Understanding Moral Injury in Health Care 13 Jan 5:28 PM (2 months ago)

Physicians for a National Health Program (PNHP) is partnering with the Robert Wood Johnson Foundation (RWJF) to study the impact of financialization on U.S. health care. Starting in the fall of 2024, and continuing through the summer of 2025, we will engage current health care professionals to better understand moral injury and distress, how these issues impact racial inequities in health care, and how best to remedy this worsening problem.

Take our brief moral injury survey

Toolkit: Share our moral injury survey

Dr. Diljeet Singh explains our research project

What is “moral injury?”

As health care has been transformed from an essential service to a profit-driven business, the morale of the entire workforce—including physicians, nurses, and allied health professionals—has suffered. This trend has led to shortages as professionals are retiring early, cutting back work hours, quitting clinical medicine, and tragically committing suicide in increasing numbers.

These responses have often been misdiagnosed as “burnout,” but the lack of efficacy of standard treatments for burnout has led insightful scholars such as Drs. Wendy Dean and Simon Talbot to identify “moral injury” as a more accurate culprit.

Moral injury in health care is described as the challenge of knowing what care patients need, but being unable to provide it due to constraints beyond physicians’ control. As a result, our focus on burnout is insufficient and, in fact, causes harm by leading to a reliance on ineffectual “wellness” programs and an obscuring of root causes. Without adequate data on moral injury, the ability of policymakers and stakeholders to address our health care crisis will remain limited.

Gaps in the literature

In an effort to better understand moral injury in health care, PNHP will survey workers throughout the medical profession and will conduct a series of 20-40 one-on-one interviews with currently practicing physicians. We will gather data points on the impact of financialization from our survey, and identify narratives from our interviews to more compellingly illustrate these data points. These elements will form the basis of our fall 2025 report, which will provide actionable recommendations for stakeholders.

Our project follows the rigorous practices of the Association for the Accreditation of Human Research Protection Programs (AAHRPP), and we have obtained Institutional Review Board approval by the independent Pearl IRB, along with our consultant at Cambridge Health Alliance’s institutional IRB.

See the following documents for specifics on our survey, and the broader moral injury project:

- Grant agreement and expectations from RWJF

- IRB approval letter from Pearl IRB

- IRB approval letter from Cambridge Health Alliance

- Consent form for study participation

Take our moral injury survey

The first part of our moral injury project consists of an intake survey to help us better understand the impact of financialization in U.S. health care, and how it intersects with racial health inequities. You can take our 10-minute survey at pnhp.org/survey.

Please note the following to better understand our survey process:

- Questions were developed in consultation with a working group of prominent physicians and academics, and through insights gleaned from a series of physician focus groups conducted over the summer of 2024.

- Our main audience for the survey is physicians who are currently practicing in the U.S., but we are collecting survey responses from all health professionals.

- We have secured Institutional Review Board (IRB) approval via Pearl IRB.

- This survey functions as an intake tool for a series of 1:1 interviews to be conducted over the spring/summer.

- We will release a high-level report of findings at PNHP’s 2025 Annual Meeting (Nov. 1-3 in Washington, D.C.), and will share this report with PNHP members, allies, and elected officials.

- We will author an academic paper detailing the results of our moral injury research, which will be submitted for journal publication at the end of 2025.

For reference, we have uploaded a PDF version of our complete moral injury survey HERE.

Share our moral injury survey

To properly understand the impact of financialization on U.S. health care, and how it intersects with racial health inequities, we will need to engage with thousands of currently practicing physicians. This means tapping our active PNHP members and going beyond this cadre of single-payer activists.

We need you to share the pnhp.org/survey link with currently practicing physicians in your network! To help you with this outreach, PNHP has put together a toolkit that includes:

- Moral injury project overview

- Sample email to recruit your colleagues

- Tips for sharing our survey in a professional setting

- Moral injury project flyer

- Frequently asked questions

We’ve also developed a one-page info sheet with information about our moral injury project.

Dr. Toby Terwilliger provides outreach tips

Respecting your privacy

PNHP’s moral injury survey covers delicate topics and gives participants the opportunity to share experiences from their practice—as well as experiences with specific employers, insurers, and other parties.

Rest assured that survey responses will be anonymized through the use of unique ID numbers and that nobody outside of PNHP’s survey team will ever have access to individual replies.

We also ask survey respondents to share their email address, so we can follow up regarding potential 1:1 interviews. Please note:

- Individuals who are not already in PNHP’s database can opt in to receive updates about our moral injury project.

- If respondents are added to our email list, they can unsubscribe at any time (link at the bottom of all PNHP emails).

- PNHP will never sell or share emails collected through our moral injury survey.

Moral injury workshop (Nov. 2024)

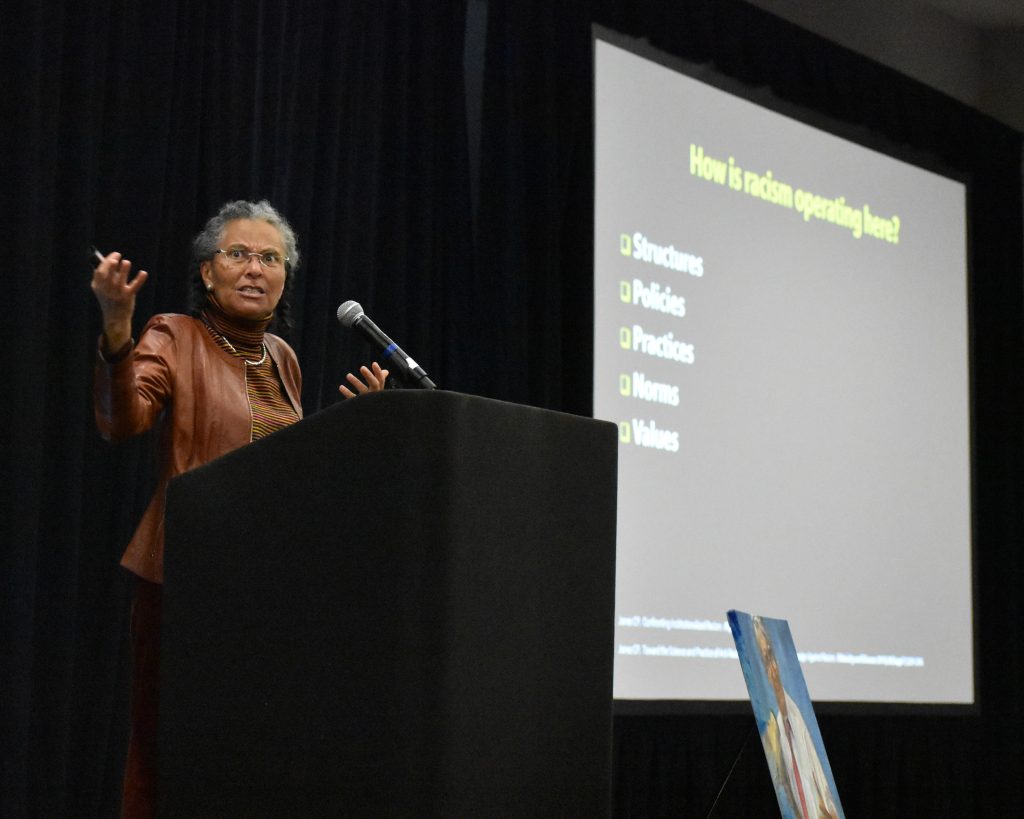

PNHP president Dr. Diljeet Singh helped lead a workshop on moral injury at our 2024 Annual Meeting in Chicago. Download Dr. Singh’s slideshow HERE.

The post Understanding Moral Injury in Health Care appeared first on PNHP.

2024 Annual Meeting Materials 4 Nov 2024 1:34 PM (5 months ago)

PNHP’s 2024 Annual Meeting in Chicago drew physicians, students, and health justice activists from across the country for a weekend of organizing, strategizing, and setting our agenda for the year ahead.

Please see below to access a selection of archival recordings, slideshows, and handouts from the meeting. To view photos from the meeting, visit our Flickr page.

During the conference, we encouraged attendees to post to social media using the hashtag #PNHP2024. Click HERE to read member tweets, and be sure to follow PNHP on Instagram, Twitter and Facebook for the latest on the Medicare for All movement.

Looking for materials from the Students for a National Health Program (SNaHP) Summit? Click HERE to access slideshows, photos, handouts, and more!

PNHP’s “Triple Aim” to advance our movement

PNHP president Phil Verhoef, MD, PhD kicked off our meeting by unveiling our “Triple Aim” of ending profiteering, improving traditional Medicare, and winning single payer (slideshow HERE).

Health Policy Update

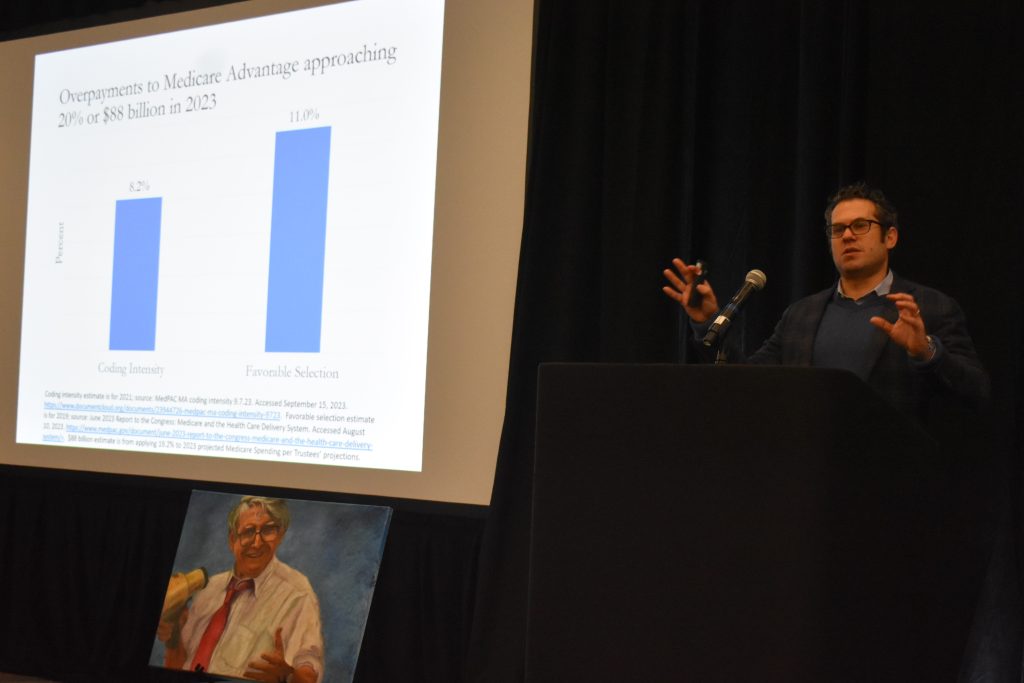

PNHP past president Adam Gaffney, MD, MPH presented the latest data on the U.S. health crisis—from declining population health, to rampant profiteering, to onerous restrictions. Download Dr. Gaffney’s original slideshow HERE or an alternate visual presentation by Dr. Ed Weisbart HERE.

