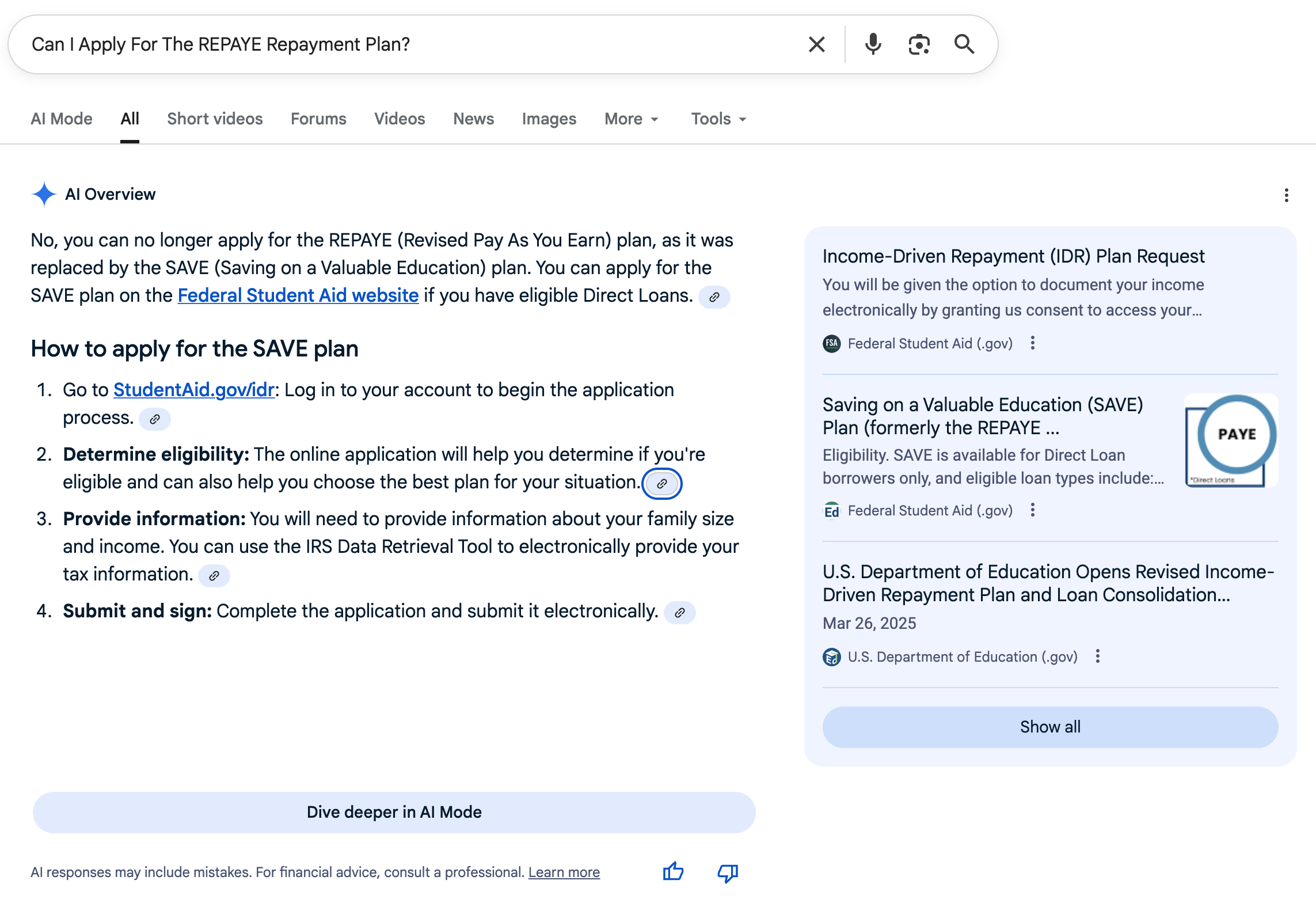

❌ Can I Apply For The REPAYE Repayment Plan?

Verdict: Incorrect

I was so hopeful this was going to be fixed...and it kind of was, then it was still wrong. Last year, it clearly said "Yes, you can apply for REPAYE" but the problem is that plan doesn't exist any longer.

This year, while it correctly said "No, you can no longer apply for REPAYE", it followed it up by saying it was replaced by SAVE and you can apply for SAVE (which is incorrect as SAVE is no longer an eligible repayment plan either).

If only Google knew (or cared) that resources like The College Investor provided accurate and updated student loan information...

Google search screenshot of query "Can I Apply For The REPAYE Repayment Plan?" [Screenshot by The College Investor]

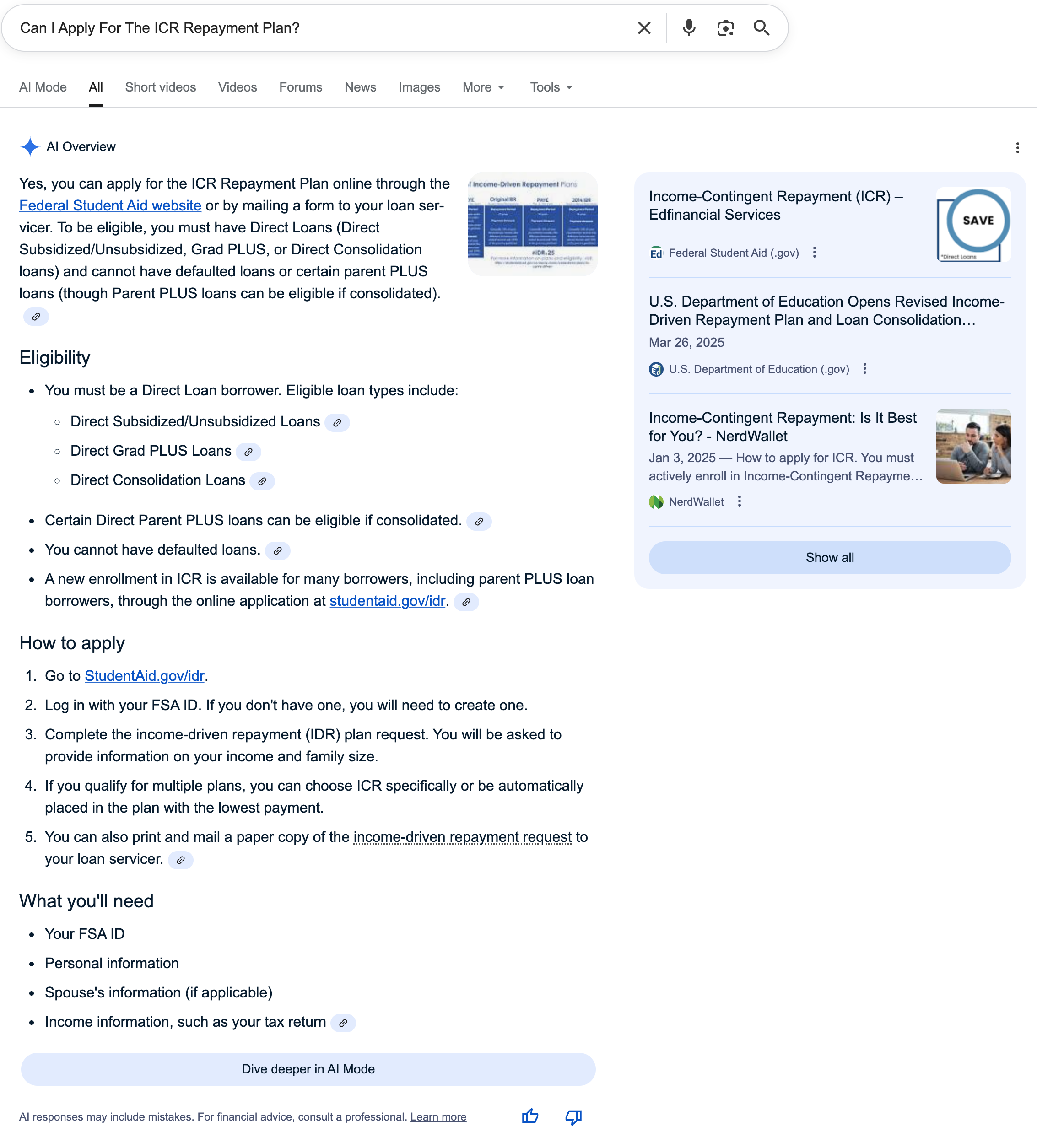

🔶 Can I Apply For The ICR Repayment Plan?

