September 2025 Toronto Real Estate Market Report 9 Oct 5:32 AM (13 days ago)

GTA Home Sales Rise in September as Buyers Respond to Lower Borrowing Costs

Home sales in the Greater Toronto Area (GTA) rose in September 2025 compared to the same period last year, as more buyers entered the market, encouraged by more affordable monthly mortgage payments. With a wide range of housing options available, buyers were able to negotiate lower prices, leading to a decline in the average selling price.

“The Bank of Canada’s September interest rate cut was welcome news for homebuyers,”

said Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule.

“With reduced borrowing costs, more households can now afford mortgage payments on homes that meet their needs. This uptick in home purchases also supports the broader economy through increased housing-related spending, helping to counteract ongoing trade challenges.”

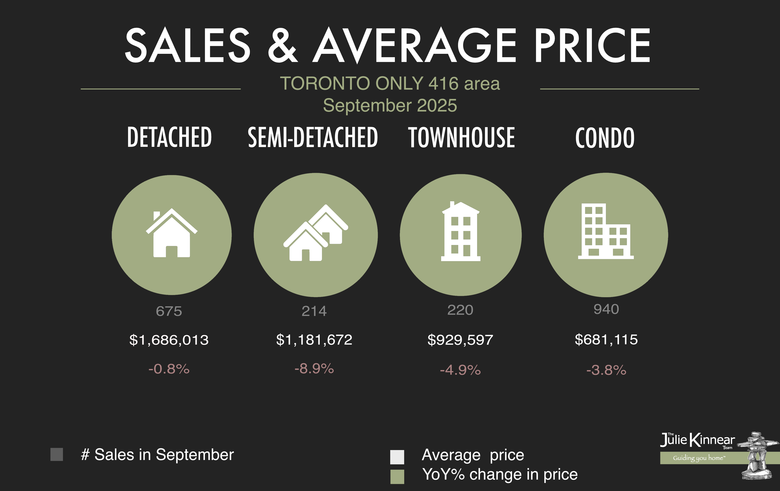

GTA REALTORS® reported 5,592 home sales through TRREB’s MLS® System in September 2025, marking an 8.5% increase over September 2024. New listings also saw a modest rise, totaling 19,260 — up 4% year-over-year.

On a seasonally adjusted basis, home sales increased from August to September 2025, while new listings declined. This shift suggests that market conditions may be tightening in certain segments, potentially leading to increased competition among buyers.

The MLS® Home Price Index (HPI) Composite benchmark fell 5.5% year-over-year in September. The average selling price was $1,059,377 — down 4.7% from September 2024. However, on a month-over-month seasonally adjusted basis, the HPI dipped only slightly by 0.5%, while the average selling price remained relatively stable, inching up 0.2%.

“Although home sales have picked up compared to last year, they still remain below typical levels given the size of the GTA’s population,”

said TRREB Chief Market Analyst Jason Mercer.

“Two additional 25-basis-point rate cuts by the Bank of Canada could help bring monthly mortgage payments more in line with average incomes, further supporting homeownership and driving economic growth.”

TRREB CEO John DiMichele emphasized the need for greater collaboration within the housing sector:

“Industry stakeholders have often worked in isolation toward similar goals, but progress has stalled. With new construction sales and housing starts in decline, it’s time to unite as a single voice. TRREB is committed to engaging with industry leaders, policymakers, and other stakeholders across the Greater Golden Horseshoe to reignite momentum and overcome the remaining barriers to housing development.”

October Krazy Kontest 2 Oct 1:35 AM (20 days ago)

The CN Tower is famous for many amazing things including ever changing stellar evening light show, The edge walk, fundraisers walking up the stairs, glass floors to walk on... What is REALLY AMAZING TO US is how it handles getting hit by lightning annually! In fact, in 2011 it was hit 52 times in just 84 minutes!

Just answer the following skill testing question for your chance to win!

One correct answer to the following skill-testing question will be drawn:

How many times per year on average does does the CN Tower get struck by lightning?

| 1) 60-70 | |

| 2) 100-110 | |

| 3) 80-90 | |

| 4) 90-100 | |

| 5) 70-80 |

This contest has closed!

August 2025 Toronto Real Estate Market Report 11 Sep 5:53 AM (last month)

August home sales reported by the Toronto Regional Real Estate Board (TRREB) were up on a year-over-year basis. Over the same period, homebuyers benefitted from an even larger increase in the inventory of listings. Average selling prices continued to be negotiated downward due to the elevated choice across market segments.

“Compared to last year, we have seen a modest increase in home sales over the summer. With the economy slowing and inflation under control, additional interest rate cuts by the Bank of Canada could help offset the impact of tariffs. Greater affordability would not only support more home sales but also generate significant economic spin-off benefits,”

said TRREB President Elechia Barry-Sproule.