Bring Power to Truth: Fighting Medicare Advantage

SNaHP executive board members Shruthi Bhuma, M4 and Swathi Bhuma, M4 presented the main components of our campaign to stop Medicare profiteering: legislative, narrative, and organizing (slideshow HERE).

Welcome from Rep. Jan Schakowsky

Medicare for All cosponsor Rep. Jan Schakowsky (IL-9) welcomed PNHP members from across the country to Chicago, and urged us to keep pushing in the fight for single-payer reform.

Panel discussion: Reacting to the election

Featuring (R to L) Abdul El-Sayed, MD, DPhil; Alex Lawson, MPP; Wendell Potter; and A. Taylor Walker, MD, MPH. Moderated by Sanjeev Sriram, MD, MPH; and Emily Huff, M3

Workshops I: Campaigns for 2025

- Growing Power within Medical Societies, presented by Eve Shaprio, MD, MPH; Shannon Rotolo, PharmD; Stephen Kemble, MD; and Donald Bourne, M3 (worksheet HERE).

- Moral Injury: Let’s Talk About It, presented by Diljeet Singh, MD, DrPH; Carol Paris, MD; and Anand Habib, MD, MPhil (video recording HERE; slideshow HERE; worksheet HERE; moral injury survey HERE).

- A Toolbox for Building Local Power, presented by Toby Terwilliger, MD; Robel Worku; and Brooke Adams, M1 (worksheets HERE and HERE).

- Making Legislative Action Real, presented by Ed Weisbart, MD; Stephan Ramdohr; and Dan Doyle, MD (slideshow HERE; worksheet HERE).

Workshops II: Building Your Practical Skills

- Recruiting and 1:1: How to Utilize your Network, presented by Andy Hyatt, MD; Jessica Schorr Saxe, MD; and Alankrita Olson, MD (worksheet HERE).

- Tension is Part of Building Powerful Relationships of Accountability with our Legislators, presented by Hannah Willage; Belinda McIntosh, MD; and Lori Clark (slideshow HERE; worksheet HERE).

- Building Powerful Coalitions, presented by Betty Kolod, MD; Brian Yablon, MD; and Alex Newell-Taylor

- Communicating Clearly and Effectively, presented by Chiamaka Okonkwo, M4; Carol Paris, MD; Dixon Galvez-Searle; and Anika Thota (slideshow HERE; worksheet HERE; Dr. Paris’ letter to the editor HERE; moral injury survey HERE).

- Running Inclusive and Effective Meetings, presented by Zach Gallin, M4; Jenn Sugijanto, M4; and Morgan Moore (worksheets HERE and HERE).

Telling your personal health care story

Carol Paris, MD; Douglas Robinson, MD; Emily Thompson, MD; and Phil Lichtenstein, MD talk about their experiences in the exam room during our “Communicating Clearly and Effectively” workshop.

PNHP timeline for 2025

Developed by meeting attendees reporting back from our campaign and skill-building workshops. Built by Ashley Duhon, MD and Ed Weisbart, MD (recoding HERE; slideshow HERE).

Keynote: Rep. Pramila Jayapal

Congresswoman Pramila Jayapal, lead sponsor of the Medicare for All Act in the U.S. House and chair of the Congressional Progressive Caucus, concluded our meeting with a dinner keynote address.

Students for a National Health Program (SNaHP) Summit

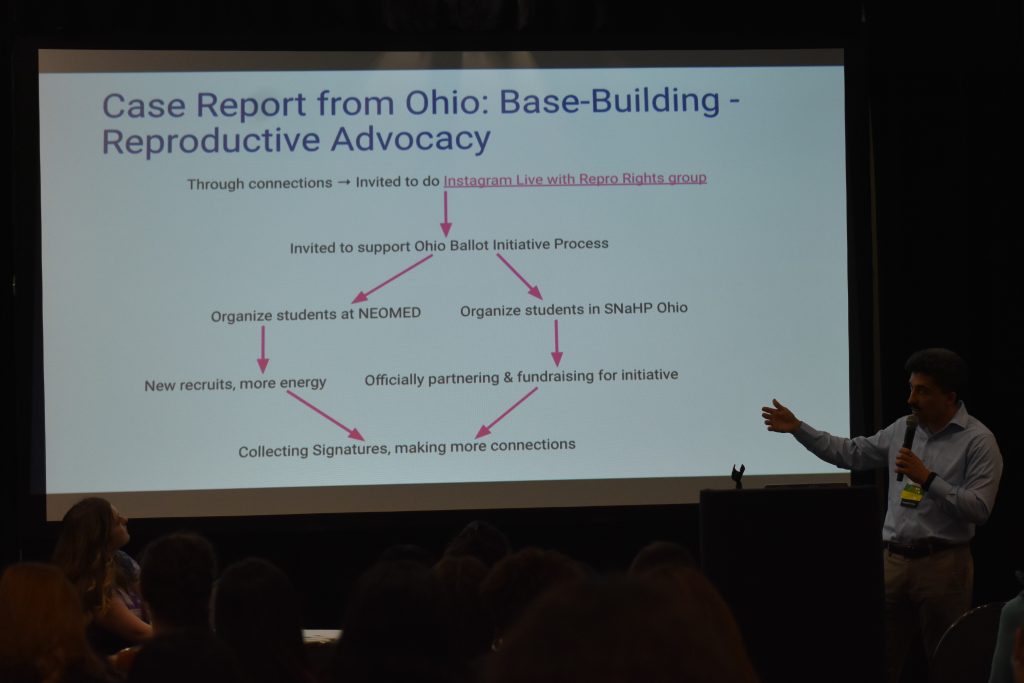

Medical and health professional students convened in Chicago for the annual SNaHP Summit on Nov. 15, 2024. During registration, students took in a wide-ranging poster presentation in the lobby.

Organizing for Human Rights

Committee of Interns and Residents president A. Taylor Walker, MD, MPH discussed her union’s organizing to pass two resolutions in support of Palestine.

Debriefing the 2024 election

Patrick Haley and Chiamaka Okonkwo led an interactive session responding to the federal election. Students wrote down both their immediate reactions and what gave them hope in the moment.

Welcome from Rep. Delia Ramirez

Medicare for All cosponsor Rep. Delia Ramirez (IL-3) welcomed students from across the country to Chicago, the “birthplace of community organizing.”

Launching the NEW SNaHP website

SNaHP media team leaders Griffin Johnson and Natalie Koconis did their best Steve Jobs impressions while launching the revamped student.pnhp.org website.

SNaHP Strategy in 2025

The SNaHP Summit started in earnest with presentations by Michael Massey (introduction, slideshow HERE); Shruthi and Swathi Bhuma (welcome to Chicago, slideshow HERE); Cortez Johnson (roll call); Max Brockwell and James Waters (strategic vision, slideshow HERE); and PNHP president Phil Verhoef, MD, PhD (Triple Aim, slideshow HERE).

Breakout Sessions I

- Building Statewide/Regional SNaHP Power, presented by Samuel Marquina, Gitanjali Lakshminarayanan, Carson Hartlage, Laureen Haack, and Helen Bassett (slideshow HERE)

- Start with Empathy: Talking Progress with Conservatives, presented by Cortez Johnson and John Kearney (slideshow HERE)

- Becoming Us: Building Power through Effective 1:1, presented by Andrew Meci and Annabelle Brinkerhoff (slideshow HERE; worksheet HERE)

- Writing Letters to Legislators, presented by Nina Silver, Halima Suleiman, and Priya Patel (slideshow HERE)

- The Labor Movement in Medicine: Lessons for Organizers, presented by Kevin Hu, Tom Statchen, Andy Hyatt, and A. Taylor Walker (slideshow HERE)

Breakout Sessions II

- Building A Powerful SNaHP Chapter, presented by Patrick Haley, Pritom Karmaker, and Mariam Tadross (slideshow HERE)

- The Power of Campaign Building and Plans: How We Win, presented by Max Brockwell and Chiamaka Okonkwo (slideshow HERE)

- Building knowledge about single-payer inside and outside of your med school curriculum, presented by Michael Massey and Constance Fontanet (slideshow HERE; worksheet HERE)

- Post Election Debrief: Connect, Reflect, What’s Next, presented by James Moore and Wade Catt (slideshow HERE)

- Becoming Us: Developing Powerful Testimony, presented by Donald Bourne, Carson Hartlage, Emily Huff, Allison Benjamin, Ksenia Varlyguina, and Mo Kinsinger (slideshow HERE)

Call to Action!

Shruthi and Swathi Bhuma (slideshow HERE); Allison M. Benjamin and Nina Silver; and Michael Massey led an interactive session where students made commitments to build power, take action, and work towards our North Star of Medicare for All.

The post 2024 Annual Meeting Materials appeared first on PNHP.