Verdict: Missing Key Information

This is correct, but it's missing the One Big Beautiful Bill Act changes that the ICR plan is being phased out. While you can technically enroll today (that's ending in late 2027), you'll be forced to change plans in 2028 if you stay in ICR.

Google search screenshot of query "Can I Apply For The ICR Repayment Plan?" [Screenshot by The College Investor]

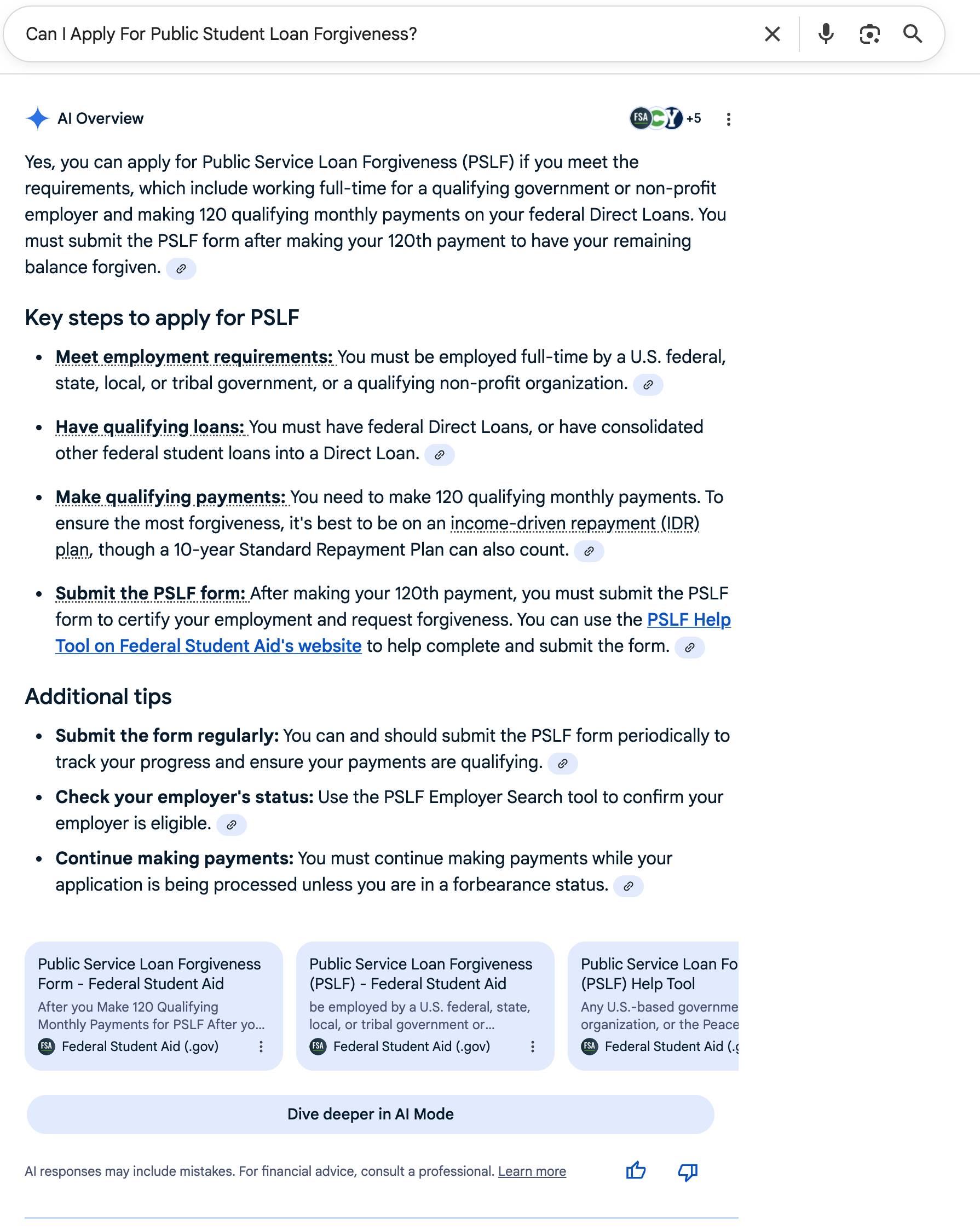

✅ Can I Apply For Public Student Loan Forgiveness?

Verdict: Correct

Nice improvement here over last year.

Google search screenshot of query "Can I Apply For Public Student Loan Forgiveness?" [Screenshot by The College Investor]

🔶 Why Are My Student Loans In Forbearance Due To SAVE?

Verdict: Misleading

While the first sentence is correct "your loans were placed into forbearance due to court orders..." the rest of the answer starts to have lots of incorrect or misleading statements.

For example, the SAVE forbearance is not over - it's been extended and will remain likely through 2028. However, interest is accuring.

Borrowers also don't have to choose a new repayment plan yet. There's a lot of nuance in leaving the SAVE plan. The frustrating part is that the official resources aren't providing much guidance, and based on the links it's clear that's what Google is pulling in.

Google search screenshot of query "Why Are My Student Loans In Forbearance Due To SAVE?" [Screenshot by The College Investor]

❌ Does A Processing Forbearance Count For PSLF?

Yes, a processing forbearance counts for PSLF. This answer appears to try to hedge it's bet by including various other periods that may or may not count for PSLF.

Google search screenshot of query "Does A Processing Forbearance Count For PSLF?" [Screenshot by The College Investor]

✅ Does Working In A Medical Group Count For PSLF?

Verdict: Correct

This AI overview was dominated by weird website blogspam in the links.

Google search screenshot of query "Does Working In A Medical Group Count For PSLF?" [Screenshot by The College Investor]

✅ Do I Have To Apply For PSLF Every Year?

Verdict: Correct

This improved over last year.

Google search screenshot of query "Do I Have To Apply For PSLF Every Year?" [Screenshot by The College Investor]