Greater Toronto Area (GTA) REALTORS® reported 5,211 home sales through TRREB’s MLS® System in August 2025 – up by 2.3 per cent compared to August 2024. New listings entered into the MLS® System amounted to 14,038 – up by 9.4 per cent year-over-year.

On a seasonally adjusted basis, August home sales edged lower month-over-month compared to July 2025. In contrast, new listings increased compared to July, reaffirming that buyers continue to benefit from a well-supplied market.

The MLS® Home Price Index Composite benchmark was down by 5.2 per cent year-overyear in August 2025. The average selling price, at $1,022,143, was also down by 5.2 per cent compared to August 2024. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite and average selling price remained flat compared to July.

“A household earning the average income in the GTA is still finding it challenging to afford the monthly mortgage payment associated with the purchase of an average priced home. This is even with lower borrowing costs and selling prices over the past year. Further relief in borrowing costs would see an increased number of buyers move off the sidelines to take advantage of today’s well-supplied market,”

said TRREB Chief Information Officer Jason Mercer.

“New, large scale infrastructure projects, including affordable housing, public transit, ports and shipbuilding will be important for sustaining Canada’s economic sustainability in the medium-to-long term. However, in the short term, spurring consumer spending on large ticket items like housing could lead recovery, as it has in previous economic cycles,”

said TRREB Chief Executive Officer John DiMichele.

September Krazy Kontest 1 Sep 5:19 AM (last month)

The first marked bike lane in Toronto started in 1979 on Poplar Plains Road. Since then more bike lanes and happily (or unhappily if you're not a cyclist) lots more bikes are on the streets. In fact Toronto’s Bike Share program is booming now and use has doubled from 2020-2024! In 2024, 70 solar stations were added, along with 335 e-docks, for a total of 862 stations.

Just answer the following skill testing question for your chance to win!

One correct answer to the following skill-testing question will be drawn:

How many rides were actually taken in the city’s bike-share service in 2024?

| 2.9 million | |

| 3.7 million | |

| 4.2 million | |

| 5.5 million | |

| 6.9 million |

This contest has closed!

July 2025 Toronto Real Estate Market Report 13 Aug 6:13 AM (2 months ago)

The Greater Toronto Area (GTA) experienced the best home sales result for the month of July since 2021. Sales were also up relative to listings, suggesting a modest tightening in the market compared to last year.

“Improved affordability, brought about by lower home prices and borrowing costs is starting to translate into increased home sales. More relief is required, particularly where borrowing costs are concerned, but it’s clear that a growing number of households are finding affordable options for homeownership,”

said Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule.

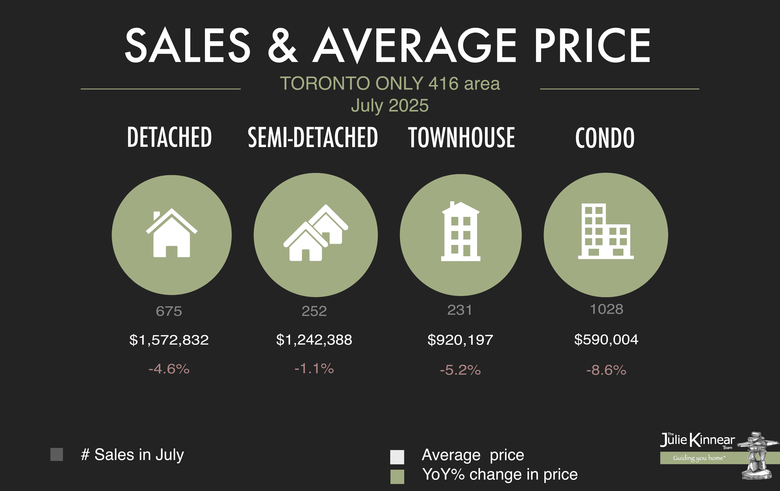

GTA REALTORS® reported 6,100 home sales through TRREB’s MLS® System in July 2025 – up by 10.9 per cent compared to July 2024. New listings entered into the MLS® System totalled 17,613 – up by 5.7 per cent year-over-year.

On a seasonally adjusted basis, July home sales increased month-over-month compared to June 2025. New listings also rose compared to June, but by a much lesser rate. With sales increasing relative to listings, market conditions tightened.

The MLS® Home Price Index Composite benchmark fell by 5.4 per cent year-over-year in July 2025. The average selling price, at $1,051,719, was down by 5.5 per cent compared to July 2024. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite and average selling price remained flat compared to June.