PNHP National Office Staff 23 Aug 2024 10:07 AM (7 months ago)

Ken Snyder – Executive Director

Ken Snyder – Executive Director

Contact for: organizational strategy; legislative and external relations; Board of Directors; development. Phone extension: 6025

Matthew Petty – Deputy Director

Matthew Petty – Deputy Director

Contact for: memberships and donations; PNHP Annual Meeting; organizational operations and finance; human resources. Phone extension: 6024

Lori Clark – National Organizer

Lori Clark – National Organizer

Contact for: membership committee; pediatricians Member Interest Group (MIG); chapters in CA, FL, GA, ME, MD, MA, OH; Students for a National Health Program (SNaHP). Phone extension: 6021

Rebecca Delay – National Organizer

Rebecca Delay – National Organizer

Contact for: specialty-based Member Interest Groups (MIGs); medical society resolutions; medical conferences; Grand Rounds; chapters in AZ, CO, IL, IN, KY, MI, MN, NM, OR, PA, TN, TX, VA. Phone extension: 6020

Mandy Strenz – National Organizer

Mandy Strenz – National Organizer

Contact for: anti-profiteering and Medicare (dis)Advantage campaign; membership committee; events calendar; chapters in AK, CT, DC, HI, IA, LA, MO, NH, NJ, NY, NC, ND, PR, RI, SC, VT, WA, WV, WI. Phone extension: 6026

Dixon Galvez-Searle – Communications Specialist

Dixon Galvez-Searle – Communications Specialist

Contact for: email communications; social media (Facebook, Instagram, LinkedIn, and X/Twitter); website updates; branding and design. Phone extension: 6022

Anika Thota – Policy and Communications Specialist

Anika Thota – Policy and Communications Specialist

Contact for: press inquiries; print and broadcast media; policy committee; policy questions. Phone extension: 6023

For a list of PNHP officers, directors, advisers, and past presidents, please see our Board of Directors page.

The post PNHP National Office Staff appeared first on PNHP.

2024 Annual Meeting 25 Jun 2024 11:49 AM (9 months ago)

Register HERE for the Nov. 16 meeting!

Note: Online registration will close on Sunday, Nov. 10 at 11:59 pm Central. Because of high demand, registration at the door may be limited.

PNHP Annual Meeting

Saturday, Nov. 16 (agenda available HERE)

- Daytime program, 9:00 am – 5:00 pm

- Dinner program, 6:00 pm – 8:00 pm

The PNHP Annual Meeting will be held in Chicago at the Venue SIX10, located at 610 S. Michigan Ave.

Sleeping rooms will be available at the Hilton Chicago, 720 S. Michigan Ave., for $229/night + $25/night mandatory destination charge (includes internet and athletic club access, and $25/day food/beverage credit). Sleeping room reservations may be booked in two ways:

- Online HERE

- Call 877-865-5320 and reference “PNHP Annual Meeting”

Sleeping room reservations must be made by Friday, Oct. 25. Note that the Hilton is completely booked for nights after Nov. 17.

SNaHP Summit

Friday, Nov. 15, 12:00 pm – 6:00 pm

The SNaHP Summit will be held in Chicago at Roosevelt University, located at 430 S. Michigan Ave. This event is not affiliated with Roosevelt University.

Scholarships are available to support student and resident attendance for both the SNaHP Summit and the PNHP Annual Meeting. Please note that the application deadline has passed, and we are in the process of awarding scholarships to qualified applicants. PNHP members and the public can support PNHP’s student outreach programs by making a GIFT to the Nicholas Skala Student Fund.

Speakers

Dinner Keynote: Rep. Pramila Jayapal

Dinner Keynote: Rep. Pramila Jayapal

Congresswoman Pramila Jayapal represents Washington’s 7th District in the U.S. House and is chair of the Congressional Progressive Caucus and co-lead sponsor of the Medicare for All Act.

Meeting Chair: Dr. Philip Verhoef

Dr. Phil Verhoef is the president of PNHP, an adult and pediatric intensivist, and a clinical associate professor of medicine at the John A. Burns School of Medicine at the University of Hawaii-Manoa.

Health Policy Update:

- Dr. Adam Gaffney, Past President, PNHP; Assistant Professor of Medicine, Harvard Medical School

- Shruthi Bhuma, executive board member, SNaHP; board advisor, PNHP; M4, Chicago Medical School

- Swathi Bhuma, executive board member, SNaHP; board member, PNHP; M4, Chicago Medical School

Plenary Discussion Panel:

- Dr. Abdul El-Sayed, County Public Health Director, host of the America Dissected podcast, and author of Healing Politics and Medicare for All

- Alex Lawson, Executive Director, Social Security Works

- Wendell Potter, President, Center for Health and Democracy

- Dr. A. Taylor Walker, President, Committee of Interns and Residents

See our agenda for a full lineup of speakers and workshops.

This conference will not be livestreamed in its entirety, but recordings of select sessions will be made available after the meeting.

Covid Safety Protocols

Please note that our medical experts recommend the following Covid safety precautions for the conference:

- Staying home if you are experiencing symptoms suggestive of Covid, such as a sore throat, persistent cough, or fever

- Testing immediately before the conference

- Vaccination, particularly with one of the updated vaccines covering newer strains

- Wearing a face mask while not actively eating or drinking

Previous Annual Meetings

Click HERE to access archival material from last year’s Annual Meeting in Atlanta. Click HERE to view photos from the conference.

Attending the 2024 PNHP Annual Meeting and SNaHP Summit is entirely voluntary and requires attendees to abide by any applicable rules of conduct, or local or state laws, that may be announced at any time. Attendees acknowledge the highly contagious and evolving nature of Covid-19 and voluntarily assume the risk of exposure to, or infection with, the virus by attending the Meeting, and understand that such exposure or infection may result in personal injury, illness, disability, and/or death. Attendees release and agree not to sue any persons or entities responsible for coordinating or organizing the PNHP Annual Meeting and SNaHP Summit in the event that they contract Covid-19. Attendees agree to comply with all Covid-related procedures that may be implemented at the Meeting, including mask-wearing.

The post 2024 Annual Meeting appeared first on PNHP.

PNHP Newsletter: Spring 2024 24 Jun 2024 2:18 PM (9 months ago)

Table of contents

Click the links below to jump to different sections of the newsletter. To view a PDF version of the shorter print edition of the newsletter, click HERE.

If you wish to support PNHP’s outreach and education efforts with a financial contribution, click HERE.

If you have feedback about the newsletter, email info@pnhp.org.

PNHP News and Tools for Advocates

- PNHP Leads Fight Against Medicare Advantage

- PNHP Caps off 35th Anniversary at Annual Meeting

- Heal Medicare: PNHP Launches Revamped Website

- Meet Mandy, Our New National Organizer

Save the Date for our Annual Meeting in Chicago

Research Roundup

- Data Update: Health care crisis by the numbers

- Studies and analysis of interest to single-payer advocates

PNHP Chapter Reports

SNaHP Chapter Reports

Reclaiming Medicare for the Public

PNHP in the News

PNHP News and Tools for Advocates

PNHP Leads Fight Against Medicare Advantage

As controversies continue to build around the corporate-run Medicare Advantage (MA) program, PNHP has become a leader in the fight to crack down against its abuses and strengthen Traditional Medicare. First, in October, PNHP released a report quantifying the egregious levels of overpayments in the program. This report was covered extensively in the media and used in briefings with members of Congress, and has set the standard for discussing MA’s raiding of the Medicare Trust Fund.

Beginning in January, PNHP chapters around the country began organizing efforts around two different letters circulating in both chambers of Congress regarding Medicare Advantage. One letter was sponsored by the insurance industry, and uncritically praised MA while calling for increased support for the program. The other letter, written by progressive members of Congress like Rep. Pramila Jayapal, Rep. Rosa DeLauro, Rep. Jan Schakowsky, Sen. Elizabeth Warren, and Sen. Sherrod Brown, outlined the many flaws in MA and the critical need to reform the program while improving benefits in Traditional Medicare.

PNHP staff, members, and allied organizations set up dozens of meetings with their Congressional representatives to ask them not to sign on to the pro-industry letter, and to instead sign on to the reform letter. PNHP members helped lead over 40 meetings with members of both the House and Senate, and were able to convince several members to sign on to the reform letter that had not done so the previous year. In total, around 50 House members and 10 Senate members signed onto the reform letter.

Alongside our organizing campaign, PNHP also conducted an extremely successful email campaign urging members to contact their representatives with a message about the two MA letters. Almost 20,000 messages were sent through our email form, sending a strong signal to members of Congress that their constituents care deeply about the need to protect Medicare from privatization.

PNHP’s campaign against Medicare Advantage will continue through the year. If you would like to get involved, please contact National Organizer Mandy Strenz at mandy@pnhp.org.

PNHP Caps off 35th Anniversary at Annual Meeting

After a year of celebrating PNHP’s 35th Anniversary through organizing, fundraising, and activism, we capped everything off at our Annual Meeting in Atlanta. Things kicked off on Friday with the Leadership Training, featuring presentations and workshops from leaders in PNHP and SNaHP. On Saturday morning, the Annual Meeting opened with the always hotly anticipated Health Policy Update, delivered by PNHP past president Dr. Adam Gaffney and SNaHP executive board member James Patrick Waters. They touched on a wide range of topics, including declining life expectancy, the ongoing Medicaid unwinding, and the dangerous expansion of Medicare Advantage.

After another day of workshops on topics ranging from organizing to moral injury to reproductive justice, attendees gathered for this year’s keynote address, delivered by distinguished physician activist and former American Public Health Association president Dr. Camara Jones. Dr. Jones gave a thought-provoking and allegory-rich talk on recognizing and combating racial inequity, both in health and in U.S. society more broadly.