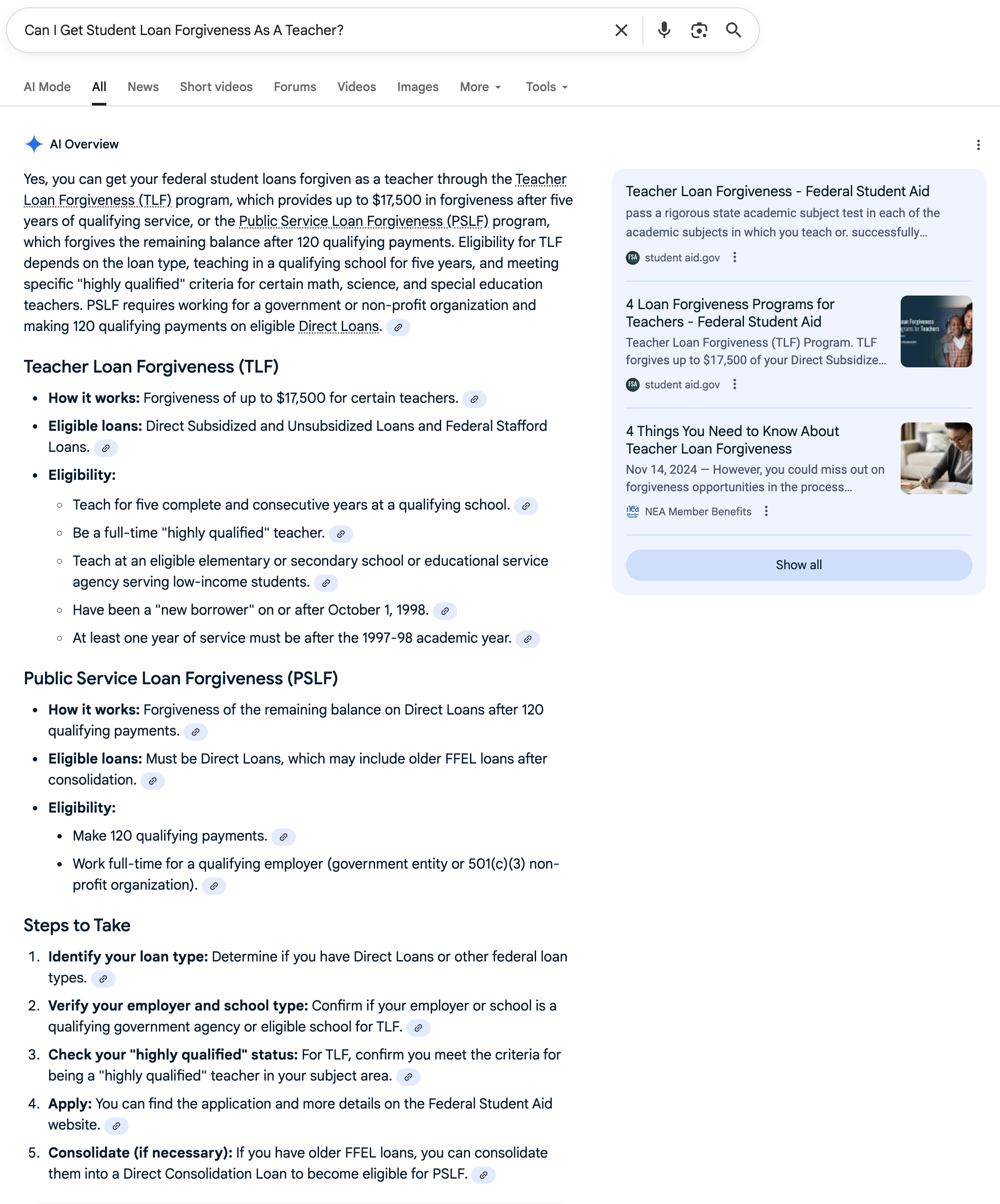

✅ Can I Get Student Loan Forgiveness As A Teacher?

Verdict: Correct

Google search screenshot of query "Can I Get Student Loan Forgiveness As A Teacher?" [Screenshot by The College Investor]

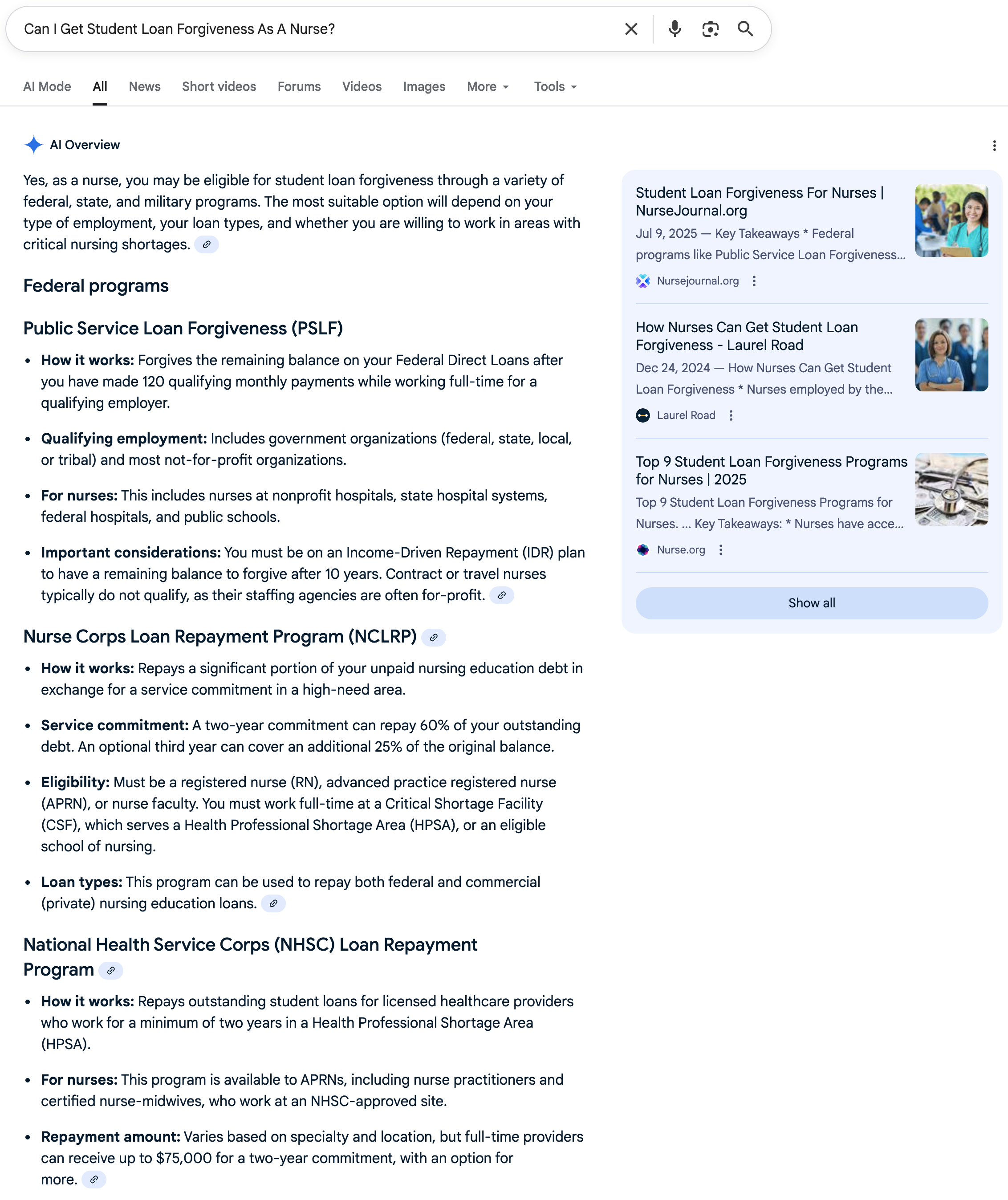

✅ Can I Get Student Loan Forgiveness As A Nurse?

Verdict: Correct

This answer is eerily similar to our own article on Nursing Student Loan Forgiveness.

Google search screenshot of query "Can I Get Student Loan Forgiveness As A Nurse?" [Screenshot by The College Investor]