“Recent data suggest that the Canadian economy is treading water in the face of trade uncertainty with the United States. A key way to mitigate the impact of trade uncertainty is to promote growth in the domestic economy. The housing sector can be a catalyst for growth, with most spin-off expenditures accruing to regional economies. Further interest rate cuts would spur home sales and see more spin-off expenditures, positively impacting the economy and job growth,”

said TRREB Chief Information Officer Jason Mercer.

“Despite widespread belief that the federal foreign buyer ban prohibits all foreign nationals from purchasing residential properties in Canada, there are exemptions that allow nonresidents to buy property, resulting in spin-off benefits to the economy. Foreign buyers can purchase multi-unit buildings with four or more units and vacant land or land for development. Non-residents can also buy other residential properties outside urban centres, including recreational properties,”

said TRREB CEO John DiMichele.

“Moreover, temporary workers and international students can purchase residential property under defined circumstances under the ban extended until January 2027,”

continued DiMichele.

August Krazy Kontest 4 Aug 3:19 AM (2 months ago)

Summer and swimming! Canada has as many as 2 million lakes, which accounts for 14% of the world's lakes.

Just answer the following skill testing question for your chance to win!

One correct answer to the following skill-testing question will be drawn:

What freshwater lake is known as the warmest in Canada?

| Bras d'Or Lake | |

| Lake Louise | |

| Osoyoos Lake | |

| Lake Memphrémagog | |

| Lake Ontario |

This contest has closed!

June 2025 Toronto Real Estate Market Report 8 Jul 11:09 AM (3 months ago)

Ownership housing affordability continued to improve in June 2025. Average selling prices and borrowing costs remained lower than last year’s levels. However, despite some month-over-month momentum, many would-be homebuyers remained on the sidelines due to economic uncertainty.

“The GTA housing market continued to show signs of recovery in June. With more listings available, buyers are taking advantage of increased choice and negotiating discounts off asking prices. Combined with lower borrowing costs compared to a year ago, homeownership is becoming a more attainable goal for many households in 2025,”

said Toronto Regional Real Estate (TRREB) President Elechia Barry-Sproule.

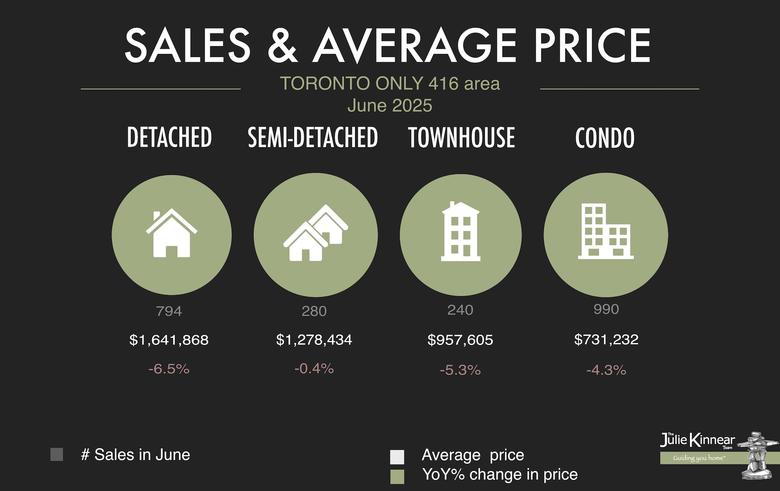

Greater Toronto Area (GTA) REALTORS® reported 6,243 home sales through TRREB’s MLS® System in June 2025 – down by 2.4 per cent compared to June 2024. New listings entered into the MLS® System amounted to 19,839 – up by 7.7 per cent year-over-year.

On a seasonally adjusted basis, June home sales increased month-over-month compared to May 2025. New listings declined compared to May. The monthly increase in sales coupled with the monthly decline in new listings continued the tightening trend experienced during the spring.

The MLS® Home Price Index Composite benchmark was down by 5.5 per cent year-overyear in June 2025. The average selling price, at $1,101,691 was down by 5.4 per cent compared to June 2024. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite and average selling price both edged lower compared to May 2025.

“A firm trade deal with the United States accompanied by an end to cross-border sabre rattling would go a long way to alleviating a weakened economy and improving consumer confidence. On top of this, two additional interest rate cuts would make monthly mortgage payments more comfortable for average GTA households. This could strengthen the momentum experienced over the last few months and provide some support for selling prices,” said TRREB Chief Information Officer Jason Mercer. “It is important to highlight that housing is not just impacted by economic and financial issues. Canadian residents, both homeowners and renters alike, are increasingly having to deal with the nightmare of violent home invasions and carjackings,”

said TRREB CEO John DiMichele.

“TRREB is encouraged by the recent federal announcement to table a crime bill this Fall introducing stricter bail conditions and sentencing for these disturbing crimes. While this is a good first step by the federal government to strengthen public safety, more is needed, such as working with provinces to increase law enforcement funding and improve capacity and efficiency in the court system,”

continued DiMichele.