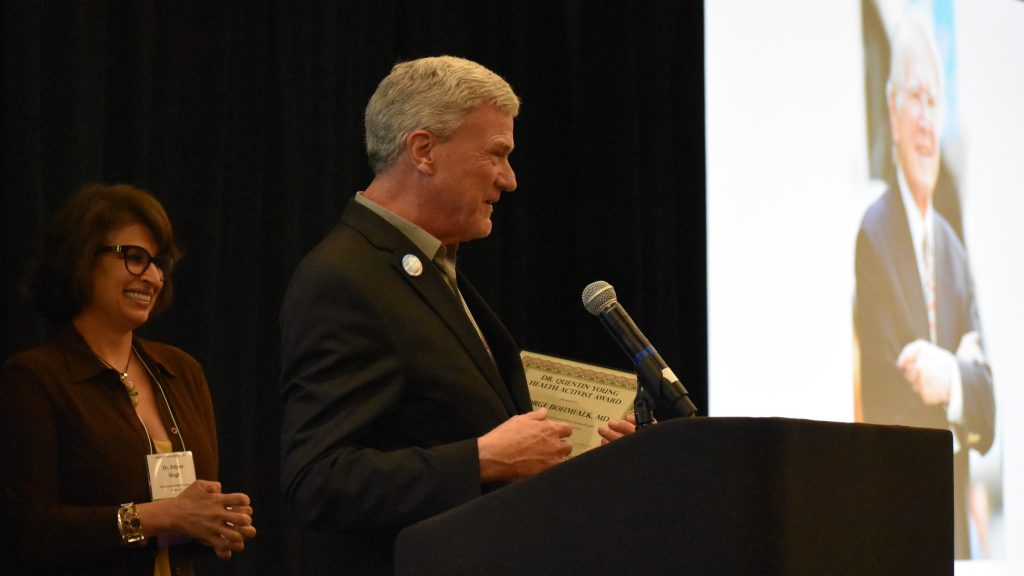

Saturday night’s highlight was the 35th Anniversary Dinner. Members took the stage to reminisce on three-and-a-half decades of fighting for health care justice with PNHP, and to recognize national allies, past presidents, medical student leaders, and co-founders. At the end of the dinner, the Quentin Young and Nick Skala health activist awards were presented to Dr. George Bohmfalk, Dr. Diljeet Singh, and SNaHP leader Donald Bourne.

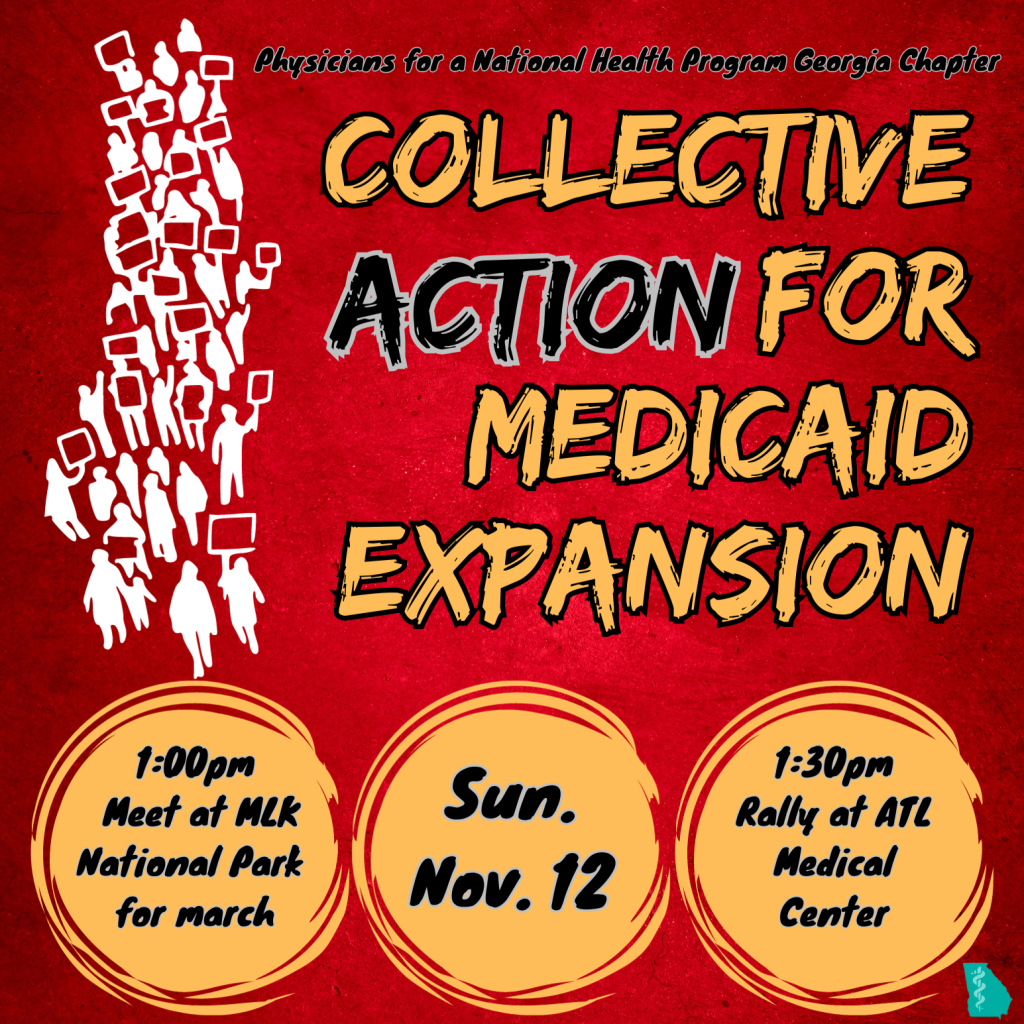

Sunday saw our SNaHP members gathered for their annual Student Summit—running their own workshops and learning from one another about activism and leadership. To end the weekend, meeting attendees piled into buses and headed off to a fantastically organized public action protesting hospital closures and demanding Medicaid expansion in Georgia. The action was even covered by the Atlanta Journal-Constitution!

PNHP’s 35th anniversary initiatives were to build the future of our movement by supporting the work of SNaHP; ramping up our fight against corporate profiteering, with a particular focus on the so-called “Medicare Advantage” program; and greatly increasing our base of active physician members fighting for improved Medicare for All. We made substantial progress in all these areas in 2023, and will continue to do so in 2024.

Heal Medicare: PNHP Launches Revamped Website

As part of PNHP’s campaign against Medicare profiteering, we have created a new website to help activists wade through the many complex issues related to both traditional Medicare and corporate-controlled Medicare Advantage (MA) plans. The new website is called HealMedicare.org, and contains many resources to help explain the dangers of MA, and how we can collectively fight back.

The two focuses of the website are education (clearly explaining the harm caused by corporations like Cigna, Aetna, and UnitedHealthcare) and activism (raising our voices and organizing an effective response). The website has already been used extensively in our 2024 MA letter campaign, and contains a legislative toolkit with a robust set of links, documents, and videos for anyone looking to engage their representatives.

We will continue to update the site as our campaign evolves throughout the year. Please take a look, and share with anyone who is concerned for the future of our public Medicare!

Meet Mandy, Our New National Organizer

Previous Experience: I worked with PNHP-NY Metro as the Chapter Coordinator starting in 2021 – and before that in the fine jewelry world, with advocacy work solely in my spare time.

What drew you to PNHP? Healthcare access is a throughline in many issues I care about: climate, immigration, reproductive rights, anti-war efforts, LGBTQIA+ issues, etc. While single payer alone wouldn’t solve any of those issues, it has the potential to majorly alleviate some of the strain people feel around them. Also, I just love getting to work on things I care about every day, especially with people as committed as PNHP members are.

What are you looking forward to working on over the next 12 months? I’m looking forward to seeing PNHP chapters grow their power and influence both locally and nationally.

What’s a fun fact about yourself? I’ve yet to meet a fermented food I don’t adore – please give me some challenging ones to try!

Thanks to the generosity of donors to our 35th anniversary campaign, Mandy Strenz joins PNHP as the third member of our growing Organizing Team alongside Lori Clark and Rebecca Delay. Connect with Mandy at mandy@pnhp.org.

Save the Date for our Annual Meeting in Chicago

Join us for PNHP’s Annual Meeting, scheduled for Saturday, Nov. 16 in Chicago at the Venue SIX10, located at 610 S. Michigan Ave.

Our annual Students for a National Health Program (SNaHP) Summit is scheduled for the preceding day (Friday, Nov. 15) at a TBD location in Chicago. Stay tuned for more information, including registration, at pnhp.org/meeting.

Research Roundup

Data Update: Health Care Crisis by the Numbers

Barriers to Care

Ketamine can be lifesaving, but is difficult to access: Although increasingly popular as an option for treatment-resistant depression, IV Ketamine treatments for mental illness are currently off-label and thus rarely covered by insurers, costing anywhere from $400 to $1000 per treatment. Esketamine, a nasal spray and the only ketamine drug approved for depression, carries an out-of-pocket cost of $784 a month for two inhalers. Emily Maloney, “Ketamine can be transformative for people with suicidal thoughts — if they can access it,” STAT News, 9/7/23.

Insurers deny critical treatment for eating disorders: In deciding whether to cover eating disorder treatment, insurers often emphasize metrics like weight and body mass index while minimizing patients’ serious psychiatric symptoms. For example, a teen couldn’t get her insurer to cover her eating disorder and suicidality, even after three separate clinicians vouched for her admission to a specialty program. In terms of total costs, a hospital stay for eating disorder treatment runs an average of $61,000. Of the 20 most expensive psychiatric stays among Washington youth in 2021, 40% involved those with an eating disorder. Hannah Furfaro, “Not sick enough: How insurance denials can delay lifesaving eating-disorder treatment,” Seattle Times, 9/10/23.

Abortion coverage limited or unavailable at many employers: Around one-fourth of large U.S. employers heavily restrict coverage of legal abortions or don’t cover them at all under health plans for their workers. 10% of large employers don’t cover abortion at all, and 18% cover it only in limited circumstances. In 2021, the median costs for people paying out-of-pocket in the first trimester were $568 for a medication abortion and $625 for an abortion procedure. By the second trimester, the cost increased to $775 for abortion procedures. Rachana Pradhan, “Abortion Coverage Is Limited or Unavailable at a Quarter of Large Workplaces,” KFF Health News, 10/18/23.

Insurance premiums rise for U.S. families: Premiums rose 7%, compared to just a 1% increase last year. The average premium is now just under $24,000 for families who get their coverage through employers (about 153 million people in the United States are covered under this type of insurance) The 7% increase is the largest since 2011, and was at least partially driven by high inflation. Cailley LaPara, “Health Insurance Premiums Now Cost $24,000 a Year, Survey Says,” Bloomberg, 10/18/23.