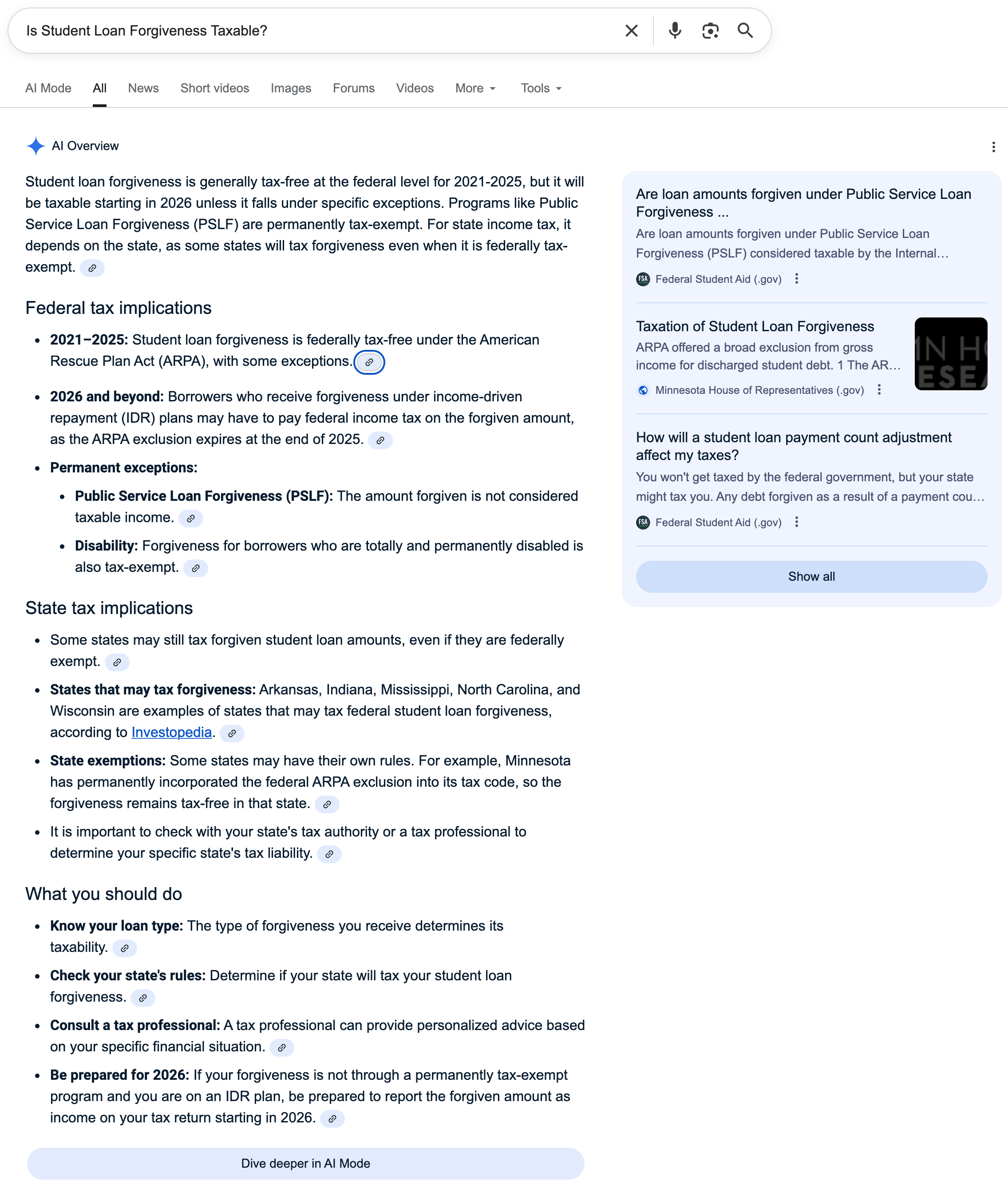

✅ Is Student Loan Forgiveness Taxable?

Verdict: Correct

We were impressed on the nuance of this answer on taxes and student loan forgiveness. Very few sources are getting this correct.

Google search screenshot of query "Is Student Loan Forgiveness Taxable?" [Screenshot by The College Investor]

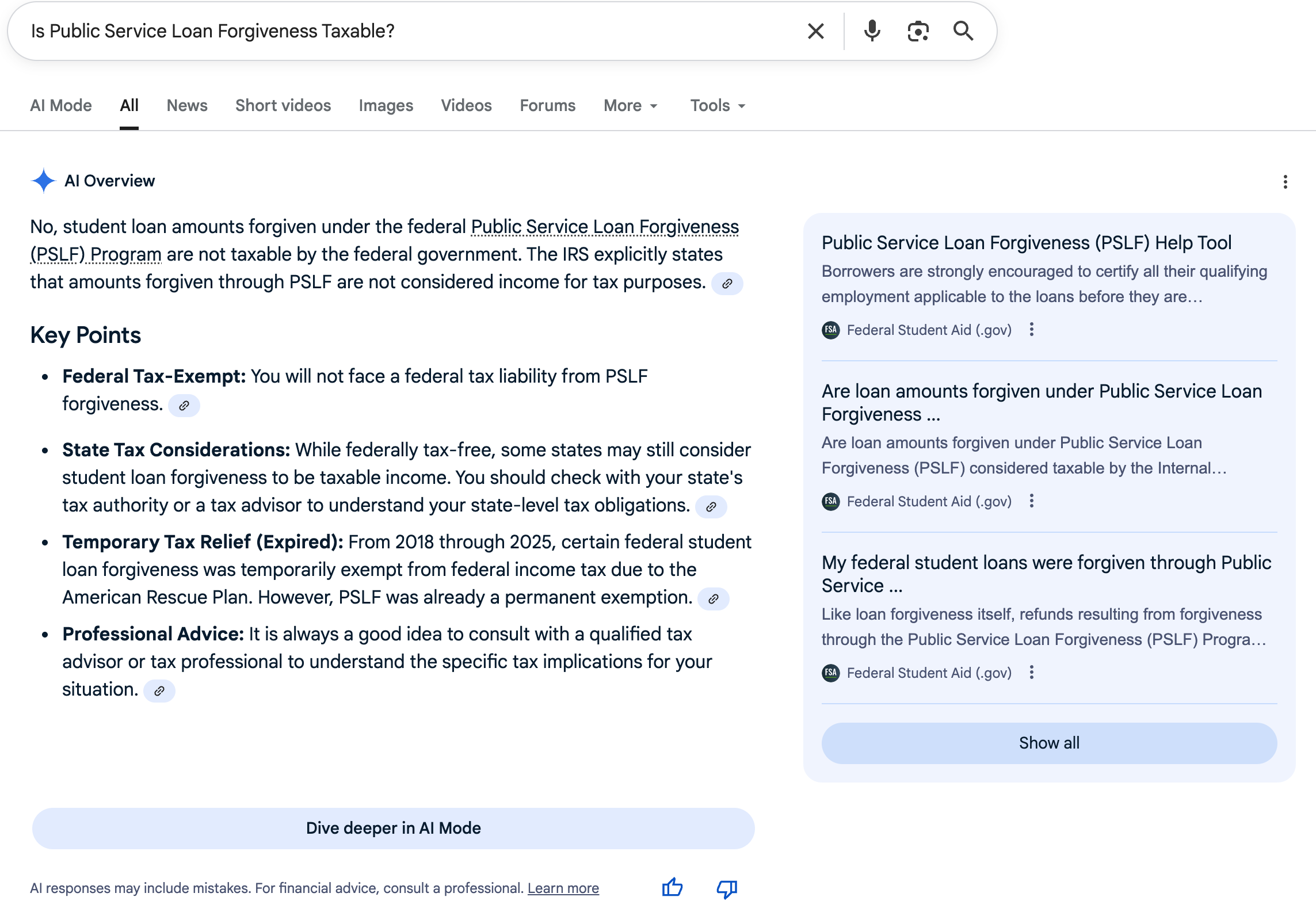

🔶 Is Public Service Loan Forgiveness Taxable?

Verdict: Missing Key Information

While it got this answer correct last year, this year it ignored the state taxes and PSLF - even though it got the nuance in the above question.

Google search screenshot of query "Is Public Service Loan Forgiveness Taxable?" [Screenshot by The College Investor]

🔶 When To Consolidate My Student Loans?

Verdict: Missing Key Information

While you "can" consolidate your student loans at those times, you can also do it other times. And the query was "when", which implies does it make sense to. Furthermore, the result doesn't highlight details like PSLF credits, interest capitalization, and access to repayment plans. This is especially important with the new PSLF weighted average rule.

Google search screenshot of query "When To Consolidate My Student Loans" [Screenshot by The College Investor]

✅ Is There A Statute Of Limitations On Student Loans?

Verdict: Correct

It generally got the statue of limitations on student loans correct, but we're surprised it didn't show the table by state.

Google search screenshot of query "Is There A Statute Of Limitations On Student Loans" [Screenshot by The College Investor]

✅ Can Student Loans Garnish Your Wages?

Verdict: Correct

It was nice to see this correct in light of collection activity resuming on Federal student loans.

Google search screenshot of query "Can Student Loans Garnish Your Wages?" [Screenshot by The College Investor]

Insurance

These are topics related to insurance. We discuss life insurance and related products, but also homeowners and other types of insurance.

🔶 Is Term Life Insurance Worth It?

Verdict: Misleading

This is an improvement over last year, but we hate the fact that Google would ever mention insurance as an investment vehicle. With that said, some of the other reasons hedge the truth as well.

Google search screenshot of query "Is Term Life Insurance Worth It?" [Screenshot by The College Investor]

✅ When Should I Get Life Insurance?

Verdict: Correct

Google search screenshot of query "When Should I Get Life Insurance?" [Screenshot by The College Investor]

✅ What Scenarios Should A Young Person Get Life Insurance?