July Krazy Kontest 3 Jul 5:24 AM (3 months ago)

Elbows up” is a hockey term describing an effective way to protect yourself from an opposing player. Now used widely and proudly used to protect Canadian sovereignty! The phrase was coined by a Canadian hockey legend, who was famously called Mr. Elbows, for his signature way of keeping at a distance on the ice.

Just answer the following skill testing question for your chance to win!

One correct answer to the following skill-testing question will be drawn:

Who is the hockey player?

| Brad Marchand | |

| Eric Lindros | |

| Mario Lemieux | |

| Wendel Clark | |

| Gordie Howe |

This contest has closed!

May 2025 Toronto Real Estate Market Report 13 Jun 5:20 AM (4 months ago)

The Greater Toronto Area (GTA) housing market experienced an improvement in affordability in May 2025 relative to the same period a year earlier. With sales down and listings up, homebuyers took advantage of increased inventory and negotiating power.

“Looking at the GTA as a whole, homebuyers have certainly benefited from greater choice and improved affordability this year. However, each neighbourhood and market segment have their own nuances. Buyers considering a home purchase should connect with a REALTOR® who is knowledgeable about their preferred area and property type. In today’s market, working with a REALTOR® who brings expertise, the right tools, and a strong network is essential,”

said Toronto Regional Real Estate Board President Elechia Barry-Sproule.

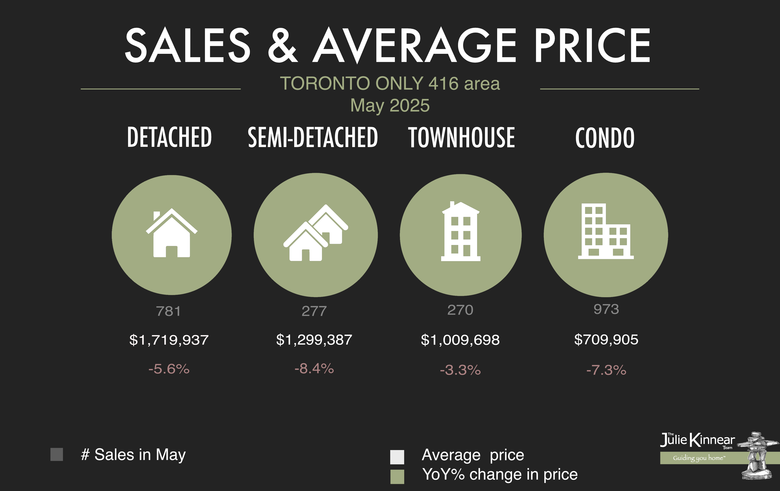

GTA REALTORS® reported 6,244 home sales through TRREB’s MLS® System in May 2025 – down by 13.3 per cent compared to May 2024. New listings entered into the MLS® System amounted to 21,819 – up by 14 per cent year-overyear.

On a seasonally adjusted basis, May home sales were up month-over-month compared to April 2025. This was the second monthly increase in a row. New listings were also up compared to April, but by a lesser monthly rate than sales, suggesting a slight tightening in market conditions.

“Home ownership costs are more affordable this year compared to last. Average selling prices are lower, and so too are borrowing costs. All else being equal, sales should be up relative to 2024. The issue is a lack of economic confidence. Once households are convinced that trade stability with the United States will be established and/or real options to mitigate our reliance on the United States exist, home sales will pick up. Further cuts in borrowing costs would also be welcome news to homebuyers,”

said Jason Mercer, TRREB’s Chief Information Officer.

The MLS® Home Price Index Composite benchmark was down by 4.5 per cent year-over-year in May 2025. The average selling price, at $1,120,879, was down by four per cent compared to May 2024. On a month-over-month seasonally adjusted basis, the MLS® HPI Composite and average selling price both edged up compared to April 2025.

“With the federal government’s housing commitments reiterated in the Throne Speech, we now need concrete actions that will restore housing affordability across the GTA and the rest of Canada. This includes lowering high housing taxes and fees, embracing innovative construction technologies, and streamlining processes to reignite the construction of homes. Home construction is associated with huge economic benefits that would help mitigate the negative impact of ongoing trade disputes. Additionally, with inflation remaining low, a rate cut would be a welcome move—particularly for first-time buyers and those renewing their mortgages”,

said TRREB CEO John DiMichele.

Blue Jays Night with the JKT 2025 10 Jun 1:49 AM (4 months ago)

We had another amazing event last night - Night at the Blue Jays with our lovely clients!

Beer coozies were certainly a hit and a walk off hit to win in the bottom of the 9th!

[This post contains video, click to play]