Large numbers of Americans struggle to pay for care: 43% of those with employer coverage, 57% with marketplace or individual-market plans, 45% with Medicaid, and 51% percent with Medicare said it was very or somewhat difficult to afford their health care. 54% percent of people with employer coverage who reported delaying or forgoing care because of costs said a health problem of theirs or a family member got worse because of it, as did 61% in marketplace or individual-market plans, 60% with Medicaid, and 63% with Medicare. Sara R. Collins et al., “Paying for It: How Health Care Costs and Medical Debt Are Making Americans Sicker and Poorer,” Commonwealth Fund, 10/26/23.

Child survivors of shootings face huge costs: Survivors’ health care spending increased by an average of $34,884—a 17.1-fold increase. Parents of survivors experienced a 30–31% increase in psychiatric disorders, with 75% more mental health visits by mothers, and 5–14% reductions in mothers’ and siblings’ routine medical care. Family members experienced substantially larger 2.3- to 5.3-fold increases in psychiatric disorders, with at least 15.3-fold more mental health visits among parents. Zirui Song et al., “Firearm Injuries In Children And Adolescents: Health And Economic Consequences Among Survivors And Family Members,” Health Affairs, November 2023.

Long term care causes dire financial issues: Among Americans who had $171,365 to $1.8 million in savings at age 65, those with greater long-term care needs were much more likely to deplete their savings than those who did not need long-term care. 23.6% of those who lived in a nursing home died broke. The median annual cost of a private room in a nursing home was over $100,000 in 2020, and a home health aide costs over $60,000. Six in 10 adults age 50 and older feel “mostly” or “somewhat anxious” about affording the cost of a nursing home, assisted living facility, paid nurse, or aide to assist them in retirement. Reed Abelson and Jordan Rau, “Facing Financial Ruin as Costs Soar for Elder Care,” KFF Health News, 11/14/23.

Thousands of U.S. rape victims unable to get an abortion: 65,000 rape-related pregnancies occurred in the 14 states which have passed near-total abortion bans since the Dobbs decision in 2022. Even for those states which provide exceptions for rape, abortions are extremely difficult to access. Texas alone, owing to its large population and total banning of abortion without exceptions, accounted for approximately 26,000 of these pregnancies. Jessica Glenza, “Nearly 65,000 US rape victims could not get an abortion in their state, analysis shows,” The Guardian, 1/25/24.

GoFundMe remains critical to paying for care: The annual number of U.S. campaigns on GoFundMe related to medical causes (about 200,000) was 25 times the number of such campaigns on the site in 2011. The company has estimated that roughly a third of the funds raised on the site are related to costs for illness or injury, but that could be an undercount as some campaigns are counted under different categories. Campaigns made an average of about 40% of the target amount, and there is evidence that this number has worsened over time. Elisabeth Rosenthal, “GoFundMe Has Become a Health Care Utility,” KFF Health News, 2/12/24.

Medicare & Medicaid Issues

Unenrolled Medicaid-eligible adults have difficulty accessing care: 37% of adults who are eligible for Medicaid but not enrolled in the program and do not have private insurance report having a usual source of care, compared to 69.9% of Medicaid enrollees and 66.8% of Medicaid-eligible individuals with private insurance. Unenrolled Medicaid-eligible individuals are more likely to delay care due to cost concerns (21.4% compared to 7.3% of Medicaid enrollees and 9.5% of Medicaid-eligible individuals with private insurance). Compared to Medicaid enrollees, unenrolled eligible adults were also less likely to have visited a doctor within the last year (23.4% vs 65.4%), had a prescription filled (27.8% vs 67%), or stayed in a hospital (2.5% vs 12.6%). Bowen Garrett et al., “Medicaid-Eligible Adults Who Lack Private Coverage and Are Not Enrolled,” Urban Institute, August 2023.

Beneficiaries in Medicare Advantage report affordability problems: 22% of Medicare Advantage (MA) enrollees reported high health care costs that made them underinsured, compared with 13% on Traditional Medicare plus supplemental coverage. 21% of MA enrollees reported problems paying medical bills and debt, compared with 14% of those on Traditional Medicare. Despite the touting of dental benefits as part of MA plans, 30% of those with MA reported delaying or not getting dental care due to cost. Faith Leonard et al., “Medicare’s Affordability Problem: A Look at the Cost Burdens Faced by Older Enrollees,” Commonwealth Fund, 9/19/23.

Georgia Medicaid enrollment is low: The program, which is known as Pathways and has work requirements, has only enrolled 1,343 residents in the 3 months since it began. The state previously said it delayed the reevaluations of 160,000 people who were no longer eligible for traditional Medicaid but could qualify for Pathways to help them try to maintain health coverage. But observers have said they have detected little public outreach to target populations. In addition to imposing a work requirement, Pathways limits coverage to able-bodied adults earning up to 100% of the poverty line, which is $14,580 for a single person or $30,000 for a family of four. Associated Press, “Georgia Medicaid program with work requirement has enrolled only 1,343 residents in 3 months,” 10/20/23.

Rural hospitals feel sting of Medicare Advantage growth: MA enrollment has increased fourfold in rural areas since 2010. However, its growth has imperiled the finances of small hospitals in these more remote regions, as their payments are often lower than traditional Medicare and are regularly delayed or never arrive from insurers. One profiled hospital, Mesa View, is owed $800,000 by MA plans for care already provided. Sarah Jane Tribble, “Tiny, Rural Hospitals Feel the Pinch as Medicare Advantage Plans Grow,” KFF Health News, 10/23/23.

Halfway through Medicaid unwinding, millions disenrolled: Of the 94 million people enrolled in Medicaid and CHIP in March 2023, at the end of January, 32 million have renewed coverage and 16 million have been disenrolled. Since the start of unwinding, Medicaid enrollment has declined in every state, ranging from 32% in Idaho to 1% in Maine. Bradley Corallo, “Halfway Through the Medicaid Unwinding: What Do the Data Show?” KFF, 1/30/24.

Medicare Advantage profitability is down: Between 2019 and 2022, the profit margin in MA declined from 4.9% to 3.4%, while earnings per member declined 28%. Increased utilization is partially responsible; UnitedHealth posted its largest medical loss ratio of 85% in the fourth quarter of 2023. Humana, which relies heavily on Medicare Advantage for its business model, reported profits falling far short of expectations in its latest release and has lowered its guidance for the coming year to $16 in adjusted earnings per share. Its stock fell over 14% after the release of its last earnings report. Emily Olsen, “Medicare Advantage profitability is declining, Moody’s says,” Healthcare Dive, 1/30/24.

MA enrollees report issues with care and benefits: Larger shares of beneficiaries in MA plans than in traditional Medicare reported they experienced delays in getting care because of the need to obtain prior approval (22% vs. 13%) and couldn’t afford care because of copayments or deductibles (12% vs. 7%). 31% of MA beneficiaries reported using none of their supplemental benefits in the past year. Gretchen Jacobson et al., “What Do Medicare Beneficiaries Value About Their Coverage?” Commonwealth Fund, February 22, 2024.

MA home health patients get less care: The study compared more than 285,000 patients receiving home health care through MA and TM from 102 home health locations in 19 states. MA patients had a shorter home health length of stay by 1.62 days, and received fewer visits from all disciplines except social work. There were no differences between the two types of Medicare in inpatient transfers. MA patients had 3% and 4% lower adjusted odds of improving in mobility and self-care, respectively. MA patients were 5% more likely to discharge to the community compared with TM. Rachel A. Prusynski et al., “Differences in Home Health Services and Outcomes Between Traditional Medicare and Medicare Advantage,” JAMA Health Forum, March 1, 2024.

Pharma

States taking steps to reduce drug prices: As Medicare prepares to begin negotiating drug prices, states are taking matters into their own hands using Prescription Drug Affordability Boards. These boards set upper limits for prices paid by state and local governments, and sometimes even for commercial health plans as well. For instance, the Minnesota board will review select brand-name drugs or biologics for which the list price rose by more than 15% or more than $2,000 during any 12-month period or course of treatment lasting under 12 months. Ed Silverman, “Medicare may plan to negotiate drug prices, but some states are taking their own steps to lower costs,” STAT News, 10/11/23.

Insurers begin charging for COVID treatment: Paxlovid, the most popular antiviral COVID treatment, was covered by the government free of charge until the end of 2023. Pfizer announced that it would set the price for the drug at $1390 per course. When the U.S. government was purchasing the drug, it paid around $530 per course. The United States purchased around 24 million courses of Paxlovid. About 3.4 million doses had been given in 2023 at the time of the announcement. Michael Erman, “Pfizer to price COVID treatment Paxlovid at $1,390 per course,” Reuters, 10/18/23.

Sickle cell therapies are costly: The newly approved drugs, the first CRISPR-based gene therapies approved by the FDA, are known as Casgevy and Lyfgenia. Casgevy is priced at $2.2 million, while Lyfgenia has an even higher price of $3.1 million. These one-time therapies have prices comparable to the lifetime estimated cost of managing sickle cell disease, estimated at between $4 and $6 million. Many of the approximately 16,000 people estimated to be eligible for Casgevy in the U.S. are covered by Medicaid, which may be limited in its ability to cover the drug. Ned Pagliarulo, “Pricey new gene therapiest for sickle cell pose access test,” Biopharma Dive, December 8, 2023.

Pharma companies use patents to stifle competition: A study in JAMA found that pharmaceutical companies use “terminal disclaimers” to create “patent thickets” by filing dozens of patents on drugs that protect little of true value, but allow companies to sue to prevent the production of generic or biosimilar drugs. 48% of the 271 drug patents currently in litigation involved the use of terminal disclaimers. An analysis found a 200% increase in patents filed by companies that made few substantive changes to their drugs. From 2000 to 2015, the FDA approved 1,421 new drugs. The ratio of continuation patents increased from 0.6 in 2000 to 1.8 in 2015. These practices allow pharmaceutical companies to keep exclusivity for their drugs and keep their prices high. Ed Silverman, “Patent thickets and terminal disclaimers: How pharma blocks biosimilars from the marketplace,” STAT News, December 21, 2023.