Verdict: Correct

Google search screenshot of query "What Scenarios Should A Young Person Get Life Insurance?" [Screenshot by The College Investor]

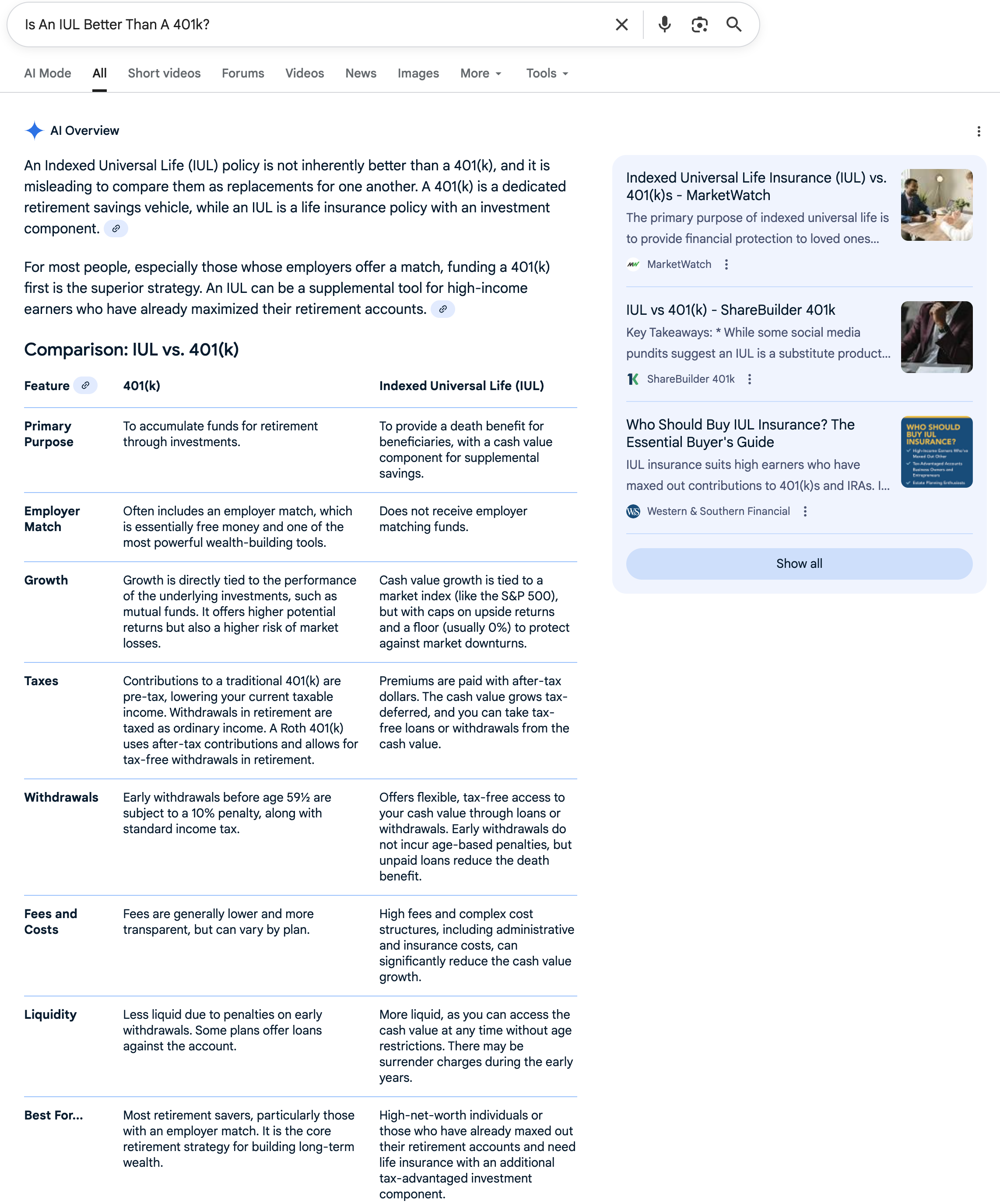

✅ Is An IUL Better Than A 401k?

Verdict: Correct

We were impressed to see the AI Overview treat this comparison the way it did.

Google search screenshot of query "Is Indexed Universal Life Insurance Better Than A 401k?" [Screenshot by The College Investor]

🔶 Is An IUL Better Than An IRA?

Verdict: Misleading

While it touches on some of the negatives of an IUL, it present it as there is a 50/50 comparison, when the reality is that an IRA is better 99% of the time.

Google search screenshot of query "Is An IUL Better Than An IRA?" [Screenshot by The College Investor]

✅ Are Annuities Better Than CDs?

Verdict: Correct

Google search screenshot of query "Are Annuities Better Than CDs?" [Screenshot by The College Investor]

🔶 Can You Get Renters Insurance For Your Dorm Room?

Verdict: Misleading

The answer started so promising, but then continued to encourage people check their parent's homeowners policy. This is generally a bad idea for student dorm room insurance because claims can be costly for the parents long-term insurability.

Google search screenshot of query "Can You Get Renters Insurance For Your Dorm Room?" [Screenshot by The College Investor]

✅ Can You Opt Out Of Car Insurance?

Verdict: Correct

They fixed this answer! Last year it said you could, and now it's more accurate.

Google search screenshot of query "Can You Opt Out Of Car Insurance?" [Screenshot by The College Investor]

❌ Can You Opt Out Of Home Owners Insurance?

Verdict: Incorrect

It got this one right last year, but this year it completely misses that you are not required to have homeowners insurance if you don't have a mortgage.

Google search screenshot of query "Can You Opt Out Of Homeowners Insurance?" [Screenshot by The College Investor]

🔶 Is Flood Insurance Required?

Verdict: Misleading

This was a better answer last year. Now it continues to mention that you may need it or want it, though it may not be required.

Google search screenshot of query "Is Flood Insurance Required?" [Screenshot by The College Investor]

✅ Is Earthquake Insurance Required?

Verdict: Correct

This answer was better last year as well, as it starts to hedge its response to when earthquake insurance is needed.

Google search screenshot of query "Is Earthquake Insurance Required?" [Screenshot by The College Investor]

🔶 Where To Open A Term Life Insurance Policy?

Verdict: Misleading

The answer was generally good, but the only blue link in the AI Overview was to an Indian website that couldn't help with US insurance (or was spam or a scam).

Google search screenshot of query "Where To Open A Term Life Insurance Policy?" [Screenshot by The College Investor]

✅ Where To Open An Indexed Universal Life Insurance Policy?

Verdict: Correct

Google search screenshot of query "Where To Open An Indexed Universal Life Insurance Policy??" [Screenshot by The College Investor]

✅ What Is A Life Insurance Illustration?

Verdict: Correct

Another taken image from Innovative Retirement Strategies for this AI Overview.

Google search screenshot of query "What Is A Life Insurance Policy Illustration" [Screenshot by The College Investor]

Home Ownership And Mortgage

Here are some topics related to home ownership and mortgages. We also included topics related to home buying.

✅ Do I Qualify For An FHA Loan?

Verdict: Correct

Google search screenshot of query "Do I Qualify For An FHA Loan?" [Screenshot by The College Investor]

✅ Can I Get Rid Of PMI?

Verdict: Correct

Google search screenshot of query "Can I Get Rid Of PMI?" [Screenshot by The College Investor]

✅ Do I Have To Have An Escrow Account?

Verdict: Correct

This was a nice improvement on the nuances of escrow accounts.

Google search screenshot of query "Do I Have To Have An Escrow Account?" [Screenshot by The College Investor]

✅ Should I Have A Home Inspection?

Verdict: Correct

Google search screenshot of query "Should I Have A Home Inspection?" [Screenshot by The College Investor]

🔶 Can I Get My Earnest Money Back If I Cancel A Deal?

Verdict: Missing Key Information

This can be a costly mistake to simply state "yes". Furthermore, some states have non-refundable earnest money.

Google search screenshot of query "Can I Get My Earnest Money Back If I Cancel A Deal?" [Screenshot by The College Investor]

✅ How Much Earnest Money Do I Have To Put Down?

Verdict: Correct

This is a much better answer than last year.

Google search screenshot of query "How Much Earnest Money Do I Have To Put Down?" [Screenshot by The College Investor]

🔶 Do I Have To Pay The Sellers Commission

Verdict: Missing Key Information

I don't think it understands the query in relationship to the latest changes from the NAR Lawsuit.

Google search screenshot of query "Do I Have To Pay The Sellers Commission?" [Screenshot by The College Investor]

✅ What Is A Home Equity Investment?

Verdict: Correct

But notice the image that was used from Investopedia and not cited.

Google search screenshot of query "What Is A Home Equity Investment" [Screenshot by The College Investor]

Financial Aid And Paying For College

Here are some financial topics relating to paying for college, including about the FAFSA and other financial aid tools.

✅ When Does The FAFSA Open?

Verdict: Correct

This was an improvement over last year - it's correct. It's also nice to see them link to my Forbes piece directly.

Google search screenshot of query "When Does The FAFSA Open?" [Screenshot by The College Investor]

⚠️ What Is An SAI?

Verdict: Missing

This AI Overview was removed between last year and this year. Here's what an SAI is if you're curious.

❌ What Is The Most Expensive College In The United States?

Verdict: Incorrect

This information is inaccurate as this is a fact that can be verified. In fact, the AI Overivew proves itself wrong - USC is the second-most expensive college. Vassar College is the first (and you can see the price listed in the very last bullet is higher than USC's).

The correct list of the most expensive colleges is here, based on tuition.

Google search screenshot of query "What Is The Most Expensive College In The United States?" [Screenshot by The College Investor]

❌ Which Colleges Have The Highest Tuition?

Verdict: Incorrect

Again, the answer provided by the AI Overview was incorrect and simply provided a similar result. This time instead of using "Tuition" it appears to use total cost of attendance.

Here is the correct list of colleges with the highest tuition. Vassar College tops the list this year.

Google search screenshot of query "Which Colleges Have The Highest Tuition?" [Screenshot by The College Investor]

✅ How Does Financial Aid Work?

Verdict: Correct

Pretty good answer about financial aid programs.

Google search screenshot of query "How Does Financial Aid Work?" [Screenshot by The College Investor]

✅ Do You Have To Pay Back Grants?

Verdict: Correct

This is another good answer about having to repay grants and the nuance involved.

Google search screenshot of query "Do You Have To Pay Back Grants?" [Screenshot by The College Investor]

🔶 Can I Get An FSA ID Without My Parents?

Verdict: Misleading

You always get an FSA ID without your parents. It appears to mix up filing the FAFSA and getting an FSA ID.

Last year, it answered this question correctly.

Google search screenshot of query "Can I Get An FSA ID Without My Parents?" [Screenshot by The College Investor]

🔶 Can I File As Independent For FAFSA?

Verdict: Misleading

While the answer does break down the criteria for filing independent for FAFSA, we see this as one of the biggest mistakes that families make filing the FAFSA. It also uses the wrong year for the FAFSA (it's pulling in last year's data here).

The answer is "No" for most undergraduate students.

Google search screenshot of query "Can I File As Independent For FAFSA?" [Screenshot by The College Investor]

🔶 Does A 529 Plan Hurt My FAFSA?

Verdict: Missing Key Information

This answer got worse than last year. While the first sentence is true, it's missing key information such as: if the student is independent, the 529 plan counts as their asset. And if the 529 plan is owned by a grandparent or other relative, it's not counted at all.

Google search screenshot of query "Does A 529 Plan Hurt My FAFSA?" [Screenshot by The College Investor]

✅ Does A Grandparent 529 Plan Count For FAFSA?

Verdict: Correct

It's funny that it missed this answer on the previous question, but correctly answered about Grandparent-owned 529 plans here.

Google search screenshot of query "Does a Grandparent 529 Plan Count For FAFSA" [Screenshot by The College Investor]

✅ Does A Roth IRA Count For FAFSA?

Verdict: Correct

It got this wrong last year, and it's fixed now.

Google search screenshot of query "Does A Roth IRA Count For FAFSA?" [Screenshot by The College Investor]

✅ Does A Roth IRA Count For CSS Profile?

Verdict: Correct

The CSS Profile does count retirement accounts like the Roth IRA in their own separate area, and schools may use this information.

Google search screenshot of query "Does A Roth IRA Count For CSS Profile?" [Screenshot by The College Investor]

✅ Where Do I Get Scholarships?

Verdict: Correct

Google search screenshot of query "Where Do I Get Scholarships" [Screenshot by The College Investor]

✅ Where Do I Get Grants To Pay For College?

Verdict: Correct

Notice that they are using our infographic from this article about grants without linking to our site.

Google search screenshot of query "Where Do I Get Grants To Pay For College?" [Screenshot by The College Investor]

Expert Opinions

We asked the following questions to a panel of experts to get their perspectives on the issues raised in the study and AI in general. You can read their bios and responses below. Just click “Read More” under the expert’s name.

- Do you think Google AI Overviews are problematic? Why or why not?

- Do you think that Your Money or Your Life (YMYL) queries should be held to a higher standard?

- What do you think Google needs to do to improve?

- Do you think the average Google user knows that these answers may be incorrect?

Read More >>

Do you think Google AI Overviews are problematic? Why or why not?

I think Google AI Overviews can be both helpful and problematic. They make it easy for people to find quick answers to their questions but the summaries can miss important context, and for the military community, there are a lot of nuances around pay and benefits that are important.

The overviews can be risky because service members and veterans are frequently the target of misleading financial products because of their steady income and valuable benefits. AI-generated overviews sometimes pull from sources that aren't trustworthy or are designed to sell something rather than educate.

For example, if a service member searches, "Can I invest in gold in the Thrift Savings Plan?", the AI Overview might correctly state that it isn't an option in the TSP, but it could also link to articles or companies trying to get them to buy gold. The initial answer is technically correct, but the links can steer someone toward sales pitches or bad financial advice. That's where the overviews can be a problem, especially for those who don't have a strong understanding of personal finance.

Do you think that Your Money or Your Life (YMYL) queries should be held to a higher standard?

Yes, YMYL queries should be held to a higher standard. People might not use Google to perform surgery on themselves, but they will often rely on it to make financial decisions that can affect their lives for years. For example, if a service member searches "how to get out of debt," the result links might lead to paid debt consolidation services instead of showing that free financial counseling is available on every military installation. I get wanting quick answers, but accuracy matters in personal finance.

What do you think Google needs to do to improve?

Google can improve by giving more weight to authentic sources that have both expertise and experience in the area, especially in areas like personal finance for the military community. Financial advice isn't one-size-fits-all, and what's accurate for a civilian might not apply to someone in the military or a veteran. The results would be more accurate and trustworthy if they gave priority to sources that have both financial expertise and real military experience.

Do you think the average Google user knows that these answers may be incorrect?

No, most people don't know they're getting the wrong answers. People turn to Google because they don't have experience or knowledge in what they're searching for. They're searching because they need help. That means that in most cases, they assume the answer they get is correct and don't know to question it. Unless someone double-checks the information somewhere else, they may never realize it’s wrong. And most people just want a quick answer, so they aren't digging deeper.

Chirag Shah

Professor, University of Washington

Co-Founder, Center for Responsibility in AI Systems & Experiences (RAISE)

Read More >>

Do you think that Your Money or Your Life (YMYL) queries should be held to a higher standard?

Absolutely. But the challenge is accurately identifying what qualifies as YMYL queries. Even when something is not that, it may have indirect affect on people’s life choices. Knowing what we know about the impacts of online searching, we should always exercise caution and maturity in answering queries.

What do you think Google needs to do to improve?

A lot! The blind rush to AI-fy everything is already hurting people and will continue hurting more — especially those who are vulnerable. Think about those teenagers who took their lives after conversations with an AI chatbot or the cases of revenge porn and deepfakes that haunt many young women. Google has a huge responsibility in doing the right thing rather than doing the fast thing. People count on it to provide access to accurate and authoritative information and that’s a huge responsibility. We want to see better guardrails, better tools for combating misinformation and hallucinations, and better accountability when things go wrong. A car company can’t provide a faulty machinery and blame the driver when it malfunctions. Google needs to stand by what it provides instead of hiding behind Section 230.

Do you think the average Google user knows that these answers may be incorrect?

No. We have learned this through many studies and interviews that an average user has blind trust in Google. Unless something really sticks out as an obviously wrong thing, an average user is not going to be aware of incorrectness in Google’s answers.

Read More >>

Do you think Google AI Overviews are problematic? Why or why not?

AI overviews can be problematic. They provide a nice summary that is helpful most of the time. However, they can be misleading or sometimes flat wrong enough to cause potential damage.

For example, I've had clients come in thinking they'd qualify for a tax credit because of an AI answer, only to find out it was incorrect. It has improved a bit, but it's just not there yet.

Do you think that Your Money or Your Life (YMYL) queries should be held to a higher standard?