Insulin becomes cheaper for many Americans: The three major insulin manufacturers have lowered the cost of insulin to $35 a month for most patients, and Medicare enrollees pay no more than $35 a month as part of provisions of the Inflation Reduction Act. The inflation-adjusted cost of insulin has increased 24% between 2017 and 2022. An estimated 8.4 million Americans rely on insulin to survive, and as many as 1 in 4 patients have been unable to afford their medicine. Experts have noted that manufacturers’ lowering of prices coincides with changes to Medicaid rebate rules that mean these companies will save hundreds of millions by lowering the price of their drugs. One of the companies, Eli Lilly, could avoid having to pay an additional $430 million in Medicaid rebates in 2024 by lowering their insulin price. Tami Luhby, “More Americans can now get insulin for $35,” CNN, January 2, 2024.

Senate Democrats investigate asthma inhaler prices: In the past five years, AstraZeneca, GlaxoSmithKline (GSK), and Teva made more than $25 billion in revenue from inhalers alone. One of AstraZeneca’s inhalers costs $645 in the U.S. but just $49 in the U.K. One of Boehringer Ingelheim’s inhalers costs $489 in the U.S. but just $7 in France. GSK’s Advair HFA costs $319 in the U.S. but just $26 in the U.K. About 25 million Americans have asthma, and about 16 million have chronic obstructive pulmonary disease (COPD), two conditions that could require the use of inhalers. Nathaniel Weixel, “Sanders, Democrats launch investigation into asthma inhaler pricing,” The Hill, 1/8/24.

Drugmakers hike prices on over 700 medications: The average price increase across the industry was about 4.5% at the beginning of 2024, slightly behind previous averages of about 5%. Two notable increases include Ozempic and Mounjaro, the weight-loss drugs that have exploded in popularity. Ozempic’s price rose 3.5% to $984.29 for a month’s supply, while Mounjaro rose 4.5% to about $1,000 for a month’s supply. Other increases listed include pain medication Oxycontin (9%), blood thinner Plavix (4.7%), and antidepressant Wellbutrin (9.9%). Aimee Picchi, “Drugmakers hiking prices for more than 700 medications, including Ozempic and Mounjaro,” CBS News, 1/18/24.

Americans pay more for drugs than people in other countries: Across all drugs, U.S. prices were 278% of comparison countries’ prices. U.S. gross prices for brand-name originator drugs were 422% of comparison country prices. The only category where Americans spent less was in unbranded generics, which accounted for 90% of U.S. prescription drug volume but only 8% of spending (compared to 41% of volume and 13% of spending for comparison countries). By contrast, brand-name originator drugs accounted for only 7% of U.S. prescription drug volume, but 87% of U.S. prescription drug spending (compared with 29% of volume and 74% of spending in comparison countries). Andrew W. Mulcahy, “International Prescription Drug Price Comparisons,” RAND Corporation, February 1, 2024.

Health Inequities

Racial disparities in access to care for chronic pain among opioid addicts: A study of Medicare beneficiaries with chronic lower back pain and opioid use disorder found disparities in the time to receive chiropractic care. Median time to chiropractic care was longest for American Indian or Alaska Native people at 8.5 days, followed by Black or African American people at 7 days, and shortest for Asian or Pacific Islander people at 0 days. After adjustment, Black or African American and Hispanic people had lower odds of receiving chiropractic care within 3 months of diagnosis compared with non-Hispanic White persons. Fiona Bhondoekhan et al., “Racial and Ethnic Differences in Receipt of Nonpharmacologic Care for Chronic Low Back Pain Among Medicare Beneficiaries With OUD,” JAMA Network Open, 9/12/23.

Unionized nursing homes more likely to report worker issues: From 2016-2021, the compliance rate for reporting workplace injuries and illnesses in nursing homes was only 40%. A study found that two years after unionization, nursing homes were 31.1% more likely than nonunion nursing homes to report workplace injury and illness data to OSHA. Further unionization could help improve workplace safety in nursing homes, a sector with one of the highest occupational injury and illness rates in the US. Adam Dean et al., “The Effect Of Labor Unions On Nursing Home Compliance With OSHA’s Workplace Injury And Illness Reporting Requirement”, Health Affairs, September 2023.

Pharmacy deserts grow in vulnerable communities: Rite Aid, CVS, and Walgreens have announced plans to collectively close an estimated 1500 stores. These store closures often hit low-income Black and Latinx neighborhoods first. An estimated 1 in 4 neighborhoods are pharmacy deserts across the country. Although the number of pharmacies in the United States has stayed at around 64,000 since 2014, pharmacies are increasingly leaving low-income and majority Black and Latinx neighborhoods and expanding in predominantly White and middle to higher-income areas, widening gaps in access. Aaron Gregg and Jaclyn Peiser, “Drugstore closures are leaving millions without easy access to a pharmacy,” Washington Post, October 22, 2023.

Young black males with ADHD are underdiagnosed and undertreated: The odds that Black students got diagnosed with the neurological condition were 40% lower than for white students, with all else being equal. For young black males, the odds were 60% lower. Black children are 2.4 times as likely as white kids to receive a diagnosis of conduct disorder compared with a diagnosis of ADHD. Claire Sibonney, “Underdiagnosed and Undertreated, Young Black Males With ADHD Get Left Behind,” KFF Health News, 11/9/23.

Disparities in infant mortality rate persist in Alabama: Although Alabama’s overall infant mortality rate fell from 7.6 deaths per 1000 live births in 2021 to 6.7 deaths in 2022, the gap between Black and white infant mortality persisted. Among Black mothers, the rate actually increased from 12.1 in 2021 to 12.4 in 2022, while for white mothers it dropped from 5.8 in 2021 to 4.3 in 2022. Summer Harrell, “Alabama sees decrease in infant mortality rate, but racial disparities persist,” ABC 33/40, 11/16/23.

Black Medicaid heart failure patients more likely to be hospitalized: 12.7 percent of Black patients who were previously diagnosed with heart failure and could enroll in Medicaid through the Supplemental Security Income (SSI) program had a preventable hospitalization. This is nearly twice the rate of white enrollees with heart failure, of which about 7.2 percent experienced preventable hospitalizations. This effect was present in the pooled sample of 11 states for which race of patients could be assessed. In general for heart failure, asthma/COPD, and diabetes, preventable hospitalization rates were substantially higher for adults eligible for Medicaid through SSI compared with adults eligible for Medicaid through other pathways. Claire O’Brien et al., “Preventable Hospitalizations among Adult Medicaid Enrollees in 2019,” Urban Institute, January 23, 2024.

Health care workers say racism in care is a major issue: 47% of U.S. health care workers said they witnessed discrimination against patients, and 52% said that racism against patients was a major problem. Employees at health facilities with a higher percentage of Black or Latino patients witnessed higher rates of discrimination. At hospitals with a majority of Black patients, 70% of workers said they witnessed discrimination against patients based on their race or ethnicity. For hospitals with mostly Latino patients, that figure was 61%. 59% of workers younger than 40 said they faced stress due to discrimination, compared with 26% of workers 60 or older. Ken Alltucker, “Nearly half of health care workers have witnessed racism, discrimination, report shows,” USA Today, 2/18/24.

Fertility treatments out of reach for the poor: A round of IVF can cost around $20,000. For comparison, the maximum allowed income for a family of two on Medicaid in New York is just over $26,000. Although Medicaid pays for about 40% of births in the United States, and 46 states and the District of Columbia have elected to extend Medicaid postpartum coverage to 12 months, fertility treatments are still not covered under Medicaid. By contrast, 45% of companies with 500 or more workers cover IVF and/or fertility drug therapy. Michelle Andrews, “If You’re Poor, Fertility Treatment Can Be Out of Reach,” KFF Health News, February 26, 2024.

Profiteers in Health Care

Medical device manufacturer reaches settlement on breathing device defects: Philips Respironics agreed to pay $479 million to settle claims that its defective continuous positive airway pressure (CPAP) devices spewed flecks of foam and gasses into the lungs of patients, causing respiratory illness and even lung cancer. More than 105,000 injuries and 385 reports of deaths that were possibly related to the foam breakdown in Philips machines have been reported to the F.D.A. Christina Jewett, “CPAP Maker Reaches $479 Million Settlement on Breathing Device Defects,” New York Times, 9/7/23.

FTC sues private equity group for attempting to create anesthesia monopoly: The firm, Welsh Carson, owns U.S. Anesthesia Partners (USAP). The firm bought competing doctor groups in its markets to gain leverage over commercial health insurers and paid shareholders large sums by saddling the company with billions of dollars in debt. As it has grown to be by far the largest anesthesia provider in Texas, it has raised prices higher than all of its competitors to match. As of early 2020, UnitedHealthcare reported that it reimbursed USAP at rates 95% higher than its in-network median for Texas and 65% higher than the Houston average. Bob Herman and Tara Bannow, “FTC sues private equity firm Welsh Carson, U.S. Anesthesia Partners for allegedly creating a monopoly,” STAT News, 9/21/23.

Columbus hospitals relieving hundreds of millions in medical debt: Four regional hospitals are relieving approximately $335 million owed by hundreds of thousands of local residents for care received between 2015-2020. Columbus residents are eligible if they earn between 200-400% of the federal poverty line, which is about $55,500-$111,000 for a family of four. This is expected to impact around 340,000 local residents, the city estimates, with the average amount forgiven coming to nearly $1,000. Tyler Buchanan, “Columbus hospitals relieving $335M in medical debt,” Axios, 10/17/23.

UnitedHealth sued over MA denials: The lawsuit alleges that United used an AI tool to deny care to beneficiaries. According to plaintiffs, Medicare Advantage members appealed less than 1% of post-acute care denials, but 90% of those denials were reversed. UnitedHealthcare cut off hospice coverage for a patient named in the lawsuit two months after his admission, deeming it medically unnecessary and denying an appeal. The patient’s family spent as much as $168,000 out of pocket for him to remain at the hospice provider until his death. Another patient had a stroke at age 74 in October 2022 and United denied coverage for 20 days of nursing home care he received, then rejected multiple appeals, the lawsuit claims. His family paid more than $70,000 as a result. Nona Tepper, “UnitedHealth sued over AI, Medicare Advantage denials,” Modern Healthcare, 11/14/23.

Profit-seekers harm patients in assisted living: More than 800,000 older Americans reside in assisted living facilities. Most residents have to pay out-of-pocket because Medicare doesn’t cover long-term care and only a fifth of facilities accept Medicaid. The industry runs operating margins around 20%, and often charges residents with extensive needs $10,000 or more a month. The national median cost of assisted living is $54,000 a year. Investigations have found that facilities have billed residents $50 per injection, $12 for a single blood pressure check, and $93 a month to order medications from a pharmacy. Jordan Rau, “Senate Probes the Cost of Assisted Living and Its Burden on American Families,” KFF Health News, 1/25/24.

Senators grill pharma CEOs on company practices: In a hearing, Senator Chris Murphy pointed out that pharmaceutical company Johnson and Johnson spent $17 billion on stock buybacks and dividends compared to $14 billion on research and development. Senator Benrie Sanders said that Bristol Meyers Squibb charges patients $7,100 per year for blood-clot drug Eliquis in the U.S., while the same product can be purchased for $900 in Canada and just $650 in France. In 2022, prices for brand-name drugs in the U.S. were at least three times higher than those in 33 other wealthy nations. Max Zahn, “Big Pharma CEOs grilled on Capitol Hill over drug prices: 4 key takeaways,” ABC News, 2/8/24.

Private equity investment in Medicare Advantage is down: In 2023, investor groups made just four MA-related deals, the lowest number since 2017. At the peak of investment in 2021, private equity groups made 19 such deals, which then declined to 12 in 2022. From 2016 to 2023 in total, private equity groups invested in 80 Medicare Advantage companies. 45 of these investments were “add-on acquisitions” in which a Medicare Advantage company was purchased by another business the investors already owned. Nona Tepper, “Private equity Medicare Advantage investment slumps: report,” Modern Healthcare, 2/13/24.

Studies and analysis of interest to single-payer advocates

“Taking Advantage: How Corporate Health Insurers Harm America’s Seniors,” Physicians for a National Health Program, May 2024. “Ultimately, the effect of enrolling in MA on the care of millions of patients is decidedly negative. The existing evidence demonstrates that MA is not doing what it promised to do, and what its participating insurers are overpaid billions to do; far from improving quality of care or outcomes, Medicare Advantage is leaving beneficiaries, health care workers, and our health care system worse off, all in the name of profit.”

“What Do Medicare Beneficiaries Value About Their Coverage?” by Gretchen Jacobson, Faith Leonard, Elizabeth Sciupac, and Robyn Rapoport, Commonwealth Fund, 2/22/24. “Delays in care resulting from prior approval requirements or unaffordable cost-sharing expenses were more likely to be reported by beneficiaries in Medicare Advantage than in traditional Medicare.”

“The burden of medical debt in the United States,” by Shameek Rakshit, Matthew Rae, Gary Claxton, Krutika Amin, and Cynthia Cox, Peterson-KFF Health System Tracker. “The SIPP survey suggests people in the United States owe at least $220 billion in medical debt. Approximately 14 million people (6% of adults) in the U.S. owe over $1,000 in medical debt and about 3 million people (1% of adults) owe medical debt of more than $10,000. While medical debt occurs across demographic groups, people with disabilities or in worse health, lower-income people, and uninsured people are more likely to have medical debt.”

“Restrictiveness of Medicare Advantage provider networks across physician specialties,” by Yevgeniy Feyman, Jose Figueroa, Melissa Garrido, Gretchen Jacobson, Michael Adelberg, and Austin Frakt, Health Services Research, 4/9/24. “Our findings suggest that rural beneficiaries may face disproportionately reduced access in these [MA] networks and that efforts to improve access should vary by specialty.”

“Older Americans Say They Feel Trapped in Medicare Advantage Plans,” by Sarah Jane Tribble, KFF Health News, 1/5/24. “Enrollment in Medicare Advantage plans has grown substantially in the past few decades, enticing more than half of all eligible people, primarily those 65 or older, with low premium costs and perks like dental and vision insurance. And as the private plans’ share of the Medicare patient pie has ballooned to 30.8 million people, so too have concerns about the insurers’ aggressive sales tactics and misleading coverage claims.”

PNHP Chapter Reports

California

In California, multiple chapters continue their work on single payer and related issues. PNHP-Ventura members have created and delivered presentations around Medicare Advantage and Medicare privatization as part of grand rounds with very positive reception. The chapter also worked on an effort to pass a Ventura City Council resolution in favor of single payer. PNHP-Humboldt members have also been presenting on MA to various senior community groups, political organizations, and local events. The chapter was even able to place ads about the dangers of MA in local newspapers. Finally, PNHP-Chico, which recently restarted activities, has been delivering informational presentations, making calls to Senators to oppose cuts to social services, and planning future events.

To get involved in California, please contact Dr. Nancy C. Greep at ncgreep@gmail.com.

Indiana

Members of Medicare for All Indiana have been hard at work together with SNaHP members passing resolutions at the Indiana State Medical Association. These resolutions include supporting Medicaid access, calling on non-profit hospitals to honor their charity care obligations, and protecting voting rights and democracy. In addition, members presented on Medicare for All at the League of Women Voters’ annual meeting in June, and gave multiple presentations on Medicare privatization throughout the year, including tabling at Farmers’ markets. The chapter also sponsored showings of American Hospitals in September.

To get involved in Indiana, please contact Dr. Rob Stone at grostone@gmail.com.

Kentucky

Members in Kentucky led a protest at Humana headquarters in downtown Louisville, demanding an end to denials of care, the right to choose your doctor, an end to forced placement in MA, and the enactment of Medicare for All. The chapter also gave several presentations and hosted webinars on value-based care, single payer, and other topics. Finally, the chapter successfully persuaded the newspaper known as the Kentucky Lantern to cover the story of Baptist Health hospitals and physicians ending contracts with Medicare Advantage companies.

To get involved in Kentucky, please contact Kay Tillow at nursenpo@aol.com.

North Carolina

In Asheville, members of Health Care for All Western North Carolina (HCFAWNC) have worked on a number of different initiatives. In October, the chapter presented to Burke County Democrats, and in November, organized a screening of the documentary “Healing US”, adding several new members to the chapter from this event. In January, members met with North Carolina House Representative Caleb Rudow to discuss single payer and his constituents’ need for it. Members also met with Senator Ted Budd to inform him of the failures of Medicare Advantage plans and to ask him not to sign the pro-MA letter.

To get involved in HCFA-WNC, please contact Terry Hash at theresamhash@gmail.com.

Washington

In Washington, members continued their tradition of holding monthly Zoom meetings with a theme and speaker. These included a report-back from four members and eight SNaHP students from around the state who attended PNHP’s 35th Anniversary Annual Meeting in Atlanta. The chapter also raised more than $20,000 in contributions for its George Martin Student Scholarship Fund, which provides support for activities of the 5 SNaHP Chapters in our region. Members worked hard to develop deeper and more productive collaboration with other organizations in the region to fight against the privatization of Medicare. These include Puget Sound Advocates for Retirement Action, Health Care for All WA, and Health Care is a Human Right WA. Finally, members have been writing and circulating sign-on resolutions, advocating for Single-Payer with state and Congressional legislators, and planning for public meetings and actions in the Spring of 2024.

To get involved in Washington, please contact Dr. David McLanahan at mcltan@comcast.net.

SNaHP Chapter Reports

Florida State University

SNaHP Students at Florida State University have focused on recruitment and collaboration. The chapter is planning to table at several student activity fairs, and has recruited members into leadership positions in the organization. Members attended a virtual town hall with Rep. Maxwell Frost in the fall, and sent students to health care focused events around Tallahassee. The chapter also continues to collaborate with other units at FSU College of Medicine on access to care for racial and ethnic minority populations. In the coming months, students will be looking to collaborate more closely with LMSA and Pride groups in the medical school.

To get involved at Florida State University, please contact Dr. Xan Nowakowski at alexandra.nowakowski@med.fsu.edu.

Hofstra University

The SNaHP chapter at the Hofstra University Zucker School of Medicine hosted a single payer 101 lecture presented by Dr. Oliver Fein in October. Students had the opportunity to learn about the basics of single payer and how it compares to our current health system in achieving affordable and universal health care coverage. Students also organized a letter writing and introduction to advocacy event. In this event, medical students learned the ins and outs of engaging in advocacy and the democratic process. These students then wrote to their state and national representatives to express support for a number of health policies, including single payer. Many students also wrote to state legislators in support of the New York Health Act.

To get involved at Hofstra University, please contact Brien Maney at bmaney1@pride.hofstra.edu.

UNC-Charlotte

Students at the undergraduate chapter of UNC-Charlotte have held several meetings on different topics. One meeting was on understanding the legislation of health care, where students heard about the legislative side of Medicare for All from Dr. George Bohmfalk and Megan Dunn. Another meeting was on reproductive justice and healthcare, held in collaboration with the UNC-Charlotte Reproductive Justice Collective to discuss how reproductive freedom relates to Medicare for All. This event was organized using information from the reproductive justice session at the PNHP Annual Meeting. The last event held was on access to mental health care, and how Medicare for All can help eliminate barriers to accessing mental health care.

To get involved at UNC-Charlotte, please contact Kayla Walker at kwalk100@uncc.edu.

University of Florida

Students at the University of Florida worked in collaboration with groups such as Medicare for All Florida and Alachua County Labor Coalition to pass a resolution in Alachua County in support of Medicare for All. The resolution passed on December 12th. The chapter also hosted 4 SNaHP events during Health Policy week for first-year medical students with local speakers and PNHP speakers Dr. Ed Weisbart, Dr. Marvin Malek, and Dr. Betty Keller. Finally, the chapter had great success with recruitment, increasing its membership from just 4 to 34 students in the last months.

To get involved at the University of Florida, please contact Patrick Haley at phaley1@ufl.edu.

Reclaiming Medicare for the Public

In late winter, legislators in the U.S. House and Senate sent a pair of letters to the Centers for Medicare and Medicaid Services, urging administrators to crack down on delays and denials in the so-called “Medicare Advantage” program—and to make sorely needed improvements to traditional Medicare. These letters were championed by Reps. Jayapal, DeLauro, and Schakowsky, and by Sens. Warren and Brown.

PNHP members were instrumental in convincing 60 Representatives and 10 Senators to sign on. We sent thousands of emails and met with dozens of legislators to talk about the dangers of Medicare profiteering.