Your money or your life queries should have a higher standard. When an AI provides a summary, its tone communicates authority. The challenge is much in personal finance has to be answered with “it depends.” There have been clients I’ve told paying off the mortgage is the right thing and others paying it off was the wrong thing. So much depends on one’s personal situation.

What do you think Google needs to do to improve?

Since much of personal finance depends on one’s unique situation, Google could train the AI to provide pros/cons to personal finance questions and offer varying opinions of how to approach the answer one is querying. This often leaves a user with less than desired feeling but it seems to be appropriate considering the potential consequences people may face with misleading or wrong information.

Do you think the average Google user knows that these answers may be incorrect?

I think the average Google user believes the answers given are correct but I think many will take the answers with a hint of skepticism.

Read More >>

Do you think Google AI Overviews are problematic? Why or why not?

I think that they are fine, and slowly getting better, but the asymptote of their accuracy is going to peak at maybe 66% given the amount of misinformation out there, especially in quickly changing industries like the college application process (my industry).

It's a great way to get a fast gut check on low-risk things, but it would be foolish for anything of importance to rely purely on the AI overview, such as five and six figure implications of various college and finance aid decisions.

What do you think Google needs to do to improve?

The algorithm will be asymptotic unless they start allowing users to VERY easily flag and report wrong information, almost like an X Community Note. That gets expensive though and then politics and swarms of people could get accurate information to take it down. I'd almost respect the algorithm continuing to algo more than the risk of human collusion on things.

Do you think the average Google user knows that these answers may be incorrect?

The average Google user can name more Kardashians than members of Congress or Cabinet members, so in short, no.

Jeremy Caplan

Director of Teaching and Learning, CUNY's Newmark Graduate School of Journalism

Founder, Wonder Tools

Read More >>

Mr. Caplan did not comment on the results of the study directly, but did share commentary on AI and personal finance in general:

The search market is becoming more competitive as people increasingly rely on services like Perplexity, ChatGPT, and other AI platforms, to answer questions.

Any player enabling search has a strong incentive to figure out ways to improve the quality and accuracy of responses. The market is moving so quickly that some product features have been rushed out, but AI competition will force those offering search to make improvements. If they don't lower their error rates, consumers will find more reliable alternatives.

Read More >>

NEFE did not comment on the results of the study directly, but did want to share some commentary on AI and personal finance in general:

Personal finance is a growing/evolving area of content on AI and social media platforms, and it can be appealing because it’s digestible in short bursts of info and has ease of access.

While millions of people are getting advice in these forums, you cannot always reasonably discern or verify everything that is seen as accurate or truthful.

There are resources to boost one’s financial acumen, and there are many communities to openly talk about money and finances. But everything needs to be taken in as part of an overall strategy for your individual financial management—with an understanding of the Personal Financial Ecosystem (this is a framework that NEFE developed to better understand financial factors related to well-being).

Financial education is not a panacea and cannot solve all economic challenges. There is no one-size-fits-all approach to building wealth or financial security quickly. Information available online and on social media platforms provides information, and information is power. But building financial well-being is a life-long process that requires patience and adaptability.

Financial information is very nuanced and should be tailored to one’s individual circumstances and short bursts of information cannot adequately address those varied needs. People should:

- Check sources

- Understand their financial values

- Know their financial goals and priorities

- Consult trusted family and friends

- Seek vetted professional financial advice when they can

- Take online queries and social media with grain of salt and skepticism

- Understand there is no easy, get-rich-quick ways to achieve financial well-being

Methodology

These AI overviews were collected on October 12 and 13, 2025 using a Chrome browser in incognito mode with a California IP address. We focused on major questions in each personal finance topic area, along with trends of questions we've seen being asked on social media.

Editor: Colin Graves

The post 37% of Google AI Finance Answers Are Inaccurate in 2025 appeared first on The College Investor.

How To Handle Basic Living Expenses During Student Loan Repayment 21 Oct 11:15 PM (yesterday, 11:15 pm)

Key Points

- Living expenses often take the biggest share of your budget while repaying student loans and planning for them prevents financial strain.

- Housing, food, transportation, insurance, and childcare typically account for 60% to 75% of take-home pay for many borrowers.

- Tracking your cash flow and updating your budget annually keeps you prepared for rent hikes or pay changes.

Once student-loan payments begin, many borrowers find their living expenses eat up more of their income than expected. Rent, groceries, insurance, transportation, and utilities can quickly compete with your monthly loan bill.

Ignoring these costs (or underestimating them) can push you toward missed payments or expensive credit-card debt. Building a budget that accounts for both your loan obligations and daily expenses helps you stay financially stable while working toward payoff.

Think of your budget as a balancing act:

- Too aggressive, and you may struggle to cover essentials.

- Too flexible, and you’ll delay your progress toward being debt-free.

@thecollegeinvestor Replying to @Caroline Kirk What happens if you can afford any of the options available to you when leaving the SAVE plan. #studentloans #studentloandebt #financialliteracy #tiktoklearningcampaign ♬ original sound - The College Investor

Would you like to save this?

We'll email this article to you, so you can come back to it later!

Incorporating Student Loan Repayment Into Your Budget

The first thing that you will want to do as you start to repay your student loans is incorporate them into your monthly budget. If you don't have a budget yet, make it a goal to create a budget and stick to it. While the word budget often has a negative connotation with many people, a budget is actually only a tool to help you save money on things that aren't important to you so that you still have money left for the things that are important.

There are many different ways to create a budget, but the simplest budget is just a tally of your income and your expenses (usually on a monthly basis). Make sure that your student loan repayment amount is included in your budget, and adjust as needed. It's important to note that besides crunching your spreadsheet, you need to also figure out the reason WHY you want a budget. Without your emotional buy-in, it will be very hard if not impossible to stick to your budget over time.

Lower Your Loan Payment

If you have a higher student loan balance than your annual salary, there are still a few options that you might be able to take advantage of. There are legal ways to lower your student loan payment amount, and many of them are available to many borrowers.

Federal student loan borrowers have income-based repayment strategies like extended repayment, graduated repayment and income-based plans. Plus, if you're going for student loan forgiveness, you need to be on an income-driven repayment plan.

Borrowers with private student loans don't have as many options, but refinancing your student loans may help lower your monthly payments.

Find Ways To Save On Major Expenses

If you've been working with your budget for a few months and you're finding it a bit tighter than you want, it may be time to take a more detailed look. You may find that there are a few things that you considered "must haves" when you first made a budget that you might be able to cut now.

Creating a budget is not meant to be a one-time "set it and forget it" — instead, it's something that should change as you go through life.

Besides just cutting things out of your budget, we have a list of 15 ways that you can save more money each month. This includes things like eliminating bank fees, using credit card rewards judiciously, getting organized and other tricks that you might be able to use to help stay within your budget.

Make sure you check out that list to see if there's anything there that might be able to help.

Increase Your Income

Besides cutting your expenses, you can also focus on increasing your income.

Of course one of the best ways to increase your total income is to maximize your earnings from your full-time job, but that's not the only way to increase your income.

You might consider investing in yourself by becoming an entrepreneur. You can also take advantage of a variety of side hustles to bring in additional income. The great thing that comes with increasing your income when you already have a budget is that you know exactly where that extra income can be best used.

What NOT To Do During Student Loan Repayment

Following the advice above can give you a leg up on handling your regular living expenses while also making your student loan payments. The one thing that you'll want to make sure to NOT do is ignore your student loan payments or the impact that they might have on your monthly budget. Sticking your head in the sand is likely to lead to an undesirable financial situation.

Many graduates get their college degree and find themselves in a position where the student loan debt they owe feels overwhelming. If that describes your situation, don't despair and don't ignore the problem.

Instead, talk to your friends, family and trusted advisors and make a plan. This could include looking for ways to increase your income, cut your expenses, modify or refinance your existing debt or all of the above.

Why This Matters

Adding a student loan repayment to your monthly budget may make things a little tight, especially if your monthly budget was already tight. But the same budgeting concepts that set you up for financial success still apply.

Chart and track your income and expenses, and remember that a budget is a marathon, not a sprint. Involve your friends and family in your journey to pay off debt, and you'll find yourself there in no time.

Don't Miss These Other Stories:

Editor: Clint Proctor Reviewed by: Chris Muller

The post How To Handle Basic Living Expenses During Student Loan Repayment appeared first on The College Investor.

10 Best Private Student Loan Lenders For College 21 Oct 11:05 PM (yesterday, 11:05 pm)

Private student loans can be a valuable tool when it comes to paying for college. They typically offer low interest rates for qualified borrowers, have flexible repayment terms, and some even offer extra features like career coaching and more. But it can be hard to find the best private loans, and should you even take them out?

We've compared 10 nationwide private student loan lenders to help you find the best option based on your credit, income, and goals. Beyond the rate, we also compared the fees, repayment terms, application process, income requirements, cosigner requirements, and borrower perks like discounts.

Promo: If you want to get a quote at a top lender right now, check out College Ave. They typically have some of the lowest student loan rates available. You can get a quote in minutes. Check out College Ave here >>

Read More

Private student loans are the last choice when it comes to paying for college. Before you take out private loans, you should make sure you exhaust all other financial aid options, including federal loans.

Before you sign on the dotted line, make sure you understand what you're getting into. Student loans are a collateral on your future earnings, and you need to ensure you have a positive ROI (return on investment) of your education.

Why Should You Trust Us?

We have been writing and reviewing student loan lenders and companies for over 12 years. Our editor-in-chief Robert Farrington is America’s Student Loan Debt Expert™ and is one of the most knowledgeable experts about students loans in the United States.

When we look at student loan lenders, we look at the various loan types they offer, how competitive their rates are in the marketplace, and what types of repayment plans they offer. You can see we've reviewed substantially all of the lenders in the student loan marketplace here.

Furthermore, our compliance team audits the posted rates every weekday to ensure that our rates accurately reflect the best available information.

Check out our list of the best private student loan lenders below:

Best Private Student Loans Of 2025

Student Loan Rates: The student loan rates below are updated daily Monday through Friday. The lowest rates are usually for shorter loan-terms, variable rates, those with high credit scores, and low debt-to-income ratios.

Lender Name | APR | Get Started |

|---|---|---|

Variable Rate 4.13% - 16.54% Fixed Rate 2.85% - 15.61% | ||

Variable Rate 4.38% - 15.29% Fixed Rate 2.89% - 15.46% | No Cosigner Required! | |

Variable Rate 4.98% - 15.46% Fixed Rate 3.24% - 14.99% | ||

Variable Rate 4.24% - 17.99% Fixed Rate 2.89% - 17.99% | ||

Variable Rate 4.99% - 16.85% Fixed Rate 2.89% - 16.49% | ||

Variable Rate 4.88% - 13.97% Fixed Rate 2.99% - 14.22% | ||

Variable Rate 4.31% - 13.49% Fixed Rate 2.99% -12.69% | ||

Variable Rate 4.37% - 16.99% Fixed Rate 2.89% - 17.49% | ||

Variable Rate 4.64% - 15.99% Fixed Rate 3.43% - 15.99% | ||

Variable Rate 3.78% - 15.74% Fixed Rate 4.74% - 15.00% |

Lender Name | APR |

|---|---|

Variable Rate 4.13% - 16.54% Fixed Rate 2.85% - 15.61% | |

No Cosigner Required! | Variable Rate 4.38% - 15.29% Fixed Rate 2.89% - 15.46% |

Variable Rate 4.98% - 15.46% Fixed Rate 3.24% - 14.99% | |

Variable Rate 4.24% - 17.99% Fixed Rate 2.89% - 17.99% | |

Variable Rate 4.99% - 16.85% Fixed Rate 2.89% - 16.49% | |

Variable Rate 4.88% - 13.97% Fixed Rate 2.99% - 14.22% | |

Variable Rate 4.31% - 13.49% Fixed Rate 2.99% -12.69% | |

Variable Rate 4.37% - 16.99% Fixed Rate 2.89% - 17.49% | |

Variable Rate 4.64% - 15.99% Fixed Rate 3.43% - 15.99% | |

Variable Rate 3.78% - 15.74% Fixed Rate 4.74% - 15.00% |

Full Breakdown: Best Student Loan Lenders

Here are all the details you need to know about the best student loan lenders.

Abe Student Loans

Abe Student Loans offers private student loans to a undergraduate, graduate, and post-bachelor graduate certificate students, with flexible repayment options and no origination, late payment, or forbearance fees. Students can use the funds from an Abe student loan to cover the cost of expenses such as tuition, room and board, books and supplies, transportation, and other personal expenses during their time at school.

You can use Abe loans to help fund the cost of a Bachelor of Arts or Science degree at an approved school. This includes private and public colleges. You can check the approved school list at the time of your application.

Read our full Abe Student Loans review here.

Abe℠ Student Loan Details | |

|---|---|

Product Name | Abe℠ Student Loans |

Min Loan Amount | $1,000⁴ |

Max Loan Amount | Cost of Attendance⁴ |

Variable APR | 4.13% - 16.54% APR¹ ² |

Fixed APR | 2.85% - 15.61% APR¹ ² |

Loan Terms | 5, 7, 10, 15, & 20 years⁵ |

Cosigner Required | No |

<img class="tve_image wp-image-31042" alt="Ascent Student Loans Logo" width="2200" height="640" title="Ascent Student Loans" data-id="31042" src="https://thecollegeinvestor.com/wp-content/uploads/2018/12/Ascent-Student-Loans.png" style="" data-css="tve-u-16ed1a3bf27" data-pin-nopin="true">

<img class="tve_image wp-image-31042" alt="Ascent Student Loans Logo" width="2200" height="640" title="Ascent Student Loans" data-id="31042" src="https://thecollegeinvestor.com/wp-content/uploads/2018/12/Ascent-Student-Loans.png" style="" data-css="tve-u-16ed1a3bf27" data-pin-nopin="true">Ascent

Ascent Student Loans is a solid choice as a private lender - as they offer both cosigner and non-cosigner loans for undergraduate and graduate students. They also offer a solid loan amount range from $2,001 - $400,000*, competitive rates, and easy repayment terms.

What we love about Ascent is how clear they make their requirements to get the non-cosigned loan for juniors and seniors that considers more than just a credit score, which is rare in the private student loan industry. The qualify, students must:

- Be a college junior or senior enrolled full-time (or with an expected graduation date within 9-months of the date the loan application is submitted) in a degree program at an eligible institution.

- Be a U.S. citizen or have a U.S. permanent resident or Deferred Action for Childhood Arrival (DACA) status.

- Have satisfactory academic performance of 3.0 GPA or greater.

They offer loans starting at just $2,001* minimum, and they offer loan deferment while in school up to 9 months after graduation.

Read our full Ascent Student Loans review here.

Ascent Student Loans Details | |

|---|---|

Product Name | Ascent Student Loan |

Min Loan Amount | $2,001* |

Max Loan Amount | $400,000 |

Variable APR | 4.38% - 15.29% APR |

Fixed APR | 2.89% - 15.46% APR |

Loan Terms | 5, 7, 10, 12 15, or 20 years |

Cosigner Required | No |

Citizens Bank

Citizens Bank offers one of the most robust private student loan programs on this list. They let you borrow as little a $1,000, and all the way up to $350,000 depending on your degree. I personally love that they base the amount you can borrow on your degree program because it does help you focus on your ROI (return on investment).

Citizens Bank offers both student and parent student loans, which can be a potential alternative to Parent PLUS Loans. Given that we recommend most borrowers refinance Parent PLUS Loans, you can potentially take advantage of lower interest rates and fees up front.

You may qualify for multi-year approval when you apply with Citizens Bank. And you'll also have the option to defer payments until after you graduate or make interest-only payments while you're in school. Parent borrowers must make at least interest-only payments while the student is in school.

Finally, Citizens Bank also doesn't charge any origination fees, application fees, and has no prepayment penalties.

Check out our full Citizens Bank review here.

Citizens Student Loans Details | |

|---|---|

Product Name | Citizens Student Loan |

Min Loan Amount | $1,000 |

Max Loan Amount | $350,000 (depending on degree) |

Variable APR | 4.98% - 15.46% APR |

Fixed APR | 3.24% - 14.99% APR |

Loan Terms | 5, 10, or 15 years |

Cosigner Required | Yes |

College Ave

College Ave offers some of the lowest rates on student loans on the market today. They are one of the largest private student loan lenders, and have highly competitive rates on their loans.