For more information about how you can get involved with our legislative campaign, visit HealMedicare.org or email National Organizer Mandy Strenz at mandy@pnhp.org.

PNHP in the News

News items featuring PNHP members

- “Three quarters of ACOs in direct contracting model earned savings,” Healthcare Finance News, 10/24/23

- “Health care choices narrow for Kentuckians in Medicare Advantage plans,” Kentucky Commonwealth Journal, 10/25/23

- “‘This Should Be a National Scandal’: For-Profit Medicare Advantage Plans Using AI for Denials,” Common Dreams, 11/3/23

- “Physicians gather in Atlanta to march for Medicaid expansion, AMC site,” Atlanta Journal-Constitution, 11/12/23, featuring Drs. Anwar Osborne and Mindy Guo

- “Medicare Advantage Plans Disadvantage Many Elderly and Disabled People,” Truthout, 12/4/23, featuring Dr. Cheryl Kunis

- “Alachua County Commission unanimously approves resolution supporting the Medicare for All Act,” Alachua Chronicle, 12/12/23, featuring Patrick Haley

- “State lawmakers look for solutions to Georgia’s maternal mortality crisis,” Atlanta Journal-Constitution, 1/5/24, featuring Dr. Toby Terwilliger

- “Republicans Are Planning to Totally Privatize Medicare — And Fast,” Rolling Stone, 2/5/24, featuring Dr. Philip Verhoef

- “Do No Harm,” Chicago Health Magazine, 4/8/24, featuring Drs. David Ansell, Susan Rogers, and Philip Verhoef

Op-eds by PNHP members

- “Healthcare Priorities for Georgia,” by Jack Bernard, Newnan Times-Herald, 11/13/23

- “The right wing loves insurance company looting of Medicare,” by Dave Anderson, Boulder Weekly, 10/26/23

- “It’s Halloween season, and Medicare Advantage is coming as a vampire,” by Dr. Peter Gann, Evanston Roundtable, 10/30/23

- “Seniors, beware: Medicare open enrollment feels like ‘open season’ on older Americans,” by Dr. Carol Paris, The Tennessean, 10/30/23

- “Medicare Advantage is a money grab by big insurers,” by Kip Sullivan, Minnesota Reformer, 11/3/23

- “Medicare recipients should look beyond ‘benefits’ of Medicare Advantage plans,” by Dr. Jeffrey Belden, et al., Columbia Missourian, 11/6/23

- “Medicare Advantage is giving away billions to corporate insurers. It’s time we put a stop to it.” by Dr. Diljeet Singh and Rep. Pramila Jaypal, The Hill, 11/17/23

- “The siren call of Medicare Advantage,” by Dr. Robert S. Kiefner, Concord Monitor, 11/25/23

- “’Medicarelessness’ Revisited After 50 Years,” by Dr. Cheryl Kunis, MedPage Today, 11/27/23

- “Medicare Advantage is bad for patients and bad for investors,” by Dr. Philip Verhoef and Wendell Potter, STAT News, 2/28/24

- “Overpayments to Medicare Advantage costly,” by Dr. Dwight Michael, Gettysburg Times, 3/16/24

- “We need to act to rein in ‘prior authorization’,” by Dr. Marvin Malek, VTDigger, 4/18/24

- “The Path Toward Medicare for All,” by Patty Harvey, North Coast Journal, 6/6/24

Letters to the editor by PNHP members

- “Politics controls health policy from upstream,” by John Steen, VTDigger, 10/22/23

- “Medicare Advantage programs are a symptom of a sick health-care system,” by Ken Lefkowitz, Washington Post, 11/13/23

- “Medicare ‘Dis-Advantage’ plans undermine system,” by Marion Brodkey, Santa Cruz Sentinel, 11/15/23

- “Private insurers never deliver,” by Cris Currie, The Spokesman-Review, 11/17/23

- “Be wary of Medicare Advantage plans,” by Patty Harvey, The TImes-Standard, 11/23/23

- “Save Medicare from corporate profiteers,” by Leslie Nyman, Greenfield Recorder, 11/29/23

- “Medicare ‘Advantage’ is no advantage at all,” by Dr. Susanne King, The Berkshire Eagle, 12/2/23

- “Hospitals and Profits: Should They Coexist?” by Dr. Marc Lavietes, New York Times, 12/18/23

- “Letter: Medicare Advantage,” by Dr. Mary McDevitt, The Sonoma Index-Tribune, 3/7/24

The post PNHP Newsletter: Spring 2024 appeared first on PNHP.

Taking Advantage 21 May 2024 8:39 AM (10 months ago)

Physicians for a National Health Program, May 23, 2024

Table of Contents

- Executive Summary

- By the Numbers

- Introduction

- Patient Harms: Restricting Access Through Networks

- Patient Harms: Prior Authorization

- Patient Harms: Limited Coverage

- Patient Harms: Excessive Costs

- Patient Harms: Trapped in MA

- Provider Harms: Barriers to Patient Care and Administrative Burden

- Provider Harms: Corporatization of Medicine

- Conclusion

- Endnotes

- Recommended Citation

- Acknowledgements

To view a PDF version of this report, click HERE for an interactive (web-friendly) version, HERE for a printable full-color version, and HERE for a printable black & white version.

To view a one-page printable handout, click HERE for full color and HERE for black & white.

Executive Summary

Medicare Advantage (MA), the privately-administered version of Traditional Medicare (TM), is causing significant harm to America’s patients, providers, and health care system. The insurers who run MA plans claim that they lead to better patient care and outcomes while saving money, but this is far from the truth.

Patients who sign up for Medicare Advantage are forced to deal with narrow networks which heavily restrict their access to physicians and hospitals, and are often misled about the size of these networks through inaccurate listings. They must seek prior authorization for many of the tests, treatments, and other procedures ordered by their doctor, often waiting days or weeks just to be inappropriately denied approval for necessary health care. These delays can have serious consequences for a patient’s health, even sometimes resulting in death.

MA plans aggressively advertise their supplemental perks, particularly their offering of dental, vision, and hearing benefits. However, plan benefits are often highly limited and do not come close to meeting the needs of enrollees. Even worse, patients in MA who become seriously ill or develop chronic conditions end up paying thousands of dollars for their care, often struggling to afford treatment and incurring medical debt in the process. These issues often have a disproportionate impact on the most vulnerable communities, reinforcing inequities in health care access and outcomes.

When patients encounter these issues in MA and wish to switch back to Traditional Medicare, they often find that they are unable to do so. In all but four states, regulations allow insurers to deny Medigap coverage to patients who have been in MA for more than a year. Without a Medigap policy to cover additional costs, Traditional Medicare is not an affordable option for many seniors who are then forced to remain in MA despite its many flaws.

MA doesn’t just hurt patients. Physicians, nurses, and other health care workers face serious barriers to caring for patients as a result of the excessive administrative burden placed on them by MA insurers. These workers must spend hours filling out authorization forms and fighting with insurers to get necessary care approved, limiting the time they can spend on their actual jobs. MA plans also frequently delay payments for the care of enrollees, or even refuse to pay altogether, causing serious financial harm to hospitals and medical practices that have limited resources to begin with.

Medicare was created to serve the people, and MA betrays that promise. We must rein in the abuses of MA insurers, eliminate profit-seeking in Medicare and beyond, and put an end to these egregious harms.

By the Numbers

- 11.1-20.5 million: Hours per year wasted by medical practices on Medicare Advantage prior authorization requests

- 11.7 million: Number of MA beneficiaries in a “narrow network” plan that excludes more than 70% of physicians in their county, based on 2017 KFF study (i) and STAT estimate of 2024 enrollment (ii)

- 7.3 million: Number of MA beneficiaries who are underinsured based on their reporting of high health care costs, based on 2023 Commonwealth Fund study (iii) and STAT estimate of 2024 enrollment (iv)

- 36: Number of studies cited in this paper collectively finding negative outcomes for patients and providers in MA

- 2x: Increased likelihood of death after pancreatic surgery in cancer patients with MA, based on study in the Journal of Clinical Oncology (v)

Introduction

Insurance corporations in the privatized Medicare Advantage program are harming millions of America’s most vulnerable, while costing the Medicare Trust Fund tens of billions more than if those people enrolled in Traditional Medicare. These insurers force patients and health care workers alike to deal with unjustifiable prior authorization requirements, limited networks, endless denials of care, and inadequate coverage, severely disrupting care in the name of financial gain. This report will summarize, through a review of relevant academic literature, research, journalism, and original interviews conducted by PNHP, the many ways in which corporate-run Medicare harms both patients and health care workers.

Medicare Advantage, also known as MA or Medicare Part C, is a privately administered insurance program that uses a capitated payment structure, as opposed to the largely fee- for-service (FFS) structure of Traditional Medicare or TM. Instead of paying directly for the health care of beneficiaries, the federal government gives a lump sum of money to a third party (usually a commercial insurer) to “manage” patient care.

“Managed care” has promised two benefits: to save money, and to improve patient outcomes. Advocates of the insurance industry assert that private insurers, by dint of their profit incentive, will do a better job at preventing unnecessary expenses and promoting efficient spending. However, as we detailed in a previous report, MA has failed to realize any true savings, and in fact transfers tens of billions of dollars from taxpayers to corporations each year. (1) But what of the second measure? Even if Medicare Advantage is more expensive than Traditional Medicare, does it provide better care?

Insurers will tell you that the answer is a clear “yes,” using the same logic as when speaking about savings. After all, it’s taken for granted that companies must satisfy their customers in order to stay competitive and stay in business. This logic is both deceptively simple and deeply flawed. The literature comparing quality and outcomes of care between MA and TM challenges the claims of insurers. The Medicare Payment Advisory Commission (MedPAC), the most authoritative source of data and analysis on the Medicare program, has found no consistent pattern of better performance or outcomes under MA, despite its higher costs. (2) What’s more, the agency notes that the practice of “favorable selection” may skew quality and outcomes data in favor of MA. (3) By signing up less costly and thus generally healthier patients, insurers make it seem as though they do a better job of keeping patients healthy. (4) Even with this leg up, there is no persuasive evidence that MA outperforms TM on the whole. Insurers do not report much of the data that could help answer open questions about care in MA, further calling into question their claims about increased quality. (